Firm

The Netherlands-based bank was described as an ‘exemplar of total transparency’; in other news, Kirkland & Ellis made a senior tax hire in Dallas

The deal establishes Ryan’s property tax presence in Scotland and expands its ability to serve clients with complex commercial property portfolios across the UK, the firm said

The Fortune 150 energy multinational is among more than 12 companies participating in the initiative, which ‘helps tax teams put generative AI to work’

The ruling excludes vacation and business development days from service PE calculations and confirms virtual services from abroad don’t count, potentially reshaping compliance for multinationals

Sponsored

Sponsored

-

Sponsored by Deloitte Transfer Pricing GlobalTransfer pricing (TP) litigation surrounding the energy and resources (E&R) sector has increased drastically over the past two years. While determining the owner of the commodity price risk has drawn increased attention, Deloitte’s Mark Barker and Aengus Barry discuss how tax authorities predominantly employ the comparable uncontrolled price (CUP) method in any TP dispute.

-

Sponsored by Deloitte Transfer Pricing GlobalOffshore marketing hubs are becoming increasingly commonplace for Australian resource firms in Asia. Deloitte’s John Bland and Milla Ivanova discuss what factors may trigger increased regulatory scrutiny for a multinational under the Australian Taxation Office’s (ATO) risk ratings.

-

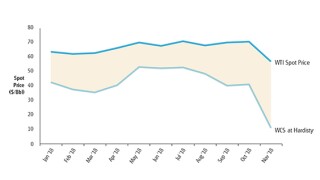

Sponsored by Deloitte Transfer Pricing GlobalVolatile oil markets in 2018 presented significant challenges to Canadian exporters, but a shortage in natural gas production globally presented a complimentary opportunity. Deloitte’s Andreas Ottosson and Markus Navikenas discuss the transfer pricing implications.

Article list (load more 4 col) current tags