Firm

The landmark Indian Supreme Court judgment redefines GAAR, JAAR and treaty safeguards, and rejects protection for indirect transfers and tightening conditions for Mauritius‑based investors claiming DTAA relief

As tax teams face pressure from complex rules and manual processes, adopting clear ownership, clean data and adaptable technology is essential, writes Russell Gammon, chief innovation officer at Tax Systems

Partners want to join Ryan because it’s a disruptor firm, truly global and less bureaucratic, Tom Shave told ITR

The Netherlands-based bank was described as an ‘exemplar of total transparency’; in other news, Kirkland & Ellis made a senior tax hire in Dallas

Sponsored

Sponsored

-

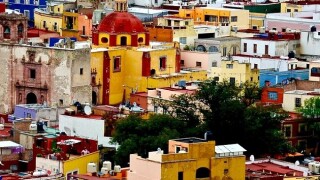

Sponsored by Escalante & AsociadosÁngel Escalante and Juan Manuel Morán of Escalante & Asociados examine whether a new fee for the use of the public infrastructure in Mexico City is a gateway to double or multiple taxation.

-

Sponsored by Lakshmikumaran & SridharanPuneet Jain and Aanchal Jain of Lakshmikumaran & Sridharan discuss the controversy on taxability of royalty, FTS and interest on receipt basis in India from the perspective of non-residents.

-

Sponsored by Deloitte NorwayLinda K Rollefsen and Lene Bergersen of Deloitte Norway explain two recent interpretative statements from the Norwegian Directorate of Taxes and discuss how they will affect the taxation of employee share incentive schemes.

Article list (load more 4 col) current tags