If Trump continues to poke the world’s ‘middle powers’ with a stick, he shouldn’t be surprised when they retaliate

The Netherlands-based bank was described as an ‘exemplar of total transparency’; in other news, Kirkland & Ellis made a senior tax hire in Dallas

Zion Adeoye, a tax specialist, had been suspended from the African law firm since October over misconduct allegations

The deal establishes Ryan’s property tax presence in Scotland and expands its ability to serve clients with complex commercial property portfolios across the UK, the firm said

Sponsored

-

Sponsored by GNV ConsultingAhdianto Ah and Aditya Nugroho of GNV Consulting explain recent Indonesian tax reforms affecting business restructurings, treaty access, and enforcement

-

Sponsored by GNV ConsultingAhdianto Ah and Aditya Nugroho of GNV Consulting summarise an extension of the government-borne incentive, new risk-based taxpayer compliance supervision rules, and revised mutual agreement procedure guidelines

-

Sponsored by Saleh, Barsoum & Abdel Aziz – Grant Thornton EgyptRabie Morsy and Ahmed Khalifa of Saleh, Barsoum & Abdel Aziz – Grant Thornton Egypt analyse the amendments and guidance, focusing on construction, commodities, exemptions, and practical compliance implications for businesses

-

The French government will target the wealthy and multinationals and ensure that the biggest companies are audited every two years.

-

Experts say HMRC’s proposed crypto-asset DeFi legislation is a good starting point but more work towards a complete crypto taxation framework is needed.

-

Luxembourg did not grant illegal state aid to French utility company Engie, according to an adviser to the Court of Justice of the EU.

-

The National Foreign Trade Council questions the compatibility of pillar two rules, while HM Revenue and Customs holds a consultation on crypto taxation.

-

Tax justice campaigners have called on King Charles to address the issue of tax transparency, but this is a matter for Parliament and not royalty.

-

Speaking to ITR, an administrative judge in São Paulo says a 'great debate' is needed before tax and transfer pricing can be reformed.

-

The Women in Business Law Awards is excited to present the shortlist for the 2023 Europe, Middle East, & Africa awards.

-

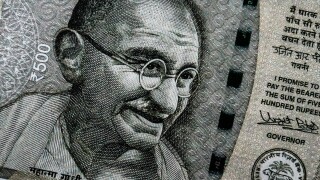

India GST breaks revenue records, the EU plans to adopt CBAM, Japanese business leaders call for a consumption tax increase, and more.

-

Although India has tweaked some tax rates for individuals and companies, it is still trying to address other issues such as capital gains, sources say.