Malta

Malta risks ceding tax revenues to jurisdictions that adopt the global minimum tax sooner, the IMF said

US and Turkey compromise again on DST, new rules in Belarus on e-services VAT, Malta forced to charge VAT on buying and selling of securities, and more

The ‘big four’ accountancy firm extends its UK chair’s term for a further two years, while UK business leaders protest against removing a VAT break for tourists

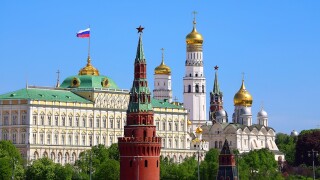

Russia will further its own economic isolation by suspending tax treaties with former allies, but this is part of Putin’s long-term mission.

Sponsored

Sponsored

-

Sponsored by Deloitte Transfer Pricing GlobalJari Ahonen and Juan Ignacio de Molina discuss global examples and assess the practical impact of retroactively applying the OECD Transfer Pricing Guidelines.

-

Sponsored by Deloitte Transfer Pricing GlobalRamón López de Haro and Alejandro Paredes evaluate how promoting the negotiation of advance pricing agreements (APAs) may raise the confidence of potential investors in the region.

-

Sponsored by Deloitte Transfer Pricing GlobalAaron Wang, Vrajesh Dutia and Chris In explain how adopting global best practices has proved to be beneficial for the development of dispute resolution procedures in China, India and South Korea.

Article list (load more 4 col) current tags