Firm overview

Official website | LinkedIn page

T: +66 2 260 7290

HLB Thailand is one of Thailand’s leading professional services firms with expertise in tax advisory including transfer pricing, audit and assurance, and outsourcing. HLB Thailand’s client base covers a variety of industries including construction, telecommunications, pharmaceuticals, manufacturing and hospitality. The firm has offices in Bangkok, the capital of Thailand, and Phuket.

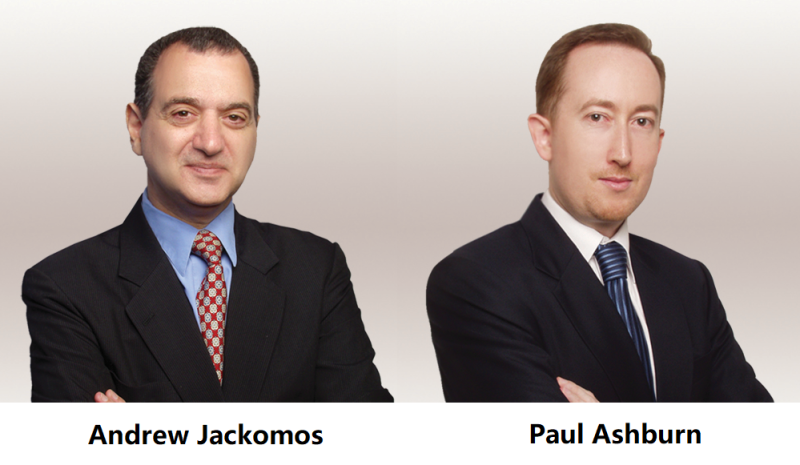

The firm’s tax practice is led by co-managing partners, Andrew Jackomos and Paul Ashburn.

HLB Thailand is a member of HLB International – a global network of independent advisory and accounting firms located in 160 countries, with almost 30,000 partners and staff in 760 offices worldwide. In 2020, HLB was announced as ‘Network of the Year’ at the 2020 Digital Accountancy Awards.

Key practitioners

Andrew Jackomos, Senior tax partner

Paul Ashburn, Senior tax partner

Duangnetr Sarachai, Tax principal

Radapak Arthapridi, Tax principal

Rohit Sharma, Tax principal – transfer pricing

Areas of practice in Thailand

International tax

Transfer pricing

Corporate tax and indirect taxation

Expatriate tax

Private client tax services

Tax dispute resolution

M&A tax structuring and due diligence

Click here for a full list of HLB Thailand's articles on ITR