Firm

The Netherlands-based bank was described as an ‘exemplar of total transparency’; in other news, Kirkland & Ellis made a senior tax hire in Dallas

The deal establishes Ryan’s property tax presence in Scotland and expands its ability to serve clients with complex commercial property portfolios across the UK, the firm said

The Fortune 150 energy multinational is among more than 12 companies participating in the initiative, which ‘helps tax teams put generative AI to work’

The ruling excludes vacation and business development days from service PE calculations and confirms virtual services from abroad don’t count, potentially reshaping compliance for multinationals

Sponsored

Sponsored

-

Sponsored by Tax Partner AG, Taxand SwitzerlandDr Alberto Lissi and Tom Lawson of Tax Partner AG - Taxand Switzerland describe how the OECD/G20 minimum taxation rules will impact multinational enterprises in Switzerland.

-

Sponsored by Rosli Dahlan Saravana PartnershipS Saravana Kumar and Nur Amira Ahmad Azhar of Rosli Dahlan Saravana Partnership discuss a high court case clarifying reinvestment allowance for capital expenditure.

-

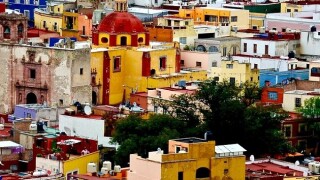

Sponsored by Escalante & AsociadosÁngel Escalante and Juan Manuel Morán of Escalante & Asociados examine whether a new fee for the use of the public infrastructure in Mexico City is a gateway to double or multiple taxation.

Article list (load more 4 col) current tags