India

Trump announced he will cut tariffs after India agreed to stop buying Russian oil; in other news, more than 300 delegates gathered at the OECD to discuss VAT fraud prevention

The ruling excludes vacation and business development days from service PE calculations and confirms virtual services from abroad don’t count, potentially reshaping compliance for multinationals

In the first of a two-part series, experts from Khaitan & Co dissect a highly anticipated Indian Supreme Court ruling that marks a decisive shift in India’s international tax jurisprudence

The Clifford Chance and Hyatt cases collectively confirm a fundamental principle of international tax law: permanent establishment is a concept based on physical and territorial presence

Sponsored

Sponsored

-

Sponsored by Dhruva AdvisorsIn April 2019, India implemented GST reform in the real estate sector, seeing rates drop to as low as 1% for some residential sectors. Dhruva Advisors' Ritesh Kanodia and Meetika Baghel discuss the implications for property buyers and developers.

-

Sponsored by Dhruva AdvisorsThe Mumbai Income Tax Appellate Tribunal (tribunal) has held that a territorial nexus is necessary for determining profits attributable to operations carried out in India. Agency commission accrued, or arising, outside of India is not taxable under domestic laws.

-

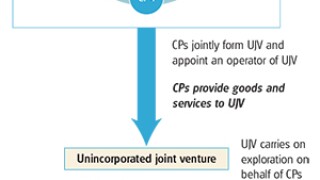

Sponsored by Deloitte Transfer Pricing GlobalIndia’s rapid growth and energy consumption has seen the government simplify public-private investment partnerships in the upstream oil and gas (O&G) sector. Deloitte’s Bhavik Timbadia and Ankit Goel discuss the transfer pricing (TP) implications.

Article list (load more 4 col) current tags