From February to April, TP Week and International Tax Review spoke to corporate tax directors to gain a snapshot of what businesses are doing to mitigate risks and optimise tax liabilities on intellectual property and other intangible assets.

Sixty-four multinational companies in sectors like biotechnology, consumer goods, healthcare, energy and financial services took part in the survey. These corporate groups varied in size and structure, but almost half the respondents have a presence in a European jurisdiction (48.9%).

This survey is the first of a series looking at the risks and rewards of tax planning in a global economy. The second will look at the advantages of controlled foreign companies (CFCs) and the third will examine the threat of unilateral action on digital tax.

Scroll down to see what your peers said in response to the questions we asked.

Location and relocation

IP holdings

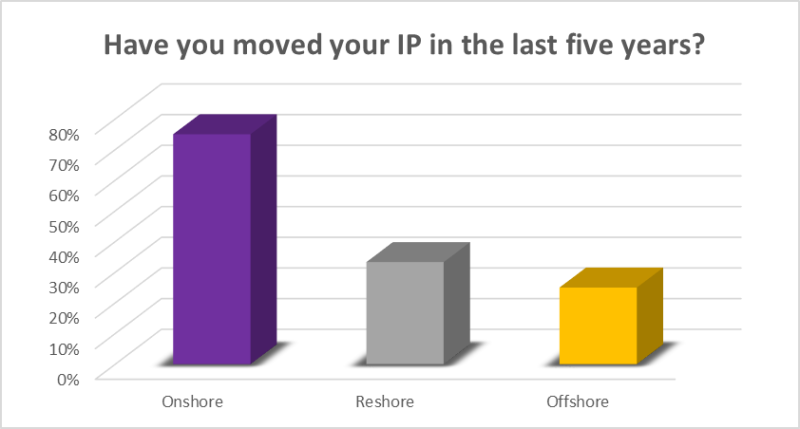

The majority of respondents (75%) said their companies moved IP holdings onshore to where their operations were bases in the past five years. Far fewer moved IP assets offshore (25%) and a slightly larger number of companies (33.3%) decided to reshore assets after having them abroad for a number of years.

Reshoring is the moving of manufacturing operations back to a country, for example, whereas onshoring is the sourcing of a brand’s production to a factory in a country.

IP location in relation to corporate headquarters

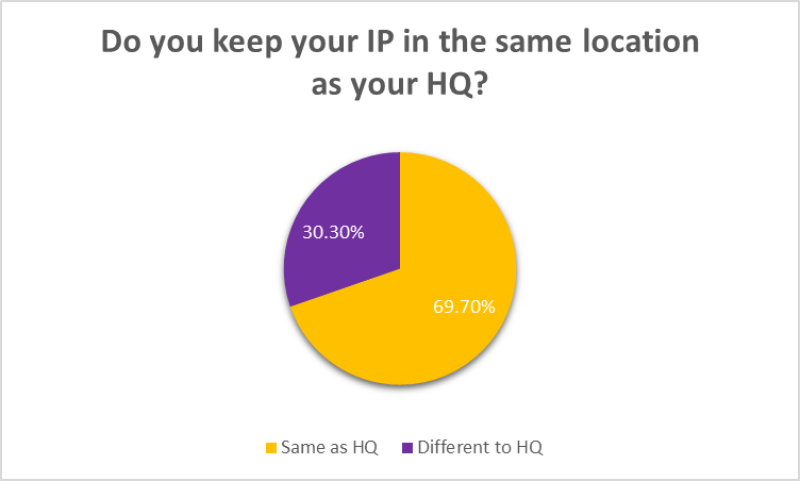

Most companies claimed to keep their IP holdings in the same location as their corporate headquarters, while a clear minority continue to keep IP in a different place.

Restructuring

IP restructuring

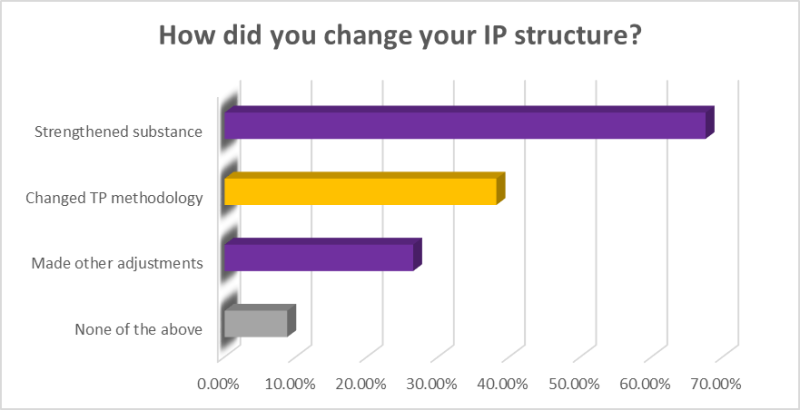

More than 67% of the respondents that changed their IP structures overwhelmingly chose to strengthen the substance of their holdings, whereas others decided to apply a different TP method. However, many companies said they are undertaking multiple changes, including new methods and other structural adjustments.

Key factors behind restructuring

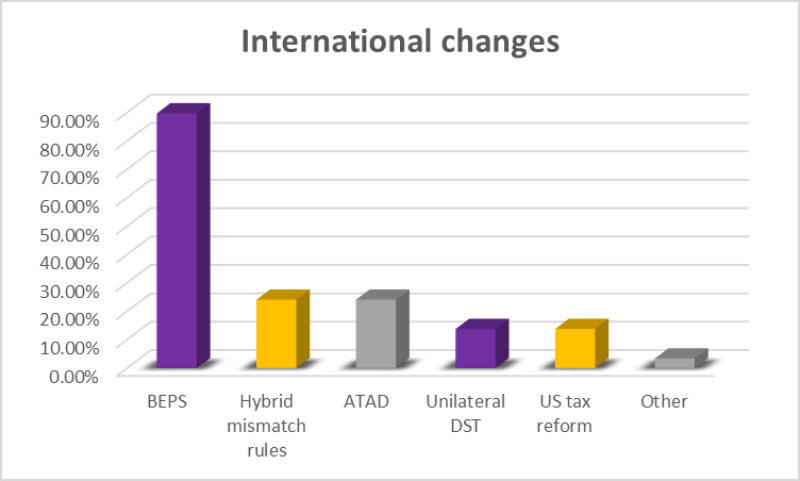

The BEPS project had the biggest impact on corporate IP structures. Most companies felt the brunt of multiple factors, including US tax reform to hybrid mismatch rules, but almost all respondents (89.7%) agreed that BEPS had affected their operations.

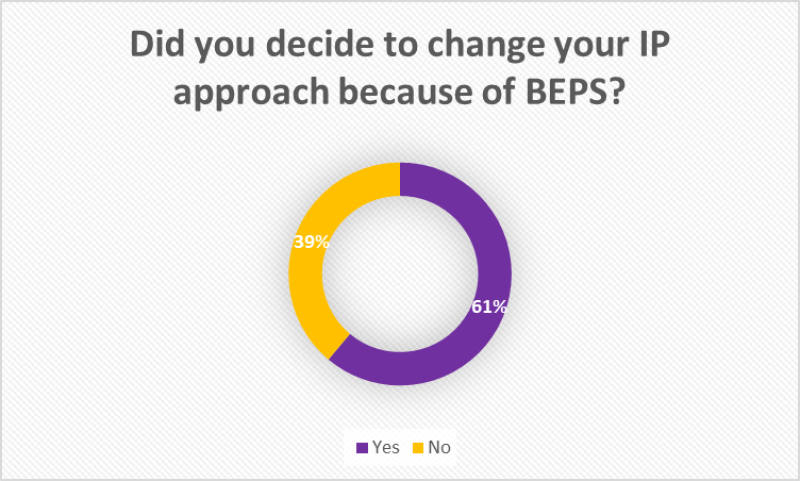

Changed IP approach due to BEPS

Although almost 90% of companies were affected by the BEPS project, the number of companies to change their approach to pricing IP because of BEPS was much lower (61%). In other words, despite the impact of BEPS not all those affected have changed their arrangements.

TP methodology

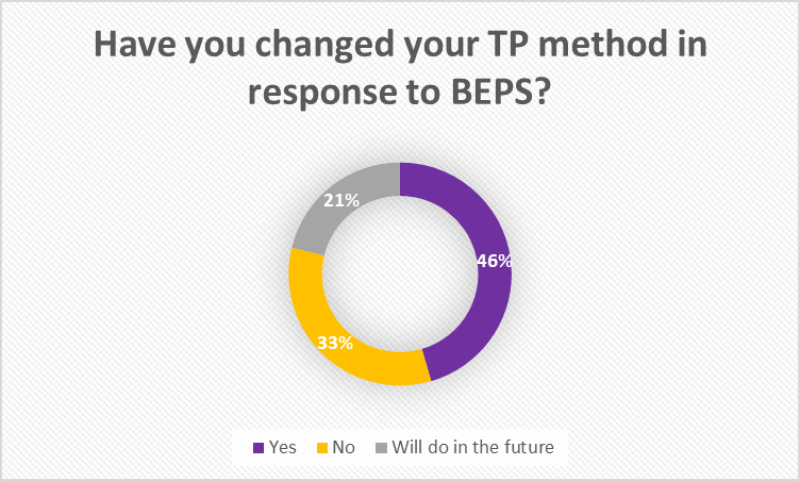

Changed TP method due to BEPS

The BEPS project had a much broader impact and many companies changed their TP methodology when it comes to intangibles.

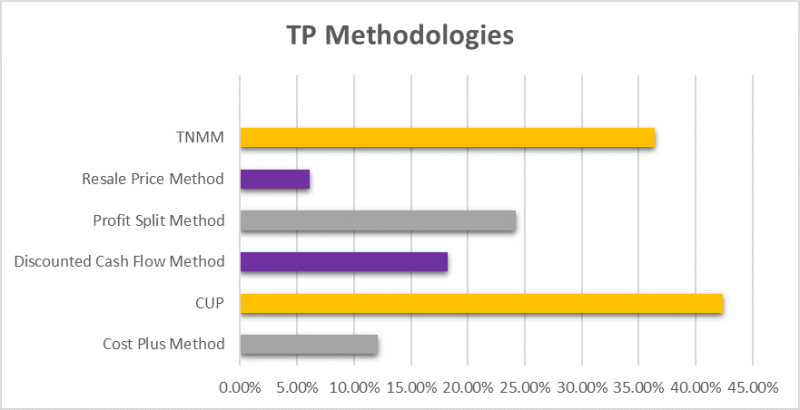

Methodologies used

The comparable uncontrolled price (CUP) method and the transactional net margin method (TNMM) are the two most common TP methods. Most companies rely on these two methods, with 42.4% using the CUP method and 36.4% using TNMM.

Many companies used one or more methods. The profit split method was the third most common method of choice at 24.2%, while the discounted cash flow (DCF) method being fourth at 18.2%. Meanwhile, the least common methods were the cost plus method (12.1%) and the resale price method (6.1%).

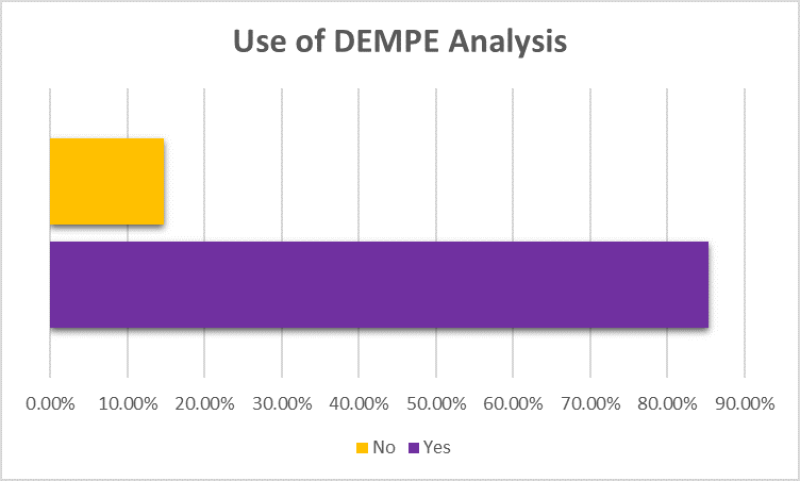

DEMPE analysis for profit allocation

The majority of companies surveyed (85.3%) use the development, enhancement, maintenance, protection and exploitation (DEMPE) analysis as part of their decisions on profit allocation, whereas just 14.7% do not use DEMPE.

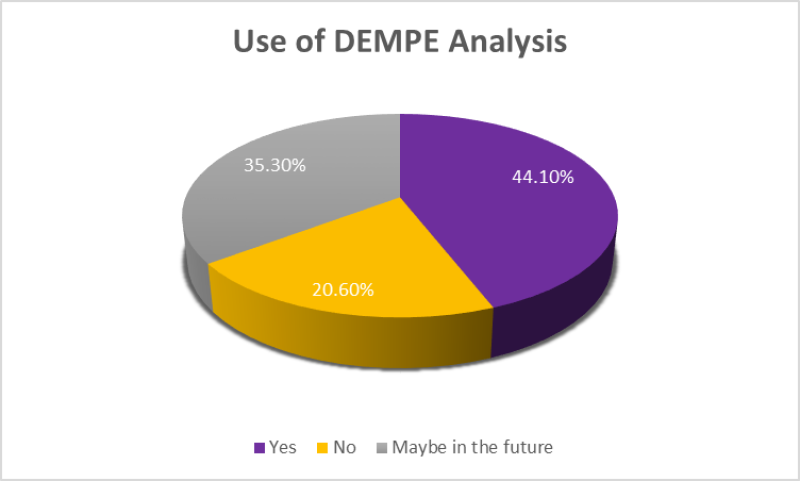

DEMPE analysis for marketing intangibles

DEMPE analysis is also used for allocating marketing intangibles. The majority of respondents said they either use DEMPE analysis (44.10%) or might do in the future (35.30%), whereas a minority of companies (20.60%) said they do not use DEMPE.

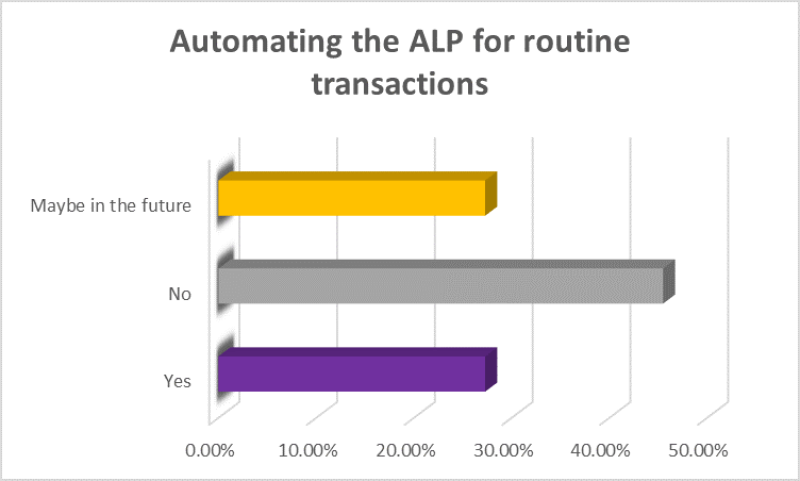

Transfer pricing automation

Transfer pricing is notoriously hard to automate, but it’s possible to apply tech solutions to routine transactions. A majority of respondents (54.6%) said yes or they would consider this in the future, while 45.5% said no.

Dispute prevention

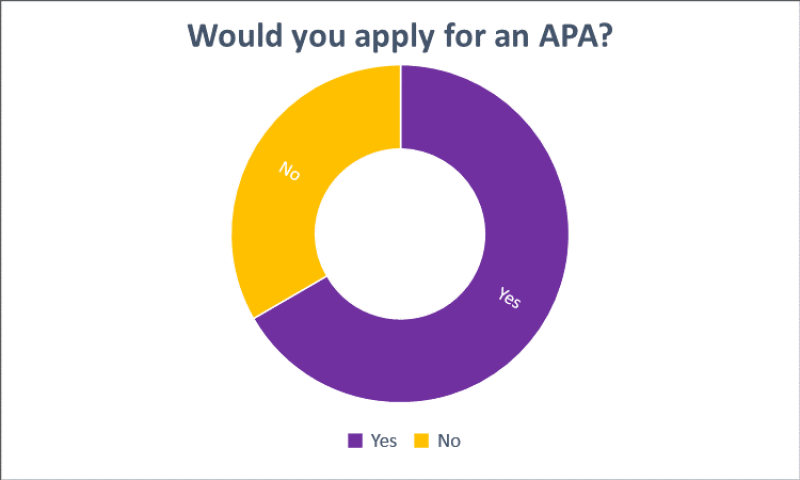

Advance pricing agreement (APA) strategy

An APA strategy is increasingly crucial for any multinational. The majority of companies (66.6%) said they would seek an APA or might do in the future, whereas 33.3% said they would not consider it. Despite the drawbacks of APAs, the agreements remain the first option for most companies.

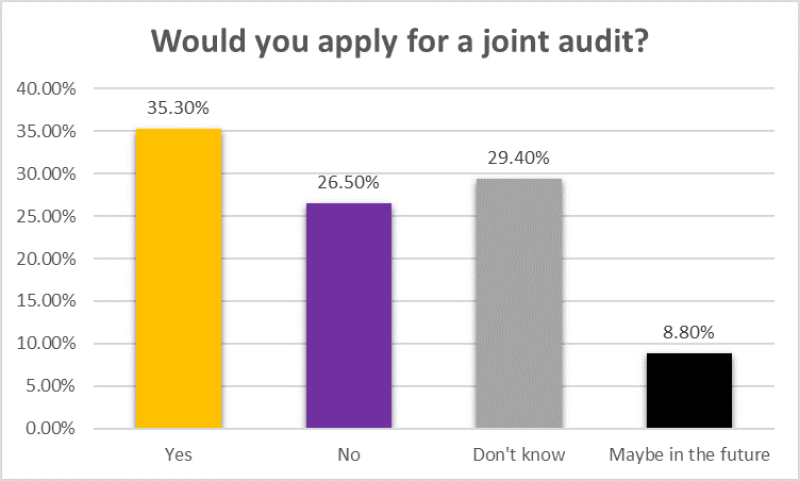

Joint audits

Joint audits are a growing trend for European multinationals with operations in Germany. It’s less important for US companies, though. Many companies have still not considered joint audits as a serious problem and do not expect to in the future.