The G20 Leaders’ Declaration in St Petersburg in September 2013 made clear that tackling cross-border tax avoidance and evasion, which undermine public finances and people’s trust in the tax system, is on the organisation’s agenda. The declaration specifically refers to the base erosion and profit shifting (BEPS) and automatic exchange of information for tax purposes (AEOI) projects, both of which are virtually led by the OECD, and at the same time emphasises the importance of developing countries being part of these projects.

How serious are cross-border tax avoidance and evasion for developing Asia?

What are practical challenges for tax authorities in developing Asia to tackle these international taxation issues?

How should the tax authorities respond to the global discussions on reviewing the international taxation system, from developing Asia’s perspective?

Cross-border financial flows in developing Asia

In reality, developing Asia is already the world’s top foreign direct investment (FDI) destination, and it indicates an imminent risk that tax revenues in developing Asia are undermined by aggressive tax avoidance schemes, which is exactly the issue being addressed by the BEPS project.

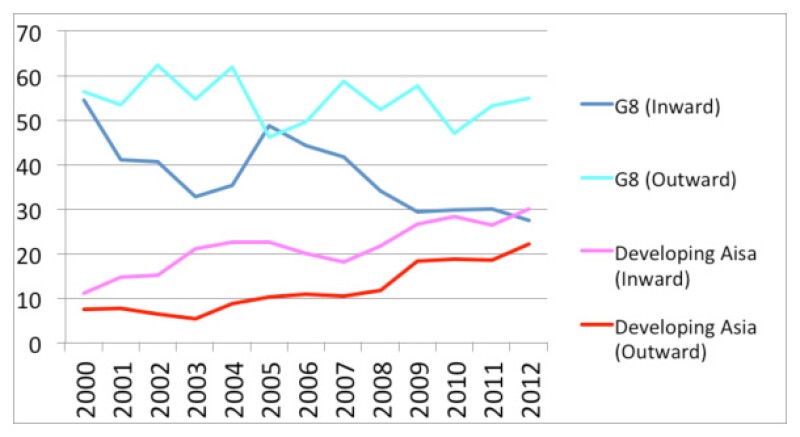

Diagram 1: Foreign direct investment flows (% of the total world)

Source: UNCTAD (UN Conference on Trade and Development)

Diagram 1 shows that, as an FDI destination (inward flows), developing Asia surpassed G8 in 2012, and in addition, as a provider of FDI (outward flows), though developed G8 countries continue to dominate the global figure, the share of developing Asia is steadily increasing from a mere 7.6% of the global share in 2000 to 22.2%in 2012, which indicates the rapid emergence of multinational enterprises based in developing Asia.

With respect to high net worth individuals (HNWIs), Asia is also about to topple Europe and North America. The World Wealth Report 2013 produced by Capgemini and Royal Bank of Canada has forecasted that, by 2014, Asia-Pacific can be the largest region in the world for HNWI population and total wealth. Individual wealth in Asia-Pacific is accumulated not only in developed countries such as Australia, Japan and Korea, but HNWIs in developing Asia including People’s Republic of China, India and Thailand are also rapidly growing, which provides a plausible reason for tax authorities in developing Asia to be capable of exchange of information with foreign counterparts to address cross-border tax evasion. |

Developing Asia’s views on international taxation rule reforms

OECD’s Action Plan on Base Erosion and Profit Shifting published in July 2013 has emphasised the importance of the project taking into account the perspectives of developing countries as well as business and civil society. As part of initiatives to have inputs from developing countries in Asia-Pacific, a High Level Regional Consultation meeting took place on February 20 and 21 in Seoul. While participant tax authorities shared recognition that cross-border tax avoidance is an issue to be addressed, there were a few noteworthy observations about the BEPS project, that is, the importance of administrative capacity to implement new international taxation rules and keeping the balance between source and residence taxation, given developing countries are still generally source countries where developed country-based multinational enterprises generate taxable income. Tax administration capacity

Men put new wine into new bottles (Matthew 9:17). New tax policies will not work effectively without good implementation capacity and the lack of it could constrain policy choices; the international taxation rule review is by no means an exception.

The commissioner of a certain tax administration body remarked at the Seoul meeting that the principal daily task of tax administration is raising revenues, not complying with international standards per se. In the case of tax authorities in developing countries, administration capacity to be strengthened is not limited to functions directly related to international taxation; it should take a comprehensive approach to bolster tax administration capacity as a whole, which includes audit, information and communication technology, and human resource management. International taxation capacity should be built upon the basis of fully-functional tax administration.

The reverse is also true; international taxation régime has to penetrate into the front line, beyond the international affairs division at the headquarters. For example, , both the Bureau of Internal Revenue of the Philippines and the Inland Revenue Board of Malaysia strengthened exchange-of-information capacity in 2012-2013 through introducing a procedural manual and setting up a dedicated exchange-of-information unit in their organisations. One the other hand, for more effective exchange-of-information operations, the capacity of front-line tax auditors in charge of cross-border tax evasion cases and collecting information in response to requests from foreign tax authorities should be enhanced.

Balance betwixt source and residence taxation

Some of the tax authority and civil society delegates that attended the Seoul meeting have also expressed a view that the revision of international taxation rules, including tax treaties and transfer pricing, should not unduly alter the balance between source and residence taxation. Looking at multinational enterprises’ operations, there is still a simplified structure that they tend to reside in developed countries with income sources in developing countries.

Though the BEPS project per se does not aim to address the balance between source and residence taxation, there are some issues which fit into the classic structure of allocation of taxable income between developed and developing countries. For example, given the fact that intangibles such as patents, trade marks and know-how are held more in developed countries than in developing countries, the result of the revision of transfer pricing rules related to transactions of intangibles may favour intangible-rich developed countries.

On the other hand, reflecting thriving consumer activities in developing countries, measures to prevent the artificial avoidance of PE (permanent establishment) status as well as base-eroding payments, such as management fees and headquarter expenses paid from foreign subsidiaries to headquarters, may have the effect of keeping taxable income in developing countries.

A win-win game?

Developed and developing countries have high expectations for the BEPS project. If its outcome helps to secure the domestic tax base which is otherwise eroded by double non-taxation or evaporates in the so-called offshore financial centres, it will be a win-win game. On the other hand, should the outcome increase tax disputes between developed and developing countries over the allocation of taxable income, in particular with respect to transfer pricing taxation, it might be closer to a zero-sum game.

Regional cooperation amongst tax authorities in Asia

For Asian tax authorities to have more say in the review of international taxation rules, it will be helpful to have more effective regional cooperative frameworks. For example, in the Asia-Pacific region, there is the Study Group on Asian Tax Administration Research (SGATAR), the membership of which covers tax administration bodies in 16 economies. On the other hand, SGATAR does not have a permanent secretariat and this may limit their functions compared with other regions such as Africa and Latin America, where the African Tax Administration Forum (ATAF) and Inter-American Center of Tax Administrations (CIAT/Centro Interamericano de Administraciones Tributarias) respectively have their secretariats in Pretoria and Panama City.

More enhanced regional cooperative frameworks will help tax authorities in Asia to deliver their collective views to the process of reviewing international standards, as well as to conduct capacity development activities at a regional level.

Satoru Araki, a public management specialist at the Asian Development Bank in the Philippines. Views expressed in this article are not those of the organisation to which the author belongs.