The tax controversy that has been smouldering between Switzerland and the EU for several years, and which has seen the EU criticise certain Swiss corporate tax regimes (namely primary holding, administrative and mixed companies), has been well-documented. To continue to offer an attractive and internationally accepted corporate tax system, Switzerland finds itself compelled to undertake appropriate changes to its corporate tax rules. These amendments are the main component of the Corporate Tax Reform III (CTR III), which is being driven forward at high pressure by the joint project organisation of the confederation and cantons for CTR III. Fiscal measures are to be taken to maintain and even increase the attractiveness of Switzerland as a business location. At the centre of these efforts is the identification of suitable replacement measures for mobile business activities, in particular for research and development activities, intellectual property (IP) exploitation, financing, trading and the activities of principal companies.

As formulated by the Steering Committee CTR III (being the competent body for the development of the reform), the replacement measures must specifically satisfy three criteria: they must ensure the ongoing fiscal competitiveness of Switzerland, be internationally acceptable and financially viable for Switzerland. The conceivable replacement measures were outlined by the Steering Committee CTR III in May 2013 in an interim report and specified in more detail in a further report in December 2013. The specific content and the details of the replacement measures will be determined in the coming months. The process includes a close consultation inter alia with representatives of business and the cantons. At this stage, the replacement measures mentioned below are considered viable. These are discussed in more detail in this and another two PwC articles in this issue.

Licence Box (at cantonal level)

Notional interest deduction on surplus equity

Other fiscal measures (inter alia capital tax relief, abolition of issuance duty on equity, improvements to the participation relief on dividends)

In order to be able to still offer a tax attractive solution for financing activities, Switzerland is considering – similar to the established Belgium regime – the introduction of a notional interest deduction concept (NID). The (novel) Swiss version of the NID proposed by the Steering Committee CTR III is, however, to be limited to a deduction on above average equity (surplus equity). This methodology prevailed over other NID models in a detailed evaluation because of various specific advantages. This article is devoted to this new model which is currently being investigated more thoroughly by the project organisation CTR III.

Basic concept of a notional interest deduction

In several European countries, for example in Belgium, Liechtenstein, Italy and Latvia, the NID concept based on an imputed deduction for interest on equity has already been introduced, even if its design differs from country to country. Regardless of the country specific details, a NID model in principle functions in a comparable manner: in addition to a deduction for interest on debt financing, a deduction for imputed interest on equity (i.e. the NID) is also allowed. The NID constitutes a commercially justified expense for tax purposes, which reduces the taxable base for corporate income tax. In this way it is ensured that the tax discrimination of equity against debt is minimised or in the best case eliminated.

Two variables underlie the determination of the effective deduction: firstly the eligible equity in the sense of the measurement base, which is entitled to the deduction, and secondly the applicable interest rate. The equity as reported in a company's balance sheet is the starting point for the eligible equity. For purposes of the NID this must be adjusted by various items. Comparing legislations, it can be stated that, for example, in Belgium and Liechtenstein basically the entire equity (subject to certain corrections) qualifies as NID base, while Italy and Latvia allow the NID only on the net increase in equity since the introduction of the NID regime. After determining the measurement base, in the next step, by using the imputed interest deduction (application of an arm's-length interest rate on the eligible equity) it is ensured that a return on equity to the extent that the NID has no corporate income tax consequences.

Functioning of the NID on surplus equity

The NID model considered for Switzerland functions conceptually in a similar way to that described above. The peculiarities are discussed in more detail below. It is the intention that all domestic corporations and domestic permanent establishments of foreign corporations should be able to benefit from the deduction.

Eligible equity

In Switzerland the imputed interest deduction is to be granted only on the surplus equity, that is, on the amount of equity which exceeds average appropriate equity financing. Consequently, only a positive excess equity financing (surplus equity) is for tax purposes not to be disadvantaged compared with debt. No deduction is granted on a company's so-called core capital.

The limitation of the imputed interest deduction to the surplus equity is based on the idea that equity and debt financing, which from a corporate finance point of view reflect obviously different functions and risk profiles, are not completely substitutable. While an enterprise can to a large extent freely determine its own capital structure, the equity – being the incorporation and risk capital – represents the base for the business activity and creates the capacity for raising debt. A certain amount of equity is therefore a basic pre-condition for debt financing and cannot be substituted. To ensure that tax considerations do not distort the financing decision on the capital structuring, equal tax treatment of debt and equity capital is necessary only for equity, which can basically permanently be substituted by debt. That criterion is only met with regard to the surplus equity. The latter is calculated as the difference between a company's taxable equity and its core capital.

The core capital is that part of the equity which an enterprise requires for its business operations on a sustainable basis from a long-term perspective. Thus, the core capital is to be determined based on an enterprise's business and its associated risks (which are reflected by the company's assets). For practical reasons and following established Swiss practice for determining the maximum debt allowable for tax purposes (cf. SFTA/Circular Letter No. 6, 1997, Hidden equity) it makes sense to determine the core capital on the basis of the enterprise specific asset structure according to the corporate income tax values by means of appropriate core capital ratios (that are to be defined). The equity required on a sustainable basis and from a long-term perspective would thereby be equated to the minimum equity requirement for tax purposes. It is also conceivable to increase the allowable core capital rate for certain asset categories by means of a fixed percentage.

From an abuse consideration viewpoint, certain specific captions, such as investments in other corporations and non-operating assets, are excluded from the surplus equity. In addition, the NID deduction should be corrected because of the unilateral tax exemption of the income and assets of foreign permanent establishments and real estate. The last corrective measure should, however, be designed in such a way that account is taken of the judgement issued by the ECJ on the Belgian NID (Argenta Spaarbank case C-350/11).

Calculation of core capital and surplus equity |

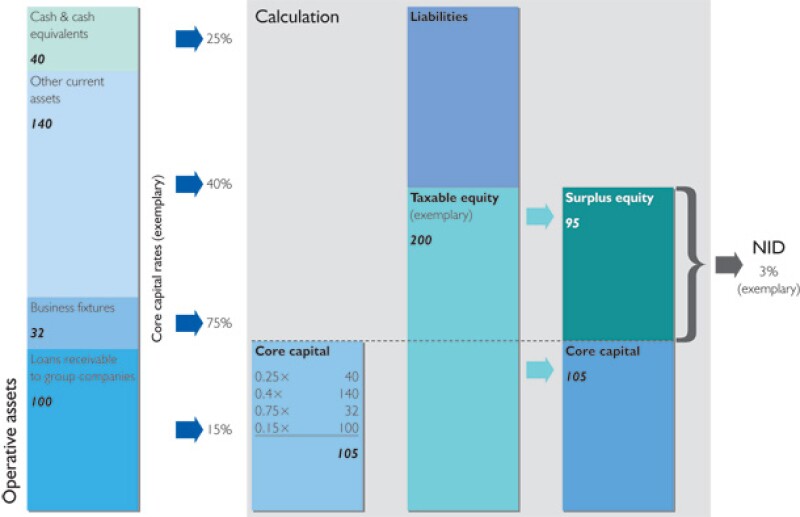

The figure below illustrates the calculation of the equity eligible for the NID: NID on surplus equity: determination of surplus equity (example)

|

Starting from a company’s assets (total assets of 312) in a first step using the (illustrative) core capital ratios the core capital (105) is calculated. In a second step the latter is set against the taxable equity (200). The difference (95) reflects the surplus equity, which forms the measurement base for the NID. |

Applicable interest rate

The NID rate should in principle be equal to the company-specific arm's-length interest rate in terms of interest on the surplus equity. For practical reasons and following the established practice on the publication of the interest rates recognised for tax purposes on advances and loans it seems, however, reasonable that the SFTA publishes each year a suitable safe harbour NID rate, which can be used by the taxpayers. On this subject the Steering Committee CTR III states in its report that the safe harbour interest rate should be adjusted continually to reflect the market and not remain constant over several years.

Taxpayers must, however, be free to prove a higher market conform interest rate using a documented arm's-length test.

Attractive taxation of financing activities in particular

Because of the high risk of migration of mobile activities in general and financing activities in particular, the competitive taxation of interest income is crucial. Firstly, it is a question of preventing companies from shifting existing financing activities out of Switzerland. Secondly, the creation of a NID concept is an important condition to encourage Swiss groups to relocate their inter-company financing activities that are now situated abroad back to Switzerland (cash pooling through to the granting of medium- and long-term loans) and enables foreign groups to extend their financing activities in Switzerland.

In calculating the surplus equity inter-company loans (following the above mentioned SFTA Circular Letter No. 6) in principle require 15% underlying core capital. The (comparatively low) core capital ratio for such loans seems, from a risk and group perspective (netting of receivables and payables within the group; harmonisation of interests within the group), appropriate. The arm's-length interest rate is applied to the determined surplus equity. In the case of financing activities it is conceivable that for evidencing the documented arm's-length test, reliance can be placed on an actual interest margin calculation – an approach already recognised and accepted for tax purposes in Switzerland (including for establishing the minimum interest on debt financed loans to shareholders or related parties). In general, with an imputed deduction on surplus equity an internationally competitive effective tax charge on finance activities rendered out of Switzerland should be achievable.

Appraisal

The approach of a NID on surplus equity meets basically the criteria determined by the Steering Committee CTR III, in particular the criterion of international acceptability. In particular, the described model includes no elements of ring-fencing and does not aim for international non-taxation. In addition, as far as is known, the basic consideration of a NID concept is accepted and neither questioned by the EU nor the OECD and, as mentioned at the beginning, various alternative designs have already been implemented in other countries. However, with a view to international acceptability, the international developments in this area, especially the work of the OECD and of the G20 as well as the relevant judgements of the ECJ, must be monitored and taken into consideration during the course of further work in Switzerland.

From a tax systemic viewpoint, the NID represents an important step in eliminating, at the corporate level, the tax discrimination of equity compared with debt. For corporate income tax purposes, debt financing is therefore no longer per se more advantageous; companies will as a result reconsider their capital structure and in future tend more towards equity financing. Excess debt incurrence will therefore also for tax purposes no longer – or at least no longer to the same extent – be rewarded. This policy, which from a business and tax perspective deserves support, encourages companies to retain earnings for reinvestment and as a consequence contributes to the preservation of existing and the creation of new jobs. In addition, in times of crisis, higher equity serves as a cushion, which reduces the risk of financial distress and bankruptcies. Despite the outlined advantages of introducing a NID concept in Switzerland, the financial viability of this measure must be investigated yet more closely. In particular, it is necessary to analyse in more detail the broad impact of the NID on surplus equity. Windfall profits and tax losses must be at a viable level. In addition to the step towards financing neutrality, the introduction of the NID on surplus equity can also ensure an attractive, internationally competitive taxation of inter-company financing activities.

The first impulse towards the successful realisation of this novel system for the Swiss tax landscape has been made. It is now a question of undertaking a detailed investigation in the course of the next steps of elaborating this measure. It should be borne in mind that the introduction of a NID on surplus equity constitutes only one of numerous replacement measures under the CTR III (see the articles in this issue by Benjamin Koch, Armin Marti and Laurenz Schneider for information on the other measures) and that the final design of this reform will finally be an interplay of single measures.

Biography |

||

|

|

Andreas StaubliPricewaterhouseCoopers Ltd. Birchstrasse 160 CH-8050 Zurich Tel: +41 58 792 44 72 Fax: +41 58 792 44 10 Email: andreas.staubli@ch.pwc.com Andreas Staubli is managing partner; leader tax, legal and HRS Switzerland. Andreas Staubli has more than 20 years of experience in domestic and international corporate structuring, mergers and acquisitions, financial services taxation, tax strategy & tax management, tax accounting and worldwide compliance engagements. He advises Swiss and international companies and is a member of the Management Board of PwC Switzerland. |

Biography |

||

|

|

Remo KüttelPricewaterhouseCoopers Ltd Grafenauweg 8 CH-6304 Zug Tel: +41 58 792 68 69 Fax: +41 58 792 68 17 Email: remo.kuettel@ch.pwc.com Remo Küttel is a director in the international tax structuring team of the tax and legal practice at PwC Switzerland. He has wide experience in rendering corporate tax services to large Swiss-based and multinational clients, in particular in the area of designing cross-border tax efficient structures and group restructurings. |