Feature

The ruling excludes vacation and business development days from service PE calculations and confirms virtual services from abroad don’t count, potentially reshaping compliance for multinationals

User-friendly digital tax filing systems, transformative AI deployment, and the continued proliferation of DSTs will define 2026, writes Ascoria’s Neil Kelley

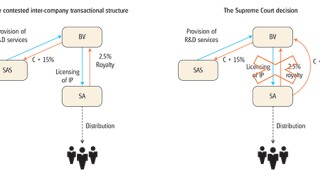

In the first of a two-part series, experts from Khaitan & Co dissect a highly anticipated Indian Supreme Court ruling that marks a decisive shift in India’s international tax jurisprudence

Libya’s often-overlooked stamp duty can halt payments and freeze contracts, making this quiet tax a decisive hurdle for foreign investors to clear, writes Salaheddin El Busefi

Sponsored

Sponsored

-

Sponsored by Lenz & StaehelinAfter Swiss tax reform failed to secure public support in 2017, lawmakers have revised key tenants to ensure it passes when it goes to a second referendum, this time in May 2019. Lenz & Staehelin’s Jean-Blaise Eckert and Frédéric Neukomm discuss the potential impact on corporations and shareholders.

-

Sponsored by Tax Partner AG, Taxand SwitzerlandAs Switzerland passes wide-scale tax reform, local tax authorities are increasingly focusing on intangibles and intellectual property (IP) audits as part of a two-pronged approach in tackling tax evasion. Tax Partner’s Caterina Colling-Russo and René Matteotti discuss the focus.

-

Sponsored by EY SwitzerlandAs Switzerland harmonises its corporate tax regime with international standards, the number of available tax incentives for businesses will diminish, while the effective tax rate will rise. EY Switzerland’s Kersten Honold and Kilian Bürgi discuss how cantonal ‘tax holidays’ provide an alternative to maintain rates below 10%.

Article list (load more 4 col) current tags