Malta

Malta risks ceding tax revenues to jurisdictions that adopt the global minimum tax sooner, the IMF said

US and Turkey compromise again on DST, new rules in Belarus on e-services VAT, Malta forced to charge VAT on buying and selling of securities, and more

The ‘big four’ accountancy firm extends its UK chair’s term for a further two years, while UK business leaders protest against removing a VAT break for tourists

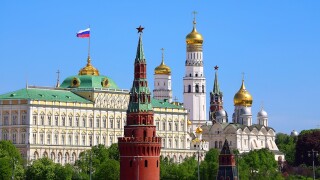

Russia will further its own economic isolation by suspending tax treaties with former allies, but this is part of Putin’s long-term mission.

Sponsored

Sponsored

-

Sponsored by DS AvocatsCyril Maucour and Jessica Benchetrit of DS Avocats evaluate the effectiveness of the OECD’s new unified approach, which provides market jurisdictions greater taxing rights over residual profits.

-

Sponsored by WH PartnersRamona Azzopardi, Fiorella San Martin and Joselyn Teuma of WH Partners explain how Malta has strengthened its financial certainty by successfully implementing the ATAD II regulations to its domestic legal system.

-

Sponsored by Camilleri PreziosiDonald Vella and Kirsten Debono Huskinson of Camilleri Preziosi Advocates examine the impact of the Anti-Tax Avoidance Directive II on the tax framework in Malta.

Article list (load more 4 col) current tags