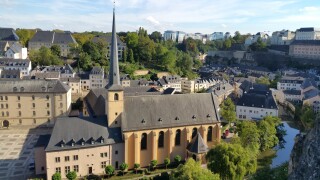

Luxembourg

Using tax to enhance its standing as a funds location is behind Luxembourg’s measures aimed at clarifying ATAD 2 and making its carried interest regime more attractive

Luxembourg’s reform agenda continues at pace in 2025, with targeted measures for start-ups and alternative investment funds

The new framework simplifies the process of relocating eligible employees to Luxembourg and offers a ‘clear and streamlined benefit’, says Alexandra Clouté of Ashurst

The Luxembourg-based TP leader tells ITR about relishing the intellectual challenge of his practice, his admiration for Stephen Hawking, and what makes tax cool

Sponsored

Sponsored

-

Sponsored by Deloitte Transfer Pricing GlobalThe OECD’s work around the digitalisation of the economy is proceeding at a rapid pace and many multinational enterprises may be surprised at the scope of changes to the international tax framework. These changes could impact all larger multinationals, not just those that consider themselves part of the digital economy.

-

Sponsored by Deloitte Transfer Pricing GlobalThe technology, media and telecommunications (TMT) sector may be directly affected by the G20/OECD digital economy tax proposals. Sajeev Sidher and Kaidi Liu of Deloitte Tax LLP look at the uncertainties ahead.

-

Sponsored by Deloitte Transfer Pricing GlobalAengus Barry and Sérgio Moreno of Deloitte UK analyse the tax proposals against the energy and resources sector, a clear example of a sector not often seen as ‘digital’ but for which the digital tax could have great implications.

Article list (load more 4 col) current tags