The global markets are currently characterised by an increasing level of volatility in comparison with the long-term average, impacting businesses across all sectors.

The CBOE Volatility Index (VIX), often referred to as the “fear index”, experienced notable fluctuations in the first half of 2025, reflecting significant market uncertainty. This volatility, primarily driven by changes in global tariff policies and geopolitical tension, presents both challenges and opportunities for businesses; particularly impacting financing and investment decisions, as well as their global value/supply chains. Understanding the dynamics of this environment is crucial for navigating the present market and making informed strategic choices.

From a transfer pricing perspective, uncertainty can put a significant focus on the capacity to manage and bear the risks of financing functions within a multinational group and its relevance to value creation. This article puts a spotlight on some of the most relevant transfer pricing issues faced by multinational groups, directly or indirectly, via intragroup financing and participating in the financial markets in the current volatile times.

1 FX, interest rates, and volatility: the current landscape

Several factors contributed to the relatively limited EUR/USD foreign exchange (FX) and euro interest rate movements in early 2025, despite overall market volatility expectations. Geopolitical and economic tensions, as well as uncertain US economic developments, on one side and decreasing inflationary pressures and improving credit conditions for the eurozone on the other – compared with the global environment – have created an increasingly complex and unpredictable market (see the Council of the European Union’s Eurogroup statement on the fiscal stance for the euro area in 2025 and Fitch Ratings’ US Faces Several Fiscal Policy Challenges in 2025).

In terms of uncertainty, the most relevant events impacting market volatility in the first half of 2025 were the US tariff policy (and the relevant responses by affected states) under the new administration and various geopolitical conflicts (see Reuters’ Market stress signals are flashing bright).

1.1 Eurozone FX and interest markets and the effect on transfer pricing

As reflected by the EUR/USD FX rate (Figure 1 below), the euro has appreciated over the first half of 2025 (by approximately 15%), which has some significant impacts on the (transfer pricing) value chain as it reduces prices of imports, with a downward pressure on eurozone inflation, besides other factors, such as interest rates and higher policy uncertainty (see the ECB’s Account of the monetary policy meeting of the Governing Council of the European Central Bank held in Frankfurt am Main on Tuesday, Wednesday and Thursday, 3-5 June 2025). However, at the same time, euro exports have become less competitive, with a potential drag on growth that could be reflected in additional pressure for the most appropriate transfer pricing set-up, especially if this continues in the long term.

In combination with a general market environment reflecting protective measures and countermeasures, the value chains of participants in export-focused European markets could be significantly affected.

Figure 1: EUR/USD FX rate, January 1 to July 7 2025

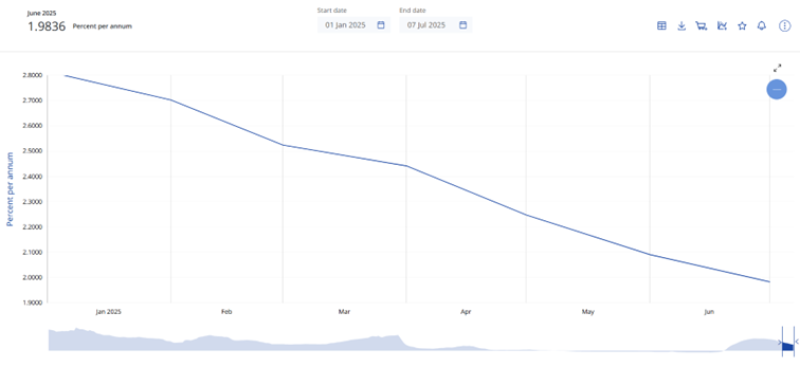

The expected (continued) decrease in euro interest rates can also be recognised (Figure 2 below) in the market. This counter-effect to the appreciation of the euro against the US dollar can have a positive effect on the cost of funding euro-financed investments and impacting supply/value chains to focus on long-term investments in the eurozone. From a transfer pricing perspective, this puts more focus on intragroup treasury functions and the most effective use of funding.

Figure 2: Three-month EURIBOR interest rate, January 1 to July 7 2025

1.2 A measure of expected market uncertainty – the VIX

In comparison with the relative straight-line development in the selected FX and interest rate markets, the VIX, representing the market’s expectation of 30-day forward-looking volatility, shows a different trend over the same time horizon. The VIX tends to rise when markets are turbulent and investors are fearful, and it falls when markets are calm (see the CBOE’s Index Dashboard).

The VIX is calculated using the prices of S&P 500 index options (specifically, near-term and next-term options contracts) using the implied volatility derived from these option prices. Implied volatility reflects the market’s consensus view on how much the S&P 500 is expected to fluctuate. A higher VIX means the market expects more significant price swings (see the CBOE’s What the VIX and VIX1D Indices Attempt to Measure and How They Differ).

For the early 2025 period, economic uncertainty had a significant impact on the expected volatility, similar to the financial crisis or COVID pandemic (see the CNBC Network’s VIX Surges: What the Spike Means for Market Stability and Investor Sentiment). However, the volatility ‘shock’ in April 2025 smoothed out after this on a high level.

Figure 3: CBOE Volatility Index, January 1 to July 7 2025

The relationship between FX, interest rates, and the VIX (i.e., an equity-referencing index) is complex and not directly correlated (see Goldman Sachs’ How do higher interest rates affect US stocks?). However, some general observations can be made, for example, about general market uncertainty; where geopolitical events, economic downturns, or unexpected policy changes can lead to both market interest rate changes and a higher VIX. Hence, considering the three factors can provide a broad picture of market development as a basis for transfer pricing decision making.

2 The impact of volatility on investment, financing, and supply chain decisions

Based on the current market sentiments outlined above, some of the main impacts on corporate decision making by changing volatility, decreasing interest rates (EUR), and the appreciation of currency (EUR/USD) can be summarised as follows:

Investment decisions – increased uncertainty makes long-term investment decisions less predictable and more challenging. Increasing FX rates (i.e., appreciation) can impact the profitability of international projects, while lower interest rates decrease the cost of capital, making particular investments more attractive. Higher uncertainty may make businesses increasingly focused on shorter-term investments and adopting a more cautious approach to longer-term capital allocation. Scenario planning and stress testing become crucial tools for evaluating investment opportunities under different volatility scenarios.

Financing decisions – volatility complicates financing decisions. Companies with significant foreign currency exposure can face increased hedging costs. Lower interest rates make debt financing less expensive, potentially impacting a multinational enterprise’s (MNE’s) ability to identify the most effective way of financing. Volatility can generally increase credit spreads and hedging costs, potentially making loans and bond issuance more expensive, especially for borrowers with lower credit ratings, to account for any uncertainty. Higher volatility also increases prices for options and other hedges.

Supply chain decisions – FX and interest rate changes, as well as market volatility, can significantly impact supply chain operations. Fluctuating exchange rates can affect the cost of imported goods and the competitiveness of exports. Volatility, as currently driven by uncertain developments in global tariff policies, can impact supply chain-related decisions. Companies may need to re-evaluate their sourcing strategies, considering nearshoring or regionalisation to mitigate FX risk.

These more general market impacts on business decision making may also have implications on, and require a review of, existing transfer pricing set-ups within MNEs. As such, the complexity of transfer pricing increases as further internal factors, such as underlying value chains, have to be considered on top of, and in relation to, the external market environment.

3 Volatility-related transfer pricing consequences

Transfer pricing – that is, the setting of prices for goods and services exchanged cross-border between related entities within an MNE – is impacted by the financial market and overall volatility on various levels.

As an example, volatile FX rates make it harder to predict the value of cross-border transactions, if in different currencies, and could lead to increasing use of hedging instruments (e.g., forwards, options), as well as shorter payment terms/settlements to reduce exposure. The transfer pricing elements of this may include a decision on where to cover related costs for hedging or where to allocate measures to reduce relevant exposures in global supply chains.

Market volatility and the impact on profitability across the global value chain of taxpayers can distort arm’s-length pricing and the applicability of related benchmarks used to test intragroup transactions. Increased volatility most certainly puts a focus on the respective function and risk analysis, as the variation of outcomes affecting the MNE’s transfer pricing set-up can be expected to increase. Moreover, these developments may also call for additional resources to be devoted to the management of respective risks to be (or to remain) effective for the MNE.

Tax authorities may scrutinise local results more closely, if the applied transfer pricing methods lead to large swings in margins or profits due to uncontrolled market factors, putting a higher focus on intergroup risk management in companies with routine function and risk profiles. Additionally, volatile input prices (e.g., commodities, freight) complicate the management of cost-based intragroup arrangements (e.g., cost sharing arrangements) or remunerations. A practical implication could be the increasing relevance of more flexible pricing models, such as cost-plus remuneration with variable markups.

Furthermore, volatility can shift the functional and risk profiles of entities within a value chain and their characterisation as routine/non-routine entities. For example, if a subsidiary in a high-volatility currency environment takes on more FX risk, its functional profile may change, requiring adjustments to the transfer pricing methodology.

Companies need to regularly review and update their transfer pricing policies to reflect the changing economic environment and ensure compliance with national and international tax regulations. Consequently, volatility and adverse market factors can lead to the reallocation of functions and risks across MNEs. However, reorganisations and changes in functional and risk profiles can trigger complex tax consequences and should be considered against the wider business of the MNEs.

MNEs can mitigate transfer pricing risks by implementing robust risk management strategies. This includes:

Clearly defining and updating the functional and risk profiles of each entity;

Establishing appropriate transfer pricing policies; and

Maintaining comprehensive documentation.

Advance pricing agreements with tax authorities can provide certainty and reduce the risk of disputes. However, their applicability to a certain set of circumstances and arm’s-length remuneration would need to be analysed for the specific case in hand.

4 Market volatility impact on intragroup financing transfer pricing

Intragroup financing – i.e., the lending and borrowing of funds within an MNE – utilises various financial instruments to optimise cash management, fund investments, and manage currency risk. Certain types of intragroup funding are affected in different ways by market factors; of course, interest and FX rates, but also changes in the level of volatility or ‘fear’ in the market.

4.1 The most common types of intragroup financing

The most frequent intragroup financing arrangements include the following.

4.1.1 Intragroup loans

Intragroup loans are the most common instrument, involving direct lending from one group entity to another. These loans can be short-term or long-term, denominated in various currencies, and carry fixed or floating interest rates.

Increased volatility in interest rates may favour applying variable rates in intercompany arrangements to mirror market rate levels at the expense of planning ability; e.g., relating to the applicability of the interest barrier rule. Furthermore, the timing of financing and refinancing becomes more relevant in times of higher expected volatility, whereas external market forces could also influence credit rating factors or the ability to serve the debt in place. Impacts to ‘vanilla’ direct intragroup loan financing can become more relevant and difficult to manage when using more complex structures such as hybrid financing or mezzanine capital.

4.1.2 Cash pooling

Cash pooling involves creating a centralised cash management system where group entities pool their cash balances into a central account. This optimises the use of liquidity within a group, reduces overall borrowing needs, and can improve a multinational group’s interest income on aggregate. There are various types of cash pooling, including notional pooling and physical pooling.

Volatile market conditions and their impact on interest rates put additional emphasis on the quality and accuracy of liquidity forecasting and the use/remuneration of intragroup cash pooling arrangements. Depending on the type of cash pools and currency arrangements (e.g., various currency-based cash pools), the complexity of cash management and changes in (i) balances in the cash pools and (ii) remuneration in basis points for additional elements such as additional transactions in non-operational currencies could be impacted.

Nevertheless, some of the most relevant transfer pricing-related questions, such as the correct remuneration and benchmarks for the cash pool leader or the treatment of long-term balances in a cash pool, also amplify the requirement to review the underlying arrangements, with increasing expected market volatility on a (more) regular basis.

4.1.3 Intragroup guarantees

Intragroup guarantees are not directly a means of financing but an important element of enabling MNE companies to receive external financing or participate in business. For example, one group entity guarantees the debt obligations of another, establishing or enhancing the borrower's creditworthiness and potentially lowering borrowing costs or guaranteeing a specific transaction (e.g., export of goods) to enable local market participation.

As intragroup guarantees have a direct link to market or counterparty risk aversion, increasing expected market volatility can have a significant influence on the value of guarantees provided intragroup. The monitoring and potential reassessment of the structure, as well as the initial pricing, of such guarantees becomes very relevant in volatile times to continue an arm’s-length remuneration for such transactions.

The following section provides insights into the potential effects of these approaches in transfer pricing analyses.

4.2 Insights on relevant transfer pricing analysis approaches

The OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations, 2022, especially Chapter X, provides an internationally accepted framework for determining arm’s-length’s remuneration (e.g., interest rates) on intragroup financial transactions. Key considerations include the creditworthiness of the borrower and the general terms of the financing transaction. These general terms of the financing should also be taken as guidance on how volatility is managed between related parties in their financing transactions.

Nevertheless, certain local transfer pricing regulations – such as the newly adopted Section 1, paragraphs 3d and 3e of the German Foreign Tax Act (Außensteuergesetz) – significantly increase the need to analyse and test all elements, from the single conditions to remuneration, of the intragroup funding arrangements.

From a wider transfer pricing perspective, risk management and the ability to effectively manage risk becomes a more relevant function in volatile markets. Functions that can identify, assess, and mitigate financial market risks are better positioned within the overall MNE value chain to navigate the challenges and capitalise on opportunities. This might include:

Implementing hedging strategies to mitigate the impact of FX fluctuations on profitability;

Utilising interest rate derivatives to manage the impact of interest rate changes on borrowing costs; or

Diversifying sourcing by building resilient supply chains and providing relevant efficient funding.

In conclusion, thorough documentation of intragroup financing arrangements and related functions and risks has become even more crucial for demonstrating compliance with transfer pricing and other tax regulations. This documentation should include details of the transaction, the rationale for the chosen financing instrument, and the methodology used to determine the arm’s-length price for funding the functions (e.g., treasury and risk management) related to it.

5 Conclusion and outlook

Expected market volatility and changes in MNE-relevant FX and interest rates present significant challenges and opportunities for businesses. By understanding the dynamics of a volatile environment and implementing robust risk management strategies, companies can navigate the challenges, protect their profitability, and make informed decisions regarding investments, financing, and supply chain operations.

Any change in functions and risks, as well as the impact or importance within existing value chains, is a key focus from a transfer pricing perspective. Hence, in volatile times, risk management and the capacity to address such risks become more important across any transfer pricing value chain considerations.

This is also reflected in how intragroup transactions reflect FX and interest rate markets, which can significantly influence investment and funding decisions. Spikes in market fear or expected volatility should also be assumed in the business’s reaction regarding the transfer pricing approaches and set-ups, which have to follow impacts on the value and supply chains. However, this must all be documented and treated with care when it comes down to outlining the business reason for changing existing transfer pricing policies.

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (DTTL), its global network of member firms, and their related entities (collectively, the “Deloitte organization”). DTTL (also referred to as “Deloitte Global”) and each of its member firms and related entities are legally separate and independent entities, which cannot obligate or bind each other in respect of third parties. DTTL and each DTTL member firm and related entity is liable only for its own acts and omissions, and not those of each other. DTTL does not provide services to clients. Please see www.deloitte.com/about to learn more.

This communication contains general information only, and none of Deloitte Touche Tohmatsu Limited (DTTL), its global network of member firms or their related entities (collectively, the “Deloitte organization”) is, by means of this communication, rendering professional advice or services. Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser.

No representations, warranties or undertakings (express or implied) are given as to the accuracy or completeness of the information in this communication, and none of DTTL, its member firms, related entities, employees or agents shall be liable or responsible for any loss or damage whatsoever arising directly or indirectly in connection with any person relying on this communication. DTTL and each of its member firms, and their related entities, are legally separate and independent entities.

© 2025. For information, contact Deloitte Global.