In its judgment in Copal Research Limited, Mauritius on August 14, the Delhi High Court laid down important principles about the taxability of indirect transfer of Indian assets (that is, a Vodafone-like situation).

Transactions with UK company

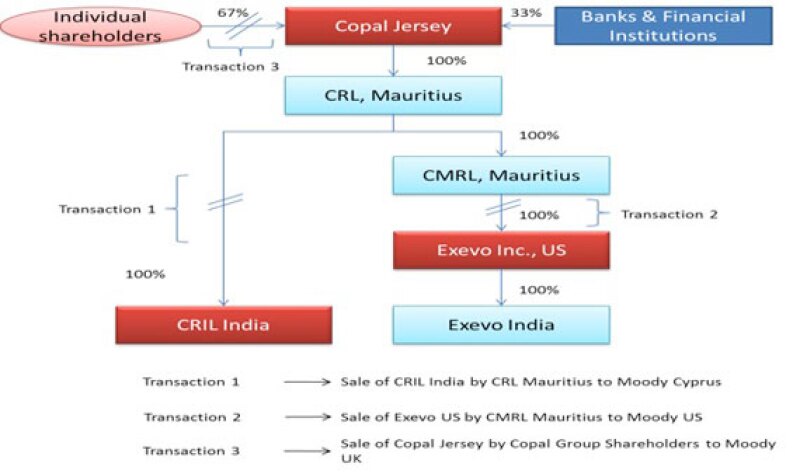

Copal Group, which has businesses in countries around the world such as India, US, Middle East, Cyprus, China and Singapore, entered into these transactions with the Moody Group of UK:

1. Transaction I: Sale of 100% shares of Copal Research India Private Limited, India (CRIL India) by Copal Research Limited, Mauritius (CRL Mauritius) to Moody’s Group Cyprus, Cyprus (Moody Cyprus) through share purchase agreement (SPA-1).

2. Transaction 2: Sale of 100% shares of Exevo Inc, US (Exevo US) by Copal Market Research Limited, Mauritius (CMRL Mauritius) to Moody’s Analytics, US (Moody US) through share purchase agreement (SPA-2). As a result of this transaction, the control of Exevo India Private Limited, India (Exevo India), a wholly owned subsidiary of Exevo US, was also indirectly transferred to Moody US.

3. Transaction 3: Sale of 67% shares of Copal Partners, Jersey (Copal Jersey) by Copal Group Shareholders to Moody’s Group UK, UK (Moody UK) through share purchase agreement (SPA-3). This transaction took place a day after Transaction 1 and Transaction 2.

Diagram 1: Group structure and transactions:

Under the applications filed by the parties, the Authority for Advance Rulings (AAR) held that capital gains arising out of Transactions 1 and 2 were not liable to tax in India in the hands of the respective Copal Group entities.

The tax authorities challenged this ruling by way of a writ petition before the Delhi High Court. With these key reasons and principles the court agreed with the ruling of the AAR and held that the transactions in question were not taxable in India:

Whether transactions were designed for tax avoidance?

The HC, after examining the sequence of the events, held that the transactions were not designed for avoidance of tax:

Copal Group Shareholders held only 67% shares of Copal Jersey. Accordingly, sale of shares of Copal Jersey to Moody UK would result in Moody Group acquiring a 67% indirect economic interest in CRL and CMRL, including interest in any consideration paid for acquiring shares of CRIL and Exevo US, as contemplated under SPA-1 and SPA-2.

The consideration received for the sales of CRIL and Exevo US was distributed as dividend and paid to both the shareholders of Copal Jersey. Therefore, the banks also received their share of the consideration for sale of shares of CRIL and Exevo US. This would not have been commercially achieved if the parties had entered into a transaction for the sale of Copal Jersey.

The intended transaction structure, as suggested by the tax authorities (that is, the sale of Copal Jersey to Moody UK without selling the shares in the other companies), would not be an alternative to the transactions in question.

Whether the transaction would be taxable if only shares of Copal Jersey were sold (without the sale of shares of CRIL India and Exevo US)?

The Delhi High Court held that even if the sale of shares by the Copal Group Shareholders to Moody UK were structured in the manner suggested by the tax authorities, there would not be any incidence of tax for these reasons:

Ratio of consideration paid for the direct and indirect acquisition of shares of the Indian companies (that is, CRIL India and Exevo India) to the aggregate consideration was minuscule.

The government’s retrospective amendment, which followed the Supreme Court judgment in the Vodafone case) seeking to tax the indirect transfer of Indian assets, was only clarificatory in nature and was introduced for the limited purpose of stipulating that assets which substantially derive their value from assets situated in India, would also be deemed to be situated in India and thus, the transfer of such offshore shares would also be taxable in India. But, this provision would apply only to the transfer of assets overseas which derive their value substantially from Indian assets.

The Delhi High Court took note of the thresholds provided under the Direct Taxes Code Bill, 2010 for taxing gains from the sale of assets situated overseas, that is, offshore shares which derived more than 50% of their value from assets situated in India, would be liable to tax in India and the recommendation of the Shome Committee Report for taxation of indirect transfer of Indian assets. The Delhi High Court further observed that similar thresholds were provided under the UN Model Double Taxation Convention between Developed and Developing Countries and the OECD Model Tax Convention on Income and on Capital for capital gains arising on account of transfer of shares which derive their value principally from immoveable property.

Therefore, gains arising from the sale of the shares of a company incorporated overseas deriving less than 50% of its value from assets situated in India would not be taxable under the amended Indian tax laws.

Were CRL Mauritius and CMRL Mauritius shell companies?

The Delhi High Court held that CRL Mauritius and CMRL Mauritius could not be described as shell companies so as to ignore their corporate identities since these companies were generating revenue from intra-group services. The tax authorities were also unable to show that the place of effective management of the companies was not in Mauritius.

Impact

This is the first ruling on the subject of the taxation of the indirect transfer of Indian assets, after the government’s much talked about amendment following the Supreme Court’s Vodafone ruling, which deals with the threshold to determine the value of the term ‘substantial’.

In this significant ruling, the Delhi High Court has interpreted the crucial term ‘substantial value’ to mean at least 50% of the total value of the assets of the foreign company, by relying on recommendations made in the Shome Committee Report (in relation to the taxation of the indirect transfer of Indian assets), Direct Taxes Code Bill 2010 and the OECD and UN Model Convention commentaries on cross-border taxation. The Income Tax Act also contains certain references, though in a different context, to the meaning of the term ‘substantial interest’ which is defined to mean, for example, 20% of the voting power, etc.

It is interesting to note that the Direct Taxes Code Bill 2013 proposes a reduced threshold of 20%, as against the Direct Taxes Code Bill 2010, which proposed a threshold of 50%, for the purpose of taxing the sale of offshore shares involving the indirect transfer of Indian assets.

Commercial substance

The other important aspect examined in this ruling is the commercial substance in the transactions. The Delhi High Court recognised the shareholders’ right to receive dividends as a commercial consideration that would be good enough to structure the transactions in a way that would best meet their requirements.

The Delhi High Court also rejected allegations that the board of the Mauritius companies were controlled and managed from UK. In this context, though the court recognised that the role of the UK resident was significant, that by itself would not be sufficient to assume that the Mauritius companies were tax residents of UK and not of Mauritius and so deny benefits of the India-Mauritius tax treaty.

It is now up to the government to expressly provide in the Income-tax Act, the intended threshold, whether 50% or 20%, for ascertaining the substantial value for the purpose of taxing the indirect transfer of Indian assets.

Sanjay Sanghvi is a partner, and Surajkumar Shetty is an associate, at Khaitan & Co.