Arms-length prices, when possible, are set based on observable market transaction information. The OECD's Transfer Pricing (TP) Guidelines for Multinational Enterprises and Tax Administrations outline five comparability factors that should be considered in evaluating whether third-party transactions are adequately comparable to the related-party transaction. These include two which are particularly interesting:

The economic circumstances of the parties; and

The business strategies of the parties in relation to the controlled transaction.

Given the volatility, structural changes and market dynamics at play within and around the Canadian oil and gas (O&G) industry, the focus by taxpayers and tax authorities on economic circumstances and evolving business strategies will likely become more important in the establishment of TP for oil, natural gas and liquefied natural gas (LNG).

Canada's O&G industry

The Canadian O&G industry finds itself at a crossroads, facing challenges for which there are no clear, short-term solutions. Significant events during the latter half of 2018 illustrate the malaise the sector has suffered since the beginning of the most recent sectoral downturn (which commenced in late 2014).

Changes in oil sands ownership

In late 2017 and early 2018, powerhouse European multinationals divested oil sands assets and focused on natural gas and/or other investment opportunities globally. These traditional powerhouses were largely replaced by Canadian energy companies and Asian national oil companies (NOCs).

Oil pipeline constraints

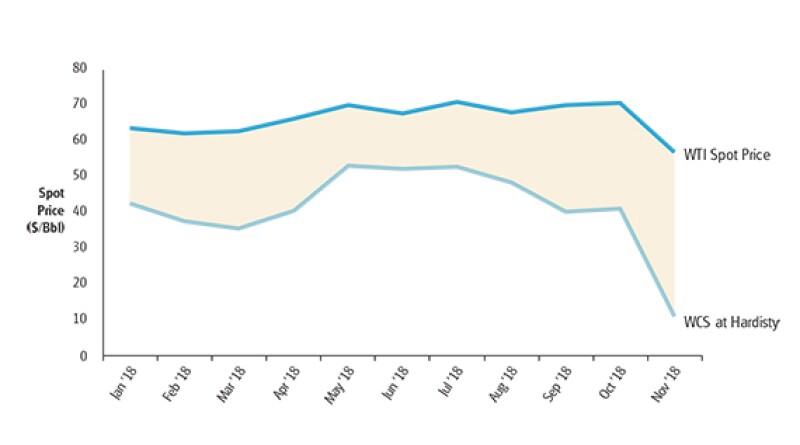

While much of the world saw a moderate strengthening and stabilisation of oil prices in 2018, Canadian oil was subject to increased volatility. In the final quarter of 2018, Canada experienced an imbalance between crude inventories and export capacity (primarily pipeline capacity). This led to a significant discount on Canadian heavy crude relative to US and worldwide crude prices (see Figure 1).

In Q4 2018, Canadian heavy crude traded at near historically high discounts to the West Texas Intermediate (WTI) benchmark. This ultimately led to Alberta's government initiating mandatory crude oil production curtailment from January 2019. These curtailments are expected to reduce production by 325,000 bbl/d until inventories return to normal historical levels.

It is expected that trains will provide additional transport capacity, but not at the levels needed. While production cuts are expected to reduce (but not eliminate) the pricing differential through 2019, they will also likely depress drilling activity. The persistent uncertainty surrounding pipeline approval will leave Canadian oil producers with excess inventories stranded due to insufficient pipeline capacity for the foreseeable future.

As a result, over the near term, Canadian oil producers are likely to face significant volatility, higher-than normal price differentials, and depressed pricing for Canadian resources.

Figure 1

Source: EIA at www.eia.gov/dnav/pet/pet_pri_spt_s1_m.htm, and Government of Alberta at economicdashboard.alberta.ca/OilPrice

Natural gas sector

Canada's natural gas pricing outlook is more positive, but experts continue to predict depressed pricing and volatility, even as North American and global supply chains come together.

In the last quarter of 2018, US natural gas prices strengthened over increased demand and reduced storage capacity. The North American LNG industry will certainly contribute to demand, and is already driving Canadian gas exports to the US.

While Canadian gas prices have increased over the second half of 2018, pricing continues to lag behind the Henry Hub benchmark. As a result, relatively affordable Canadian gas will continue to be attractive to the US.

However, national production curtailments in 2019 could dampen demand for Canadian natural gas, given that Alberta's oil sands producers utilise approximately 40% of Alberta's gas production.

Meanwhile, the economic outlook is forecast to slow down in Europe and Japan, and a softening in demand for hydrocarbons from China will keep natural gas pricing volatile.

Canadian natural gas producers may be finding advantages in being able to deliver gas to different markets, allowing them to capture various pricing opportunities. However, the outlook for the Alberta Energy Company (AECO) benchmark price continues to be lower in the medium term.

The headline story for Canadian natural gas in 2018 revolved around LNG Canada receiving approval. The project will enable Canadian gas producers to sell and deliver LNG to customers in Asia and worldwide, finally bringing much-needed market options to Canadian producers. As a result, the North American LNG industry will be fascinating to watch over the next five to 10 years, while the Canadian energy industry will continue to examine its relationship with the US market because of recent tax reform initiatives.

Transfer pricing landscape

Canada's O&G sector presents a few attributes that may inform, or otherwise influence, the determination of reasonable arm's-length prices for cross-border intercompany flows of hydrocarbon commodities (such as market access, capital flight, re-domestication and consolidation of upstream assets, historic differentials). It seems sensible for Canadian taxpayers and the Canada Revenue Agency (CRA) to account for such circumstances, bearing in mind the prevailing TP law and relevant administrative guidance.

Canada's domestic legislation does not contain specific rules or guidance on how transfer prices ought to be determined for intercompany commodity flows. The same is true for many OECD members. Instead, the general TP law provided in section 247 of the Canadian Income Tax Act (ITA), as interpreted by jurisprudence, governs such transactions.

However, the ITA is silent on how to carry out the TP analysis contemplated in subsection 247(2). Simply reading the statute will not provide sufficient guidance on whether it is prudent to contemplate such economic circumstances, or to what extent. Thankfully, Canadian courts have dealt with the matter in several decisions. Canadian TP analysis requires consideration of all characteristics and circumstances (economic or otherwise) that are relevant and have bearing on the price in any given case. It is clear that a proper analysis, by necessity, is heavily fact-driven and case-specific.

While the OECD's TP guidelines lack the force of law in Canada, the CRA endorse the guidelines, and they provide practical guidance on the application of the TP analysis required under the ITA.

Accordingly, the prevalent economic circumstances of the Canadian O&G sector, and the business strategies employed by the actors that operate in that market, should have a directional bearing on TP analysis associated with commodities, both in terms of accurately delineating a particular transaction and in the context of performing comparability analyses (OECD TP guidelines, paragraphs 1.110–1.113 and 3.7, July 2017).

Role of the parties involved

Canadian courts have affirmed that the roles, functions, and interests of the parties to a particular transaction should be kept in mind when conducting TP analysis. Practically, it is also important to pay attention to the expanded process in the revised Chapter 1 of the OECD's TP guidelines.

However, recent Canadian jurisprudence suggests that firms bearing contractual risk will be entitled to the resulting profit or loss (for Canadian TP purposes, it is currently not critical that a firm directly employs the individuals that manage a particular risk).

Pricing methods

Canadian statute does not mandate the use of any specified TP method (or provide a hierarchy of methods), but courts seem to indicate a preference for traditional transaction methods that directly test the price of the transactions undertaken. Administratively, the CRA's published guidance reflects the OECD TP guidelines and subscribes to the notion of selecting the most appropriate method based on the degree of comparability, and the availability and reliability of data.

It should be noted that the OECD's 2014 discussion draft on the TP of cross-border commodity transactions endorsed the use of the comparable uncontrolled price (CUP) method, and quoted prices as the most appropriate method for pricing commodity transactions.

Several stakeholders responded to the OECD's request for comments on the discussion draft publicly, suggesting that the CUP method may often be appropriate (at least as a starting point to the analysis), but that other TP methods should be considered and, depending on the applicable facts, used. This is particularly true in light of the complex, often vertically integrated, value chains that are commonplace in the industry.

Future pricing strategies

First, it is prudent to clearly distinguish between pure-play producers, traders (that may be vertically integrated), and those that use hydrocarbon commodities within a fully or partially integrated supply chain (e.g. LNG proponents or integrated O&G). Business strategies and effects of economic circumstances in the sector will vary for these players, and appropriate TP strategies should not ignore such differences.

In the case of a Canadian E&P selling crude to other members of the industry value chain (e.g. traders or processors/refiners) through a foreign related intermediary (considered commonplace given the prominent trade direction), the CUP method could be considered. In a very simple fact pattern, one can base such an approach on a price index, or perhaps on an actual internal or external CUP with appropriate comparability adjustments (for example, for quantity, quality/blend, and delivery terms).

However, given the prevalent economic circumstances, it is important to avoid inadvertently shifting (or trapping) the volatile effects of price risk outside the jurisdiction where it functionally and contractually belongs.

In the event that either party (or both) mitigates price risk exposure through hedging, it is necessary to evaluate whether contractual allocation of hedging gains and losses through the International Swaps and Derivatives Association (ISDA) master agreements, mirror ISDA agreements or similar arrangements are required.

Canadian players with more globally interconnected and vertically integrated supply chains may also consider adopting alternative pricing models, such as the profit split method (PSM), either as a primary method or as corroborative evidence of arm's-length outcomes that are well aligned with assumption of risk and value creation.

However, the relative importance of producing, storing, upgrading, transporting and trading/optimising may have shifted in light of the economic circumstances. Accordingly, careful consideration of what exactly creates value, who contributes (owns), and the appropriate bargaining strength of the parties must be given in view of how arm's-length parties behave in the current environment.

With the emphasis on a more disciplined application of the CUP method and indices, taxpayers are likely to face more rigorous TP audits and tax authority disputes regarding the relative merits of selected indices, transaction dates and computation of adjustments.

Disagreements between tax authorities may arise around debates over economic circumstances, which call into question what profit or loss potential should be attributed to contractual risk versus economic risk, and the functions that control such risks. Taxpayers seeking certainty may therefore access the Canadian advance pricing agreement (APA) programme with more regularity.

Given the depressed pricing environment for hydrocarbon commodities in Canada, more Canadian players are likely to seek out international markets. The burgeoning Canadian LNG industry, which is today focused on Asia, is a good example of this. As business models and strategies change accordingly, TP policies will need to keep pace.

© 2019. For information, contact Deloitte Touche Tohmatsu Limited.This communication contains general information only, and none of Deloitte Touche Tohmatsu Limited, its member firms or their related entities (collectively, the "Deloitte network") is, by means of this communication, rendering professional advice or services. Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser. No entity in the Deloitte network shall be responsible for any loss whatsoever sustained by any person who relies on this communication.

Andreas Ottosson |

|

|---|---|

|

Partner Deloitte LLP Tel: +1 403 267 0665 Andreas Ottosson is a tax partner with Deloitte LLP in Calgary, and is the Canadian transfer pricing leader for the oil and gas industry. With well over a decade of professional experience in TP, Andreas assists a broad spectrum of established and emerging multinationals, often within the upstream and midstream sectors of the oil and gas industry. Andreas's work involves planning, developing and documenting strategic and dynamic cross-border transaction solutions and TP models. He also specialises in pricing models for intercompany loans, guarantee fees and hedging activities. Andreas also assists clients with tax authority audits on a wide range of TP matters, and helps clients navigate through recourse avenues. |

Markus Navikenas |

|

|---|---|

|

Partner Deloitte LLP Tel: +1 403 267 1859 Markus Navikenas is a partner with Deloitte LLP, and the tax leader for Canada's west region. He also leads the Canadian E&R tax industry team. Markus advises many of the world's largest multinationals in the energy sector. He is sought as a speaker to industry and tax organisations across North America. His expertise spans assisting client's with developing innovative transfer pricing strategies, negotiating tax authority dispute resolutions, and aligning TP models with commercial objectives. He is routinely recognised as one of the world's top TP advisors. Markus has a passion for working with companies to find innovative ways to create value in terms that resonate with his clients. |