In recent years, the Republic of Chile, like most countries in the world, has experienced uncertainty on what to expect for its future. The current situation, in what used to be one of the most promising and stable countries in the region, has been compounded by a burst of internal political and social conflicts long-awaited to be solved.

To counter the social demands that arose in October 2019 in what was called “Estallido Social” (social outburst), the conservative government agreed to increase social expenditure and aligned with other political forces to convene an ad-hoc assembly to draft a new political constitution.

A few months passed and then the COVID-19 pandemic wreaked havoc across the nation. The rest of the story is familiar to the reader.

After the pandemic was overcome, global and local factors remained a source of instability, such as:

High inflation rates, which have a negative impact on consumption and investment;

Increase in the overall interest rates because of the Central Bank’s efforts to curb inflation;

Economic slowdown and contraction in economic activity;

The tax reform project: initially, the tax reform project sent by president Boric to congress focused on tax collection, but included measures that discouraged savings and investment, negatively affecting growth. The law did not pass in congress, and a wider dialogue with political and economic forces resumed, considering a few proposals from the initial project; and

Expectations regarding the new constitution: although an initial draft was rejected by over 60% of citizens, the lack of clear rules in both constitutional and tax contexts are postponing investment plans in the local market.

On the other hand, as everyone recalls, in response to the "aggressive tax planning strategies" employed by certain multinational groups, the OECD implemented a series of actions to address BEPS. These actions are expected to result in fundamental changes to international tax standards and are based on three core principles: coherence, substance, and transparency. Like most OECD countries, Chile has also incorporated (and continues to work on) these BEPS actions.

In this context, in the last 12 months in Chile, there have been updates to TP practices coming from the local tax authority. These include a tax ruling regarding economic substance, an increase in the frequency and stringency of TP audits, promotion of advance pricing agreements (APAs), and the unsuccessful tax reform project that included further details regarding TP adjustments.

Tax ruling regarding economic substance

In a recent tax ruling regarding a group restructuring and the transfer of functions, assets, and risks abroad, the Chilean tax authority, (hereinafter "Chilean IRS" or "SII,") placed particular emphasis on the application of the GAAR to counter avoidance schemes. Specifically, it targeted aspects related to economic substance, duplication of functions, and erosion of the tax base.

In this case, before the tax ruling was issued by the SII, a consultation was made regarding the transfer and centralisation of procurement functions abroad. After that, the Chilean IRS placed specific emphasis and scrutiny on the following topics in terms of applying the GAAR:

The need to establish the foreign entity and centralising functions for the effective operation of the business;

Verification of the actual provision of services by the company established abroad; and

Elimination of any potential function duplication.

Despite the significance of these points, it is surprising that the Chilean IRS deems a restructuring of a multinational group as "elusive", even if it adheres to all the requirements outlined in Chapter 9 of the OECD Guidelines concerning TP. This chapter addresses "Business Restructuring and Transfer Pricing" to ensure compliance with the arm's length principle.

Increase and tightening of TP audits

It is fascinating to observe the evolution of TP audits conducted on multinational companies operating in Chile. A decade ago, the number of audits was insignificant, and the required information was considerably less compared to today’s practices. However, over time, the team dedicated to these examinations in the Chilean IRS has experienced exponential growth and significant improvements in terms of professionalisation, specialisation and size.

In recent years, transactions conducted abroad have become a major focus for the Chilean IRS, particularly due to the increasing number of economic groups diversifying their investments overseas amid uncertain conditions. Additionally, according to a recent report by the OECD, 46% of the tax revenue collected via corporate tax in Chile is contributed by companies belonging to multinational groups.

Considering this, and with the aim of combating base erosion and profit shifting, the Chilean IRS published its annual Tax Compliance Management Plan (TCMP) in February this year. The plan outlines control actions to be taken within multinational groups, with specific emphasis on transactional risks associated with tax planning and TP. Some of the key areas addressed in the plan include:

Remittances not subject to withholding tax;

Loans granted to foreign related companies;

Proper use of withholding tax on back-to-back loans;

Non-abusive utilisation of benefits provided by double taxation treaties;

Emphasising information exchange through collaborative work and communication with foreign tax administrations and other public bodies, as this facilitates the analysis and characterisation of relevant segments;

Monitoring investments made abroad, among other measures.

These actions reflect the commitment of the Chilean IRS to enhance tax compliance and mitigate risks related to TP and tax planning within multinational groups. The mechanism for controlling these actions is through conducting audits and compliance reviews to address the risk of tax planning use. The TP audits in Chile these days exhibit several key characteristics, such as:

Increased and improved TP audit teams: the Chilean IRS has expanded and strengthened the teams dedicated to conducting TP audits. This allows for more detailed and effective examination of TP practices;

The focus of these audits has shifted towards verifying the actual provision of services (reliability) and assessing the economic substance of transactions;

The information requirements may include interviews with key executives of the multinational group and the submission of financial and tax information from entities abroad. Various sources, such as deliverables, e-mails, minutes, strategic plans, and board minutes, may be utilised to extract relevant information to demonstrate the nature of services received; and

Interrelation between different types of audits, including tax and TP. This means that inspections associated with the deductibility of expenses may encompass transactions between related companies, both local and cross-border. TP examinations can also trigger withholding examinations, adjustments of the taxable net income, deductibility of expenses, and analysis of other types of taxes or specific regulations.

Undoubtedly, for companies that are part of multinational groups, these processes are likely to lead to an increase in the resources allocated to addressing the requirements and inquiries from the tax authority.

APA: automation and promotion

In Chile, unlike many other countries, alongside the promise of increased inspection action, the tax reform project and current legislation have expanded the scope of an instrument that reduces uncertainty and risk for companies in this context: APAs.

Although TP regulations in Chile have allowed for the submission of APA requests since 2013, it is only in recent years that these agreements have begun to be signed between taxpayers and the Chilean IRS. To promote the use of APAs, the IRS established a dedicated team composed of tax, economic, and legal specialists solely responsible for reviewing APAs and mutual agreement procedures.

Moreover, in February this year, the IRS launched a specialised online platform on its website to streamline the submission of APAs. Through this platform, taxpayers can:

Request a pre-filing meeting by simply completing a form, which can be submitted on an anonymous basis;

Submit the APA request, including a description of the relevant transactions, their prices, values, or normal market returns, and the period to be covered. All additional information required by the APA regulations, such as corporate structure, balance sheet, contracts, information on other APAs, TP reports, and other relevant information, can also be provided;

Track the status of the submitted documents;

Access a step-by-step guide with explanatory videos and frequently asked questions; and

Access relevant information on APAs, including current regulations and statistics.

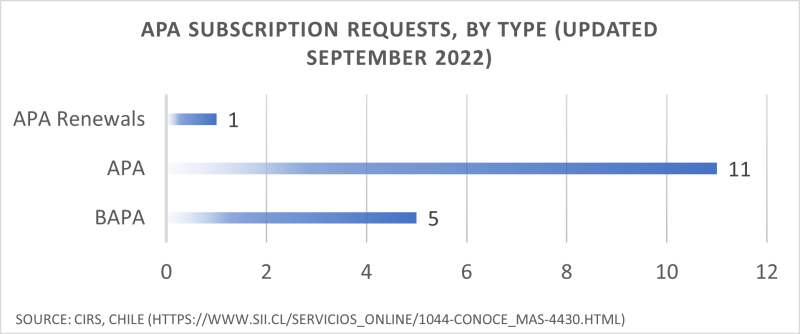

As of September 2022 (the most recent available data), the Chilean IRS has received a total of 16 requests for subscriptions of APAs. Out of these requests, 11 are unilateral APAs and five are bilateral APAs (BAPAs).

Among the bilateral requests, the related companies' countries of residence include Canada (two), Switzerland (two), and England (one). Additionally, there has been one request for the renewal or extension of a unilateral APA.

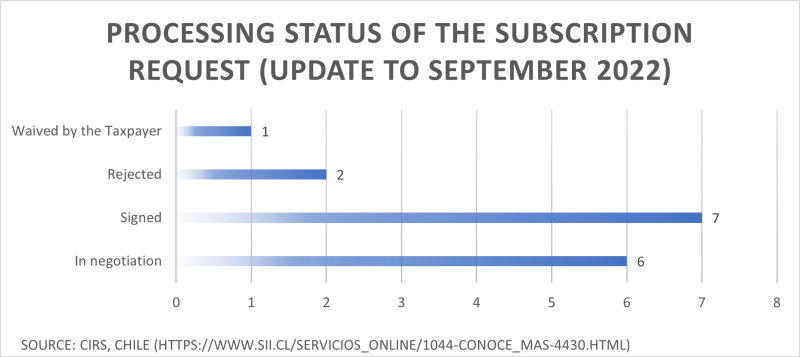

Out of the total subscription requests received, six requests are currently under negotiation between the taxpayer and the IRS, seven requests have been successfully signed and finalised, two subscription requests were rejected, and one subscription request was voluntarily withdrawn by the taxpayer.

While these numbers may appear modest compared to the figures reported by the US or the European Community, it is important to note that the Chilean IRS is making notable progress in signing APAs with taxpayers within the region. It is worth mentioning that Mexico, with its significant experience in APAs, is another country in the region actively engaged in this area. Furthermore, according to the TCMP, these agreements have contributed to a collection of more than $650 million.

Two significant aspects should be highlighted regarding APAs in Chile:

In case of agreements related to the imports of goods, the National Customs Service is also involved in the negotiation process alongside the Chilean IRS and the taxpayer.

It is important to note that the concept of "roll back" APAs, which allows for the application of APA terms to previous years, is not currently regulated in the local legislation. This aspect was also among the points addressed in the recently rejected tax reform project.

TP self-adjustment and the unsuccessful tax reform

Firstly, it is crucial to clarify that TP self-adjustments are not regulated in Chile. However, the provisions outlined in the recently rejected tax reform project have established a significant precedent in this matter.

It is important to note that a self-adjustment occurs when a taxpayer determines that their transactions with related parties do not adhere to the arm's length principle. In such cases, the taxpayer may adjust their prices, values, or returns prior to any examination. The proposed text in the reform project poses an interesting dilemma in this regard. When the adjustment results in higher revenue for the Chilean taxpayer, it is treated as an addition to the tax base. Conversely, if the adjustment leads to a reduction in revenue (or an increase in costs) for the Chilean entity, the tax base cannot be decreased. In other words, even if the arm's length principle is being complied with, a lower tax liability or tax loss cannot be determined.

Considering all these regulatory changes, companies that are part of a multinational group must ensure thorough documentation of intragroup transactions with convincing supporting evidence. The challenge with audits is that they can occur several years after the transactions take place, making the collection of information and documents more complex. In view of this new scenario, it is recommended to take the following additional measures:

Conduct an analysis before the end of the year to ensure that a compliant TP policy is accurately reflected in the accounting records. This will help avoid TP adjustments and potential discrepancies during audits.

Consider restructuring and/or reorganisations while keeping in mind the three pillars of the OECD guidelines: economic substance, coherence, and transparency. By aligning these principles, companies can ensure that their operations follow international standards and regulations.

By proactively addressing these recommendations, companies can better prepare themselves for potential audits and mitigate the risks associated with TP compliance. It is essential to adapt to the evolving regulatory landscape and maintain comprehensive documentation to support intragroup transactions.