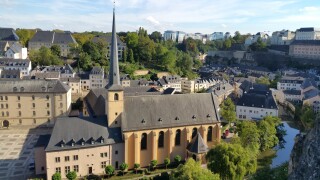

Luxembourg

Using tax to enhance its standing as a funds location is behind Luxembourg’s measures aimed at clarifying ATAD 2 and making its carried interest regime more attractive

Luxembourg’s reform agenda continues at pace in 2025, with targeted measures for start-ups and alternative investment funds

The new framework simplifies the process of relocating eligible employees to Luxembourg and offers a ‘clear and streamlined benefit’, says Alexandra Clouté of Ashurst

The Luxembourg-based TP leader tells ITR about relishing the intellectual challenge of his practice, his admiration for Stephen Hawking, and what makes tax cool

Sponsored

Sponsored

-

Sponsored by Deloitte LuxembourgJoin ITR and Deloitte Luxembourg at 4pm CET (3pm GMT, 10am EST) on November 9 2023 to hear about strategies to effectively manage transfer pricing controversy, and the latest market developments in the area of financial transactions transfer pricing.

-

Sponsored by Deloitte LuxembourgVincent Martin and Jordan Feltesse of Deloitte Luxembourg overview the evolving tax landscape for crypto assets in Luxembourg, offering guidance in the absence of established regulation.

-

Sponsored by Deloitte LuxembourgBalazs Majoros and Adam Wojewoda of Deloitte Luxembourg offer practical tips for businesses facing audits in Luxembourg and anticipate some significant upcoming tax law changes.

Article list (load more 4 col) current tags