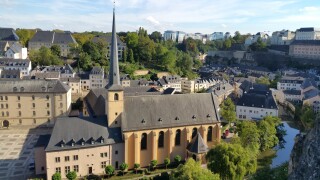

Luxembourg

Using tax to enhance its standing as a funds location is behind Luxembourg’s measures aimed at clarifying ATAD 2 and making its carried interest regime more attractive

Luxembourg’s reform agenda continues at pace in 2025, with targeted measures for start-ups and alternative investment funds

The new framework simplifies the process of relocating eligible employees to Luxembourg and offers a ‘clear and streamlined benefit’, says Alexandra Clouté of Ashurst

The Luxembourg-based TP leader tells ITR about relishing the intellectual challenge of his practice, his admiration for Stephen Hawking, and what makes tax cool

Sponsored

Sponsored

-

Sponsored by EXA AGFrank Schoeneborn and Divya Vir Rastogi of EXA AG discuss how the development of state-of-the-art operational transfer pricing solutions are enhancing the day-to-day work of tax professionals.

-

Sponsored by SF Consulting/Crowe IndonesiaSri Wahyuni Sujono and Gandi Siregar of SF Consulting/Crowe Indonesia summarise the tax audit procedure in Indonesia, while explaining why pressure to achieve tax revenue targets in 2020 may stimulate an aggressive approach.

-

Sponsored by Deloitte LuxembourgRalf Heussner and Iva Gyurova of Deloitte Luxembourg explore the key global transfer pricing trends of the coming years, which will influence businesses and taxpayers in the financial services sector.

Article list (load more 4 col) current tags