Firm

The Netherlands-based bank was described as an ‘exemplar of total transparency’; in other news, Kirkland & Ellis made a senior tax hire in Dallas

The deal establishes Ryan’s property tax presence in Scotland and expands its ability to serve clients with complex commercial property portfolios across the UK, the firm said

The Fortune 150 energy multinational is among more than 12 companies participating in the initiative, which ‘helps tax teams put generative AI to work’

The ruling excludes vacation and business development days from service PE calculations and confirms virtual services from abroad don’t count, potentially reshaping compliance for multinationals

Sponsored

Sponsored

-

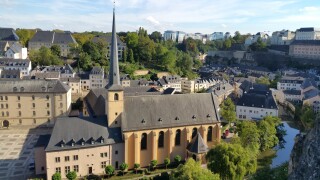

Sponsored by Deloitte LuxembourgThe differences and similarities in the implementation of the MLI in Austria, Germany, France, Luxembourg and Poland are summarised by Yves Knel and Anne-Sophie Le Bris of Deloitte Luxembourg, in association with regional experts.

-

Sponsored by PwC ChileAstrid Schudeck and Belén Guiachetti of PwC Chile consider whether Chilean VAT on digital services is more effective than Amount A in the pillar one measures.

-

Sponsored by Lakshmikumaran & SridharanRaghavan Ramabadran and Sahana Rajkumar of Lakshmikumaran & Sridharan Attorneys discuss GST in India, five years since it was first introduced, and consider how the government and industry are striking a balancing act.

Article list (load more 4 col) current tags