Japan

Former EY and Deloitte tax specialists will staff the new operation, which provides the firm with new offices in Tokyo and Osaka

Jaap Zwaan’s arrival continues a recent streak of A&M Tax investing in the region; in other news, the US and Japan struck a deal that significantly lowered tariff rates

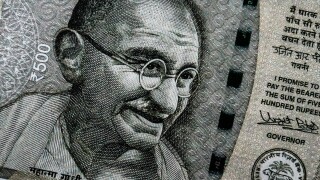

The move to a new ‘high spec’ hub is slated for 2026; in other news, India reassesses its pillar two participation following the US’s withdrawal

Jurisdictions that have ratified the global minimum tax are now in the process of making it a reality

Sponsored

Sponsored

-

Sponsored by Deloitte Transfer Pricing GlobalTehmina Sharma and Riddhi Shah of Deloitte India examine the industrial products and construction sector, where digitalisation is upending traditional business and supply chains.

-

Sponsored by Deloitte USIn a wide-ranging interview, ITR speaks to Terri LaRae, partner and leader of the global operations transformation tax team at Deloitte, about the factors driving tax transformation and how tax departments can get the best out of it.

-

Sponsored by Nagashima OhnoJapan will reduce its corporate tax rate by five percentage points to 35% from next April, in an effort to boost the country’s ailing economy.

Article list (load more 4 col) current tags