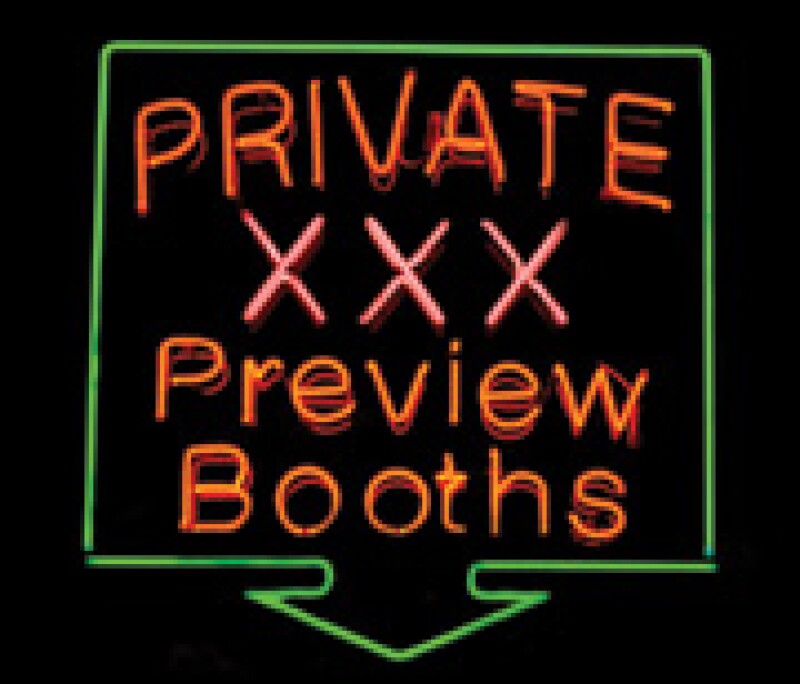

A lap-dancing club called Sugar & Spice, based in Norwich in the UK, has lost its dispute with HM Revenue & Customs (HMRC) over whether the hiring of private booths qualifies for a VAT exemption. The club claimed that cash generated from its supply of booths – used by dancers for private performances – should not have a VAT charge attached to it. The club provides an "exempt supply of land" for an agreed time period, it argued.

In October 2012 a New York lap-dancing club, Nite Moves Gentleman's Club in Albany, tried to convince a New York tax court that nude lap-dances should be considered a form of art, and therefore they should be entitled to the same exemption afforded to other "live dramatic or musical arts performances". Nite Moves wanted admission fees, as well as money generated from private dances, to be tax exempt.

Regardless of the dispute's outcome, Tax Relief doubts whether there would have been an upsurge in the number of people keeping hold of their VAT receipt from Sugar & Spice for the purposes of claiming expenses.