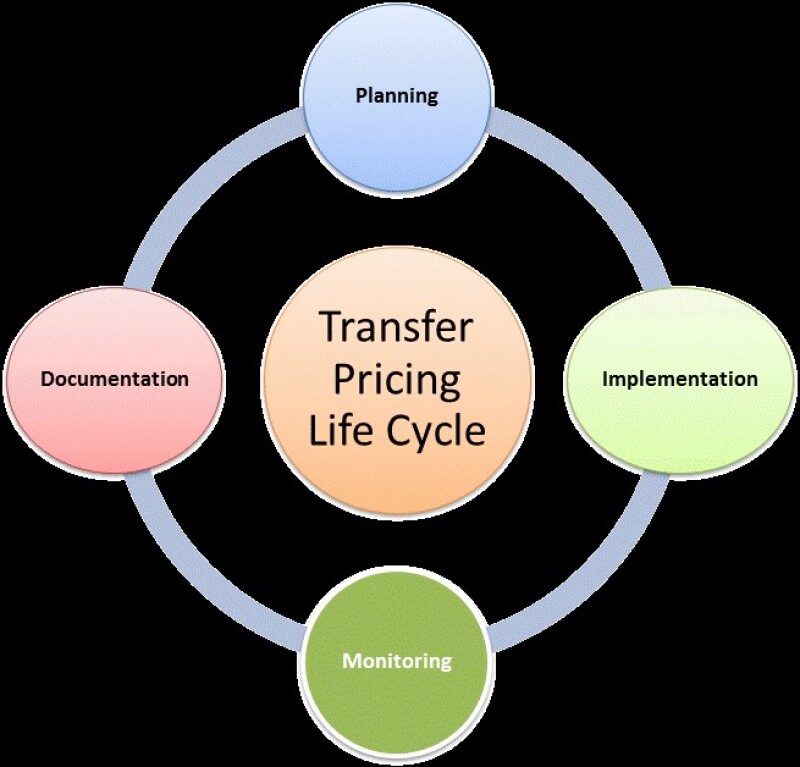

Read Part 1 of the series here: TP lifecycle planning stage

Formation of a TP policy

Once the planning phase of the TP lifecycle is over, it should be supported by a robust group TP policy in the form of a written document reflecting the work done in the planning stage and how one should work towards achieving the desired outcome. This is a rule book which defines the standard processes and procedures to be followed by different functions within the organisation.

Along with a robust TP policy in place it is important that intercompany agreements are entered into which capture the key terms and conditions of every transaction. Once these agreements are prepared, each one should be vetted by all the functions within an organisation that are responsible for executing it. It is important that the business follows the terms of the agreement in substance and does not deviate from the written form.

If one were to describe the key challenge of developing a group TP policy within an organisation in one line, then it would be: Whose job is it anyway?

Every organisation will face this challenge while developing the group TP policy. A typical MNE setup has tasks broken into several processes and there is a specialist position for most processes. In setups like this, where people work in silos, it can become challenging, at times, for the tax team to involve everyone in policy formation and also help them understand the ultimate aim of the exercise.

It is critical to address the ambiguities of the roles and responsibilities that commonly exist across intercompany processes. The goal of a formal TP policy is that it clarifies the respective responsibilities that the relevant internal functions have in executing the TP strategies.

However, it is important to make a policy which is comprehensive and covers all the finer aspects of intercompany transactions, so that the benefits automatically start accruing to the business when different teams start following this rule book.

Furthermore, it is important to remember that even more valuable than the production of this sort of policy document is the work undertaken to compile it and the resultant benefits achieved when the teams start to follow the rule book.

Working methodically through the tasks being performed, and comparing the ‘as-is’ method with the ‘to-be’, identifies where there are gaps in understanding, where inefficiencies are being propped up. Critically, it also evaluates where there is a mismatch between data and activity which would lead to the end result deviating materially from the plan.

Risks emanate from every point where responsibilities are transferred within the organisation and where a task is itself poorly designed and controlled. Although the tax team may have a view on what is, or what should be, happening, it is extremely important that business, finance, controlling, legal and IT colleagues are fully engaged in this process as their participation is a necessary to truly understand the execution.

While a key driver for undertaking this exercise of developing a TP policy may be to improve efficiency of the intercompany transactions, one should expect it to also reveal errors. To overcome these errors it is important to have a collaborative approach within different functions and at the same time clearly define the roles and responsibilities for various activities.

One also needs to bear in mind that TP has evolved significantly, making it more important than ever to integrate the views of the different stakeholders within an organisation.

The old perception of TP was that it was a headache only for the tax people within an organisation and that it would not impact any other function. However as time passes, this perception within organisations is changing and today one can be sure that TP is now an organisational issue and no longer only a tax issue.

With number of the stakeholders involved in the TP lifecycle increasing, it becomes crucial for tax departments to consider the views of all the stakeholders and take them all in its stride.

Monitoring Stage

The next stage after policy is the monitoring phase. Monitoring becomes the area of focus for the tax department to ensure that transfer prices fixed in the planning and policy formation produce the desired outcome.

The comparison of the budgeted profitability statement with the actual results should be performed at least quarterly to be aware of any problems as and when they arise.

As far as possible, monitoring of TP positions should be automated and an adjustment mechanism should be set up to ensure transfer prices are adjusted in the nick of time.

Some kind of IT system will generally be required, from a simple spreadsheet to software or an enterprise resource planning (ERP) system. Whatever the case, systems need to be designed with transparency in mind to make it easy to extract the information required to demonstrate that the TP policy has in fact been followed.

With the kind of TP tools available in the market it is relatively easier than before to automate the monitoring process so that it reduces human error and provides more time to focus on effective monitoring.

Some of the largest companies operate with in-house TP groups that use specific tools and databases to centralise information about TP documentation for different geographies, in addition to other supporting documentation such as contracts and intercompany agreements. Having the right tools and ensuring their availability is a best practice in and of itself.

In this phase the company should also review its inter-company agreements. Matching form with substance in this way is essential. Often intercompany agreements differ considerably from the transactions that take place, and this can create significant problems down the line.

A good monitoring system can result in a lot of efficiency in the TP lifecycle process. Companies can save themselves from last minute surprises for example where at the close of the financial year the desired level of margins are not arrived at, and there is no scope to take any sort of corrective action. At times making huge TP adjustments at the year-end can also create customs complications.

Read Part 3 of the series here: TP lifecycle documentation