Malta

Malta risks ceding tax revenues to jurisdictions that adopt the global minimum tax sooner, the IMF said

US and Turkey compromise again on DST, new rules in Belarus on e-services VAT, Malta forced to charge VAT on buying and selling of securities, and more

The ‘big four’ accountancy firm extends its UK chair’s term for a further two years, while UK business leaders protest against removing a VAT break for tourists

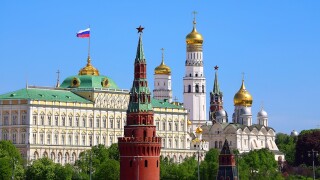

Russia will further its own economic isolation by suspending tax treaties with former allies, but this is part of Putin’s long-term mission.

Sponsored

Sponsored

-

Sponsored by EY Asia-PacificAlbert Lee and Agnes Fok of EY explain how an intelligent tax function will help businesses manage the ever-increasing global tax reporting requirements and turn data into insights.

-

Sponsored by EY Asia-PacificPaul Griffiths and Edvard Rinck of EY assess what the paradigms for multinational operating models in Asia may look like after the COVID-19 crisis and consider what this means for tax departments.

-

Sponsored by EY Asia-PacificTracey Kuuskoski, Gavin Shanhun and Kevin Zhou of EY consider how the indirect tax landscape continues to evolve across the Asia-Pacific region (APAC), and look ahead for what to expect beyond 2020.

Article list (load more 4 col) current tags