Firm

Partners want to join Ryan because it’s a disruptor firm, truly global and less bureaucratic, Tom Shave told ITR

The Netherlands-based bank was described as an ‘exemplar of total transparency’; in other news, Kirkland & Ellis made a senior tax hire in Dallas

The deal establishes Ryan’s property tax presence in Scotland and expands its ability to serve clients with complex commercial property portfolios across the UK, the firm said

The Fortune 150 energy multinational is among more than 12 companies participating in the initiative, which ‘helps tax teams put generative AI to work’

Sponsored

Sponsored

-

Sponsored by EY ColombiaAndrés Parra and María Alejandra Cuervo of EY Colombia explore how the international transfer pricing guidelines have influenced regulations in the country.

-

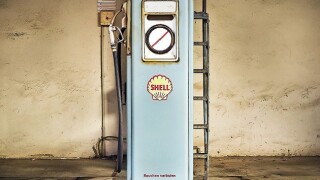

Sponsored by EY MexicoVíctor Anaya Sánchez of EY Mexico discusses how the newly introduced control system by the Mexican Tax Administration seeks to improve reporting functions related to fuel transactions.

-

Sponsored by BurckhardtRolf Wüthrich of burckhardt Ltd explains how Switzerland is improving its compliance and reporting functions to strengthen the country’s reputation as a global business centre.

Article list (load more 4 col) current tags