Following corporate tax reform (CTR) in Switzerland, it is expected that most of the tax privileges available for corporate taxpayers (which sees an effective tax rate of 10% or less), will be abolished.

While the outcome is yet to be finalised in a public referendum on May 19 2019, CTR is ultimately necessary to bring Swiss tax law and practice in line with OECD and EU standards.

To ensure a seamless transition, and in light of the principle of mutual trust, Switzerland will grant transitional measures (such as a tax-neutral step-up) to allow taxpayers to implement and adjust to the new environment over the next few of years. Furthermore, almost all Swiss cantons have announced, if not already enacted, a reduction in their headline tax rates, ranging between 11.3 to 14% (including federal tax).

Corporate tax reform will also see the cantons introduce a number of other measures, such as a patent box regime, a research and development (R&D) super-deduction, or a notional interest deduction.

Swiss tax holidays

One instrument that will continue to be available after CTR is the Swiss holiday tax. It is a tax incentive granted by the federal and/or cantonal governments if a new business is established or relocated to Switzerland, ultimately creating jobs and encouraging business innovation.

Tax holidays are an economic policy designed to strengthen the competitiveness of individual Swiss regions. It should be noted that it is the government and not the tax authorities who are granting tax holidays.

Like most holiday's, Swiss tax holidays also come to an end, but usually after a maximum period of 10 years. During this period, it is possible to obtain a low single-digit tax rate.

With many tax privileges expected to be abolished as a consequence of CTR, the relative importance of tax holidays as a tax incentive for doing business in Switzerland increases. It is subsequently worth exploring this tax incentive.

Tax alignment with OECD and EU standards

According to the OECD's final report on BEPS Action 5, tax incentives in the form of a tax relief designed to encourage the economic development of specific areas are regarded as having a small risk potential of base erosion and profit shifting.

Although such incentives will continue to be monitored by the OECD, no further review is currently planned unless there is a clear indication of adverse economic effects. As a result, Swiss tax holidays are a legitimate tax advisory instrument that aligns with the OECD's BEPS initiative.

In order to be considered by the OECD as a "low risk regime", the following conditions must all be met:

The tax holiday is only available in a pre-defined geographical area and specifically contributes to that region's economic development;

The main purpose of the tax holiday is to create new jobs and attract tangible investments, rather than just intellectual property (IP) or some other mobile income;

The taxpayer benefiting from a tax holiday fulfills significant substance requirements (e.g. can prove the generation of new employment, assets and investments); and

The country keeps relevant data (the number of benefiting taxpayers, sector of their activity, and aggregated amount of exempt income) to allow monitoring of the economic impact of the tax holiday.

With regard to IP income, the OECD rules provide some tolerance so that a tax holiday may also grant incidental preferential tax treatment for IP income, as long as there is no specific preferential tax treatment of such income.

Swiss tax holidays have never been qualified as a harmful tax practice, neither in the original BEPS report in 2015, or in the Progress Report on Preferential Regimes by the OECD in 2018. The legitimacy of the Swiss tax holiday scheme to incentivise and promote regional development is also recognised by the EU.

'Good bait catches mice', but Switzerland is no mouse trap

Swiss tax holidays can be a powerful instrument in terms of their impact on the effective tax rate (ETR). An ETR of significantly less than 10% can be achieved.

After the expiration of tax holidays, there will usually be a 'soft landing', as the ordinary tax rates range between 11.3% and 14% (depending on the location and prior to any additional tax reductions through patent boxes, for example).

Tax holidays generally come with a claw-back provision, which usually requires the taxpayer to stay another five years at the tax holiday location, otherwise the tax benefits received might have to be paid back in full, or more often, pro rata temporis (i.e. the longer the tax payer stays before exiting, the less tax benefits have to be paid back).

An exit after the claw-back period will usually not trigger any obligations to pay back any tax benefits received. Concrete terms and conditions applicable in a specific case are generally subject to a so-called performance agreement between the cantonal government and the taxpayer.

Given the fact that a tax holiday can last up to 10 years, and that a claw-back period of typically 5 years has to be observed in order to enjoy the full tax holiday benefit, the taxpayer needs to have a long-term view of at least 15 years when taking a decision to establish or relocate a business to Switzerland.

Therefore, it is important to be confident that the place where the investment is going to be made will be able to sustain a tax-friendly climate in the long run. It is worth noting that public finances in Switzerland are rather solid compared to other global actors, with gross public debt slightly below 30% of GDP, as determined by the Swiss Federal Finance Administration (and in line with the European Maastricht criteria).

Additional room for the Swiss government to manoeuver and keep the ordinary corporate tax rate at a low level between 11.3% and 14%, and provide the rather low Swiss VAT rate of currently 7.7% (EU minimum VAT rate is 15%), varies widely on the canton and municipality where the tax payer is resident.

Cantonal tax holidays

The tax laws of all 26 Swiss cantons provide an explicit legal basis to grant tax holidays if new jobs and innovative businesses are created (or maintained).

In Switzerland, granting temporary tax relief instead of a cash grant or loan (without interest or a preferential interest) is the typical and preferred instrument to support regional economic development, even though other such incentives are generally possible and seen in practice.

Historically, some Swiss cantons, in particular those with an already low headline tax rate (and/or adhering to a rather straight economic liberalism) have been somewhat reluctant to use tax holidays as an instrument for regional economic development.

However, in light of the expected changes from CTR, it seems that at least some of these cantons are more open to also consider tax holidays as an option to improve their regional attractiveness.

While cantonal practices vary widely, typically the following requirements must be fulfilled in order to qualify for a cantonal tax holiday:

The business will be newly founded or plans to relocate to Switzerland;

It is an innovative business, and it is in the canton's economic interest to locate this business to its canton;

Taxpayers already domiciled in the canton will not be adversely affected by the canton granting a tax holiday, in particular to a potential competitor of existing taxpayers;

The business maintains employment from a quantitative as well as qualitative perspective;

The business plans future investments, and

The business expects a certain profit level.

An application with a detailed business plan needs to be addressed to the cantonal government, typically to the department of economy, which examines the request and makes a suggestion to the cantonal government to approve or reject.

Formally, the cantonal government will issue a decree on their decision. An objection can be filed in cases where the applicant does not agree with the cantonal government's decision, specific terms or conditions.

Furthermore, some cantons require applicants to acquire a 10-year tax break in tiers by initially applying for a period of 5 years, and then renewing for another 5 years (if all requirements are met).

Federal tax holidays

A federal tax holiday will only be granted if the canton (in which the taxpayer is resident) has also granted a cantonal tax holiday for the same undertaking. This condition is paramount, has always been required, and proven to be non-negotiable.

The legal basis for a federal tax holiday is the Federal Act on Regional Policy, which was partly revised in 2016. The revised legislation (effective since July 1 2016) provides for relief from federal corporate income tax (CIT) for a maximum period of 10 years for (a) industrial enterprises and (b) production-related service providers.

Under the revised legislation, industrial enterprises not only include entities conducting manufacturing activities, but also businesses providing information technology services.

Whereas the term "industrial enterprises" is rather clear, the term "production-related service providers" needs some precision as it also includes globally active industrial companies centralising their R&D, accounting or supply chain management activities, and/or other management activities in Switzerland.

The distinction between industrial enterprises and production-related service providers is important since the latter is only eligible for a federal tax holiday if they create at least 10 new jobs (FTEs) within the first five years. There is no such limitation for industrial enterprises.

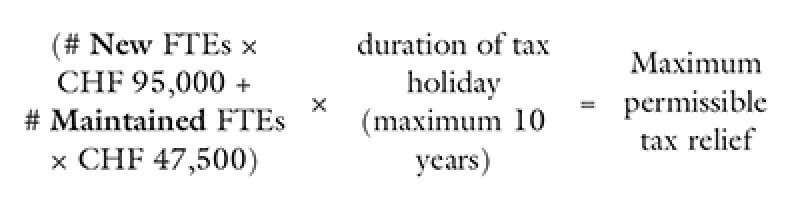

The magnitude of a federal tax holiday is linked to the number of newly created or maintained jobs in a qualifying area. According to a formula foreseen in the law, an annual tax credit of up to CHF 95,000 (US$94,200) for each newly created job, and CHF 47,500 for each maintained job, is possible.

To qualify as a "maintained job", the enterprise needs to substantially realign its business, and such strategic realignment must trigger significant investments and see an improvement of products, processes or techniques. The formula looks as follows (considering the maximum amounts per job):

The federal tax relief is limited by the amount of the cantonal tax relief, i.e. if the canton grants a tax holiday below the maximum permissible tax relief, the relief at federal level would not exceed the cantonal tax holiday.

Sample calculation |

|

Undertaking creates 50 new jobs (FTEs) over the next 10 years with annual profit of CHF 80 million |

|

Total tax burden without tax holiday |

CHF 137 million based on 17.4% statutory rate (combined federal and cantonal tax) |

Maximum federal tax relief |

50 new FTEs × CHF 95,000 × 10 years = CHF 47.5 million |

Cantonal tax relief |

CHF 64.6 million |

Total tax burden with tax holiday |

CHF 137 million - 47.5 million - 64.6 million = CHF 24.9 million |

Resulting cash tax rate |

3.1% (during 10-year tax holiday period) |

The federal tax holiday will be granted in the form of a tax credit which can be offset against the federal income tax liability during the tax holiday period. Non-utilised tax credits can be carried forward within the tax holiday period.

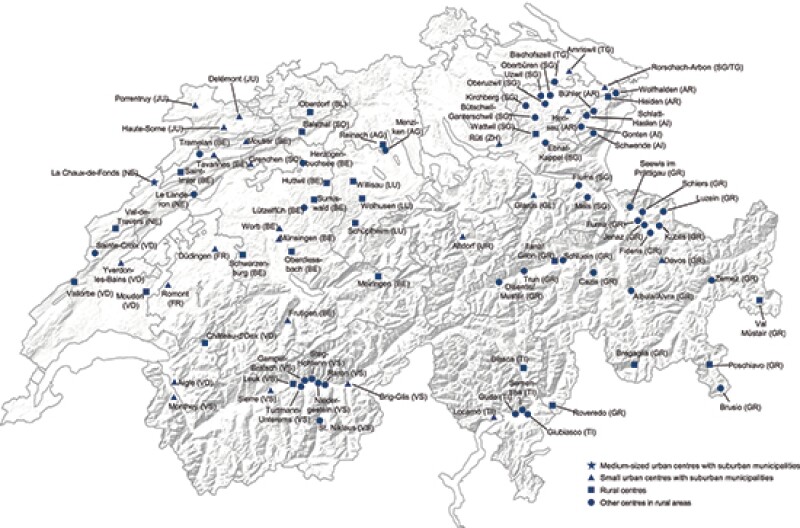

The revised legislation in 2016 includes an adjustment of the regional areas where qualifying enterprises can apply for a federal tax holiday. The new areas are much more attractive for businesses.

While the former qualifying areas mainly included micro-communities spread over Switzerland in rather remote mountain and rural areas, the new selection of regional economic development areas takes into account more strategic regional planning considerations and includes locations with closer proximity to urban areas.

The revised regulations describe the qualifying regions for federal tax holiday purposes as rural centres, small or medium sized urban centres (including the surrounding areas), and smaller and less urban areas with a central function. Qualifying areas: 93 regional centres in the following 19 cantons (see also the map in Figure 1):

Aargau

Appenzell Ausserrhoden

Appenzell Innerrhoden

Basel-Landschaft

Berne

Fribourg

Glarus

Grisons

Jura

Lucerne

Neuchâtel

Saint Gallen

Solothurn

Thurgau

Ticino

Uri

Valais

Vaud

Zurich

Since it is a pre-condition that the canton has also granted a cantonal tax holiday for the same undertaking, the request for a federal tax holiday can be filed with the State Secretariat for Economic Affairs (SECO) once the cantonal tax holiday has been approved by the cantonal government.

After the SECO's assessment and recommendation to approve or reject the federal tax holiday, the final decision is taken by the Federal Department of Economic Affairs, Education and Research (i.e. the Federal Minister of Economic Affairs).

Once approved, the SECO will annually publish the information in relation to granted federal tax holidays, which includes the name of the enterprise, its location, information on the maximum permissible amount of tax relief, and the number of jobs to be created or to be maintained.

For cantonal tax holidays, a federal tax holiday is subject to claw-back provisions. The claw-back clause is generally triggered if the canton revokes the cantonal tax holiday, or if the conditions and requirements laid down in the tax holiday are not met, or no longer met (e.g. if the envisaged number of jobs have not been created or have not been maintained within the given time frame).

A partial or full cancellation of the federal tax holiday relief can only take place within a term corresponding to one-and-a-half times of the regular tax holiday period (i.e. within a maximum period of 15 years).

Figure 1

Source: State Secretariat for Economic Affairs

Switzerland's outlook for business competitiveness

Even though significant changes to Swiss tax law and practice are expected as a result of the upcoming CTR, Switzerland continues to offer attractive conditions for doing business in Switzerland.

With tax incentives such as Swiss tax holidays, tax rates of significantly less than 10% are still possible. Even once an individual tax holiday has expired, there will be an attractive combination of generally low headline tax rates, plus additional measures in line with international standards (e.g. patent box, R&D super deduction, notional interest deduction) which could result in single-digit tax rates even without a tax holiday.

As tax is only one (but important criterion) for an investment decision, it is the combination of attractive taxation, excellent infrastructure in the heart of Europe, highly-skilled and international labor pool, top-ranking universities and research institutions, a powerful financial system, and stable political environment with a centuries-old tradition of property rights protection that makes Switzerland a destination of choice.

Kersten Honold |

|

|---|---|

|

Partner EY Tel: +41 58 286 3166 Kersten Honold is a tax partner at EY in Switzerland. Based in Zurich, he is a managing partner of EY's Swiss transaction tax (M&A tax) practice in Zurich, Berne and Geneva. Kersten has extensive experience in international corporate tax matters, particularly in domestic and cross-border M&A transactions and reorganisations. He advises both multinational groups/corporates, as well as private equity investors in tax matters. This includes financing, acquisition structuring, capital market transactions, and management incentive schemes, but also due diligence, pre-deal structuring carve-outs, as well as post-deal services such as post-acquisition integration, tax effective supply chain planning, IP, R&D planning, as well as function and risk allocation within multinational groups. Kersten is lecturer in national and international taxation at the University of St. Gallen and a frequent speaker at tax conferences. He holds a PhD in economics from the University of St. Gallen and is a Swiss certified tax expert. |

Kilian Bürgi |

|

|---|---|

|

Tax consultant EY Tel: +41 58 286 3477 Kilian Bürgi is a member of EY's transaction tax (M&A tax) Team in Zurich. Kilian advises clients in international as well as transaction tax matters covering tax structuring, due diligence as well as cross-border reorganisations. He is deeply familiar with the upcoming changes resulting from the contemplated Swiss corporate tax reform (CTR) and assists multinational groups with tax modelling the CTR effects and the expected impact of the various measures available post-reform. Kilian holds a master degree in law from the University of St. Gallen. |