The much-anticipated Patent Box Regime (Deduction) Rules (the patent box regime) were published on August 13 2019. The rules have been modelled to be compliant with the OECD's modified nexus approach and came into force on January 1 2019.

It caters for a tax deduction with respect to qualifying intellectual property (qualifying IP), which includes:

A patent or patents, whether issued or applied for (where an application for a patent is rejected, it would no longer fall within scope); or

Assets in respect of which protection rights are granted in terms of national, EU or international legislation, including protection rights in relation to plants and genetic material, utility models and software protected by copyright; or

With respect to small entities, as defined, intellectual property which is non-obvious, useful, novel and having features similar to patents may qualify subject to a determination by Malta Enterprise. The patent box regime refers to guidance provided by Malta Enterprise, which is yet to be published.

In all cases, the qualifying IP concerned must be granted legal protection in a jurisdiction. In addition, it should be noted that certain IP falls outside the scope of the new rules e.g. marketing related intellectual property, such as brands and trademarks are excluded.

Entitlement to a deduction in terms of the patent box begime is subject to the satisfaction of an exhaustive list of conditions which include:

i) the research, planning, processing, experimenting, testing, devising, designing, development or similar activity leading to the creation, development, improvement or protection of the qualifying IP must be carried out by the beneficiary – solely or together with any other persons – or in terms of cost sharing arrangements;

ii) the beneficiary must be the owner or holder of an exclusive licence in respect of the qualifying IP;

iii) an adequate level of substance must be put in place in the relevant jurisdiction – which includes physical presence, personnel and assets. The level of substance must be commensurate with the activities carried out by the beneficiary with respect to the qualifying IP;

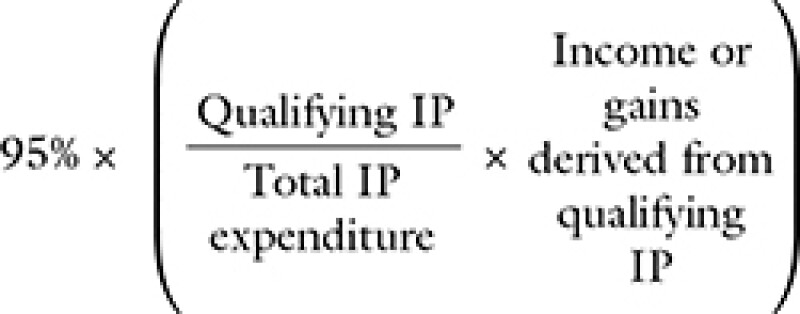

Subject to satisfying all requirements, a beneficiary may then claim a deduction against income and capital gains derived from qualifying IP, which deduction is calculated according to the following formula:

The deduction may be claimed against income or capital gains which fall within scope of the Income Tax Act. The income includes income derived from the use, enjoyment and employment of the qualifying IP, royalties or similar income received from the sale of goods or services and any sum paid for the granting of a licence or similar empowerment with respect to the qualifying IP, amongst others.

In applying the available deduction, the patent box regime provides guidance as to what constitutes qualifying IP expenditure, which includes inter alia expenditure – whether incurred directly by the beneficiary or through an unrelated subcontractor – in the creation, development, improvement or protection of the qualifying IP.

Fenech and Fenech Advocates

E: rebecca.diacono@fenlex.com

W: fenechlaw.com