Since the Mexican tax authorities usually give preference for the outcome-testing (ex post) approach (transactions priced after they took place), ex ante adjustments (transactions priced at the time they took place) may lead to double taxation. Moreover, transfer pricing adjustments have different fiscal, customs duties and VAT implications, which should be taken into account. In this article we analyse the application of the price-setting versus the outcome-testing approach for transfer pricing purposes in Mexico.

Reflecting timing issues in transfer pricing

Mexican taxpayers are required to comply with the OECD Transfer Pricing Guidelines for Multinational Entities and Tax Administrations. This implies that taxpayers need to prepare annual transfer pricing documentation showing that all intercompany transactions (local and cross-border) were performed at arm's-length. If the result of the controlled transactions falls outside of the range of comparable data then an adjustment of the intercompany transaction should be evaluated under the arm's-length principle. In some cases, the transfer pricing adjustment may derive from the difference between the actual outcome of the controlled transactions at the year-end and the projected transfer pricing policies used to set prices during the year.

Ex post and ex ante approaches

The price-setting versus the outcome-testing in transfer pricing is occasionally an issue between taxpayers and the tax authorities in Mexico. Market expectations, which are taken into account in the arm's-length price-setting is known as the ex ante approach; while actual outcomes observed in the arm's-length outcome-testing is known as ex post approach. Paragraphs 3.69 to 3.71 of the OECD guidelines mention those two approaches; however, the OECD guidelines do not clearly determine how prices in the intercompany transactions should be set and analysed although both approaches are covered in some detail. Consequently, in June 2012 a draft report was issued on timing issues relating to transfer pricing by Working Party No 6 of the OECD Centre for Tax Policy and Administration on certain transfer pricing issues, which opened a discussion on use of those approaches under different circumstances.

Many commentators have pointed out that the ex ante and the ex post approaches should target different circumstances and should result in different consequences. Specifically, in the case of recurring transactions such as distribution arrangements, manufacturing contracts, and services, among others, the ex ante approach may yield similar results as the ex post approach. Also, in commodity trading (such as gold or silver), foreign exchange or interest rates in financing transactions are usually priced ex ante, consistent with third party market practices. If no specific renegotiation clause exists in those and comparable agreements, those should be analysed from the moment the transaction was undertaken.

On the other hand, one-off transactions including licensing arrangements or a one-time contract for a significant project may be agreed and evaluated at the outset for a future period. To consider this approach, renegotiation clauses should be evaluated, which third parties would be willing to include in their agreements. Also, the consideration of bargaining power and the valid business reasons for both parties to renegotiate a contract should be part of the analysis. Therefore, in addition to the characteristics of the intercompany transactions, specific terms and allocation of risk should also be considered for the determination of the timing period included in the analysis.

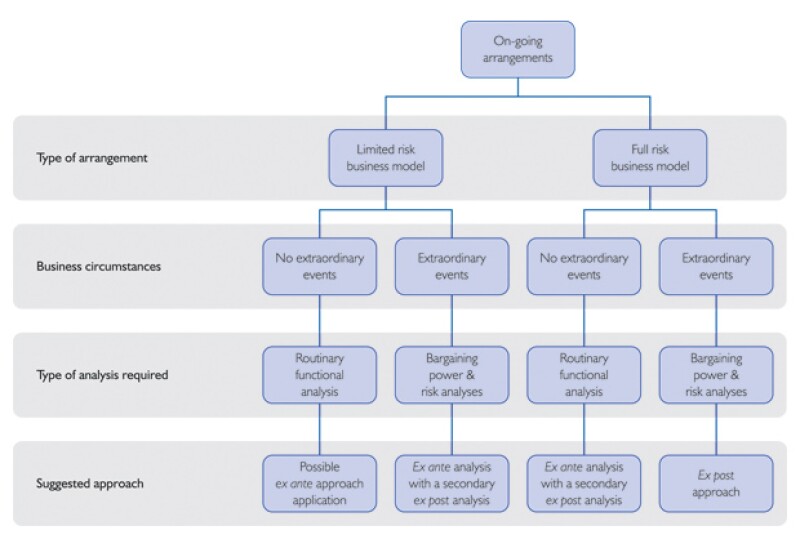

Diagram 1 summarises a potential approach to analyse and consider timing issues for on-going arrangements in transfer pricing analyses.

In practice, the ex ante approach in Mexico will often apply in very limited circumstances and there is a preference for the ex post approach by the tax authorities. The ex ante approach may be applicable especially when the outcome of the transaction does not yield very different results for recurring arrangements. An ex ante approach only becomes a potential problem in Mexico if the results are later evaluated using an ex post approach and these ex post results are below an arm's-length range on an ex post basis. In cases when this happens, the taxpayers will have the burden of proving that the difference is not attributed to transfer pricing (for example, volume and independent party input price variations) and must develop support to maintain that third parties would not be able to recover shortfalls until a later date, or at best, recover shortfalls prospectively. In some cases, perhaps pertaining to limited risk arrangements, the variances (positive or negative) would be expected in subsequent periods even when an ex ante approach is used. The later catch-up or recovery should also consider that a multi-year average for the tested party is generally not accepted by the Mexican tax authorities.

Diagram 1 |

|

Preference for ex post approach by the Mexican tax authorities

Based on our experience, the Mexican tax authorities do not feel comfortable with transfer pricing documentation based only on ex ante analysis and the use of the historical data for the purpose of the comparability analysis. This is mainly because of the fact that Mexico is an emerging market and the Mexican subsidiaries have faced significant volatility in the past related to foreign exchange or interest rates, among others. Therefore, for the purpose of the transfer pricing analysis of the intercompany operations of the Mexican subsidiaries consideration should be given to support the ex ante approach with additional analyses showing the comparability of the sample with the business circumstances of the Mexican subsidiary.

The above is important in Mexico because of the fact that information on foreign comparable uncontrolled companies (mainly US) is often used (since there is a lack of information on public Mexican companies). It is commonly understood that there is a correlation between US and Mexican markets; however, interestingly, in some cases it can be observed that there is a delay of the Mexican market response to the US market performance; thus, the use of the historical financial information in some cases may be appropriate to increase comparability of the analysis.

Consequently, for the purpose of the transfer pricing analysis of the intercompany operations of the Mexican subsidiaries, the Mexican tax authorities will probably maintain that the ex ante approach without adjustment for the analysis of an intercompany arrangement can be defensible in specific arrangements and when it can be shown that there is no renegotiation clause in the contract that would be agreed between third parties. In other cases, the use of the ex post approach would be preferred by the Mexican tax authorities unless it can be established that the third parties under comparable circumstances would agree to the price adjustment clauses or prospective renegotiations and the similar clause has been considered in the intercompany agreement.

In cases where timing issues are material and complex, and uncertainty may create double taxation because of the inconsistency in approaches between different territories, multilateral advance pricing agreements might be an appropriate option.

Taxpayer initiated year-end transfer pricing adjustments

In practice, the transfer pricing adjustments are often performed before the end of the fiscal year, as a result of the transfer pricing analysis of the company's preliminary results. This preliminary analysis provides the ability to adjust the financial statements before year-end, if necessary. In these cases, the transfer pricing adjustment is typically reflected in its accounting books for that financial year and in its tax return. In these cases, the commercial arrangements (invoices, etcetera) and customs duties, if applicable, should be corrected before year-end.

If the results of the intercompany transactions were not adjusted and the corresponding credit/debit notes were not issued before the end of the fiscal year, it is still possible to perform tax return adjustments, which would be included as a reconciling item in the fiscal year tax return and Dictamen Fiscal, since is not yet reflected in accounting books and commercial documents.

There are several considerations which should be taken into account when making transfer pricing adjustments in Mexico including their presentation, deductibility requirements, customs duties and VAT implications, effects of secondary adjustments, as well as the risk of the double taxation.

Presenting transfer pricing adjustments

As a best practice, the transfer pricing adjustment in Mexico should be correlated with a specific transaction that is carried out with related parties as balancing payments are not generally accepted. Invoices issued by Mexican taxpayers or the related parties should specify to which intercompany transaction the adjustments refer, since several accounting, customs duties and fiscal implications may arise from the adjustment. Moreover, if the adjustment is made after the year-end, the transfer pricing adjustment should be presented in the intercompany transactions summary Appendix in Dictamen Fiscal, as well as the Appendix 9 of the Multiple Information Return.

Tax implications

When the Mexican taxpayer makes post year-end adjustments after the original income tax return is filed, recognising an additional income by the Mexican taxpayer often requires a payment of additional income tax, surcharges and adjustments. Also, the fiscal year Mexican income tax return should be amended. Moreover, recognising additional income sometimes requires adjusting the employee profit sharing.

Customs duties and VAT implications

Mexican taxpayers should take into account that, for Mexican income tax purposes, they should only deduct the actual price for the imported products, which cannot be greater than the declared price on the import customs declarations. Therefore, in cases of transfer pricing adjustments to the prices of the goods purchased from foreign related parties, a change in the price of the goods purchased by the Mexican related party should entail a change in the customs values declared for the products during import and amendments to customs forms should be filed.

If the adjustments required the initiation of an import duty refund and/or compensation request from the authorities, amendments to each import customs declaration related to a product which underwent a transfer price adjustment would have to be filed. The filing would have to include the corresponding (re)calculation of customs duties paid in each import declaration during the fiscal year. Therefore, Mexican taxpayers have to consider the additional administrative time and expenses related to filing said amendments.

Moreover, any adjustment to the price of goods or services may also trigger a corresponding adjustment for VAT purposes, which should be analysed in detail.

Existence of comparables

When performing adjustments to the imported products (especially commodities), it is advisable to analyse if external comparable uncontrolled transactions exist and or determine which products, imported by the Mexican taxpayers from related parties, could be considered a commodity and whether market reference prices are readily available. It is important to mention that the Mexican tax authorities have initiated a programme to jointly review audit prices of individual products for customs duties and for income tax purposes (transfer pricing). Please note that secret comparables (entities doing business in Mexico for which information is not public) are allowed pursuant to the Mexican Tax Code.

The customs duties implications should also be reviewed in case of the royalty payment adjustments. The Mexican Customs Law establishes that in some cases royalties should increase the customs values declared for the imported products that are subject to the use of the intangible that is granted through a royalty agreement.

Double taxation

If the post year-end tax return adjustment is performed it may lead to double taxation if the adjustment is not accepted or recorded by the counterpart. Also, the risk of double taxation may exist because of the different understanding of the timing issues (ex ante and ex post approaches) by different countries.

Transfer pricing reviews recommended

Under the arm's-length principle, the decision on the application of the price-setting and outcome-testing approach in their transfer pricing should be consistent with what a third party would be willing to agree based on the decisions on operational and business related factors. Notwithstanding the above, the Mexican tax authorities generally prefer the use of ex post approach, so the supporting analyses should be sought out as necessary so as to favourably resolve, or avoid, any dispute with the tax authorities regarding timing issues in transfer pricing.

Since there is no clear guidance from the OECD at the present time, it is advisable to perform transfer pricing reviews and risk assessments to identify potential contentious timing issues that may be relevant for the Mexican taxpayers. If significant timing issues are identified; those should be supported with the relevant economic analyses. Alternatively, to mitigate this problem it may be necessary to closely monitor the financial results throughout the year with a view to adjusting transfer prices if the actual result deviates from the budget. It is also advisable to consider multilateral advance pricing agreements with the Mexican tax authorities, where timing issues are material and complex.

Biography |

||

|

|

Fred Barrett Transfer pricing partner PricewaterhouseCoopers Tel: 52-555-263-6069 Fax: 52-555-263-6010 Email: fred.barrett@mx.pwc.com Fred Barrett is the partner in charge of the transfer pricing practice of PwC in Mexico. He has been a US CPA since 1982 and is also a CPA in Florida. Fred Barrett graduated from the University of Florida and has been a mexican income tax adviser since 1993. He has more than 31 years of experience providing tax consulting on international transactions, including mergers and acquisitions, debt financing alternatives and corporate restructurings in several industries including financial services, mining, mutual funds, insurance, consumer products, pharmaceutical, telecommunications, manufacturing, automotive, retailing, real estate, construction, transportation, oil and gas and refining. Fred Barrett also has extensive experience in the area of transfer pricing dispute resolutions and negotiating multilateral APAs. |

Biography |

||

|

|

Marta Milewska Transfer pricing senior manager PricewaterhouseCoopers Tel: 52-555-263-5849 Fax: 52-555-263-6010 Email: marta.milewska@mx.pwc.com Marta Milewska is a transfer pricing senior manager in the Mexico City office of PwC. Marta is an economist from the Poznan University of Economics in Poland and has post-graduate studies at ITAM-DUKE University in Mexico. Marta specialises in the consumer goods and pharmaceutical industries and has various years of experience participating in different dispute resolution and restructuring projects. |