Firm

Partners want to join Ryan because it’s a disruptor firm, truly global and less bureaucratic, Tom Shave told ITR

The Netherlands-based bank was described as an ‘exemplar of total transparency’; in other news, Kirkland & Ellis made a senior tax hire in Dallas

The deal establishes Ryan’s property tax presence in Scotland and expands its ability to serve clients with complex commercial property portfolios across the UK, the firm said

The Fortune 150 energy multinational is among more than 12 companies participating in the initiative, which ‘helps tax teams put generative AI to work’

Sponsored

Sponsored

-

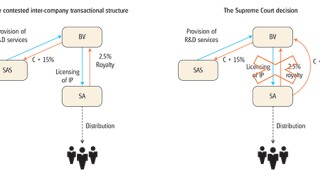

Sponsored by Tax Partner AG, Taxand SwitzerlandAs Switzerland passes wide-scale tax reform, local tax authorities are increasingly focusing on intangibles and intellectual property (IP) audits as part of a two-pronged approach in tackling tax evasion. Tax Partner’s Caterina Colling-Russo and René Matteotti discuss the focus.

-

Sponsored by EY SwitzerlandAs Switzerland harmonises its corporate tax regime with international standards, the number of available tax incentives for businesses will diminish, while the effective tax rate will rise. EY Switzerland’s Kersten Honold and Kilian Bürgi discuss how cantonal ‘tax holidays’ provide an alternative to maintain rates below 10%.

-

Sponsored by BurckhardtSwitzerland receives an unprecedented number of information exchange requests every year by foreign countries. Burckhardt Law’s Rolf Wüthrich explores how the private banking state is amending its exchange obligations around share rights and corporate ownership in a bid to harmonise its laws with international norms.

Article list (load more 4 col) current tags