Driven by regulatory changes and capital market reforms, private equity (PE) investment in China enjoyed strong growth in the preceding decade and has become an important component of the Chinese market. However, several headwinds in recent years - from the global pandemic to rising interest rates, weaker stock markets and geopolitics risks – have tempered this investment enthusiasm to a degree. This has seen PE funds put greater focus on exits for their existing portfolios in recent times. The Chinese taxes associated with such exits can have a significant impact on post-tax investment returns, and so need to be a key focus area for PE funds to consider.

This article will analyse Chinese taxes associated with different exit routes for USD and RMB PE funds, including onshore exits offshore exits, and new emerging exit options within China’s PE market.

Exit at the onshore level

A direct disposal of shares of a Chinese portfolio company (onshore level) is most commonly associated with exits within the Chinese marketplace (pre-IPO share disposal or IPO within China).

Tax implications for USD funds on onshore direct exits

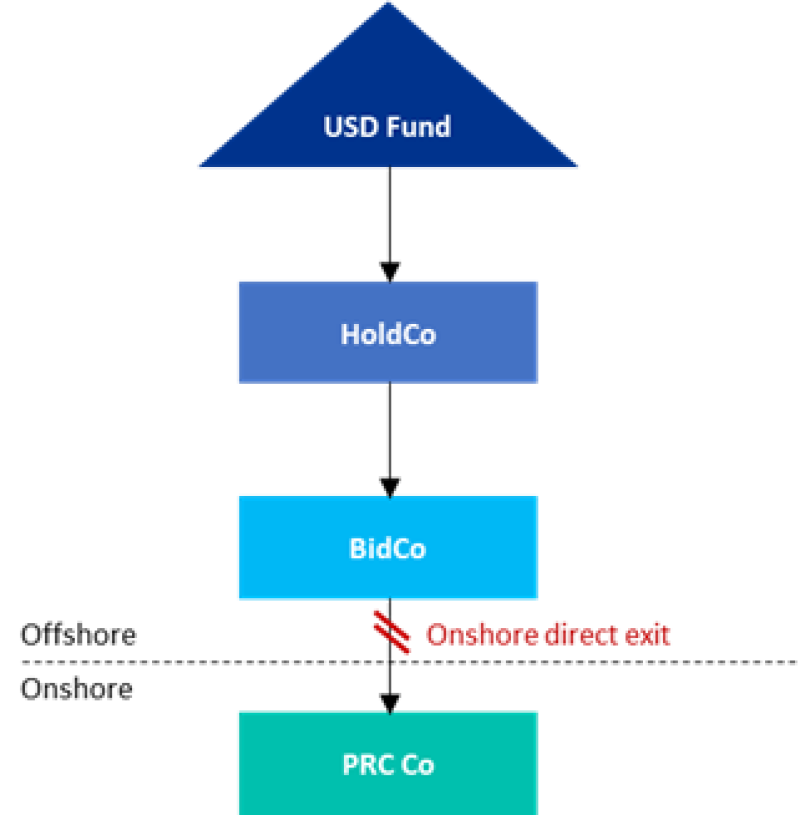

The key Chinese tax considerations arising from an onshore direct transfer of shares in a Chinese company by a USD fund (assuming the shares are held through one or two tiers of offshore holding companies as illustrated in Figure 1) are discussed in Table 1 for both pre-IPO share disposal and post China IPO exit scenarios.

Figure 1: Typical simplified investment structure and onshore exit route of a USD fund

Table 1: Chinese tax implications for USD funds on onshore direct transfer

Chinese tax implications for USD funds on onshore direct exit | |||

Entities | Tax | Pre-IPO disposal | Post- IPO exit |

BidCo | Corporate income tax (CIT)/ withholding tax (WHT) | A 10% WHT on the gains derived from disposal of shares by BidCo in the Chinese Co, provided that BidCo is not considered as having a taxable permanent establishment in China or as being a Chinese tax resident (TRE). The 10% WHT may be exempted should the BidCo be in a country/region that has a treaty relief clause with China, and certain specified requirements can be satisfied. | |

VAT | Not applicable | 6% on taxable gains (i.e., gross sales proceeds minus the higher of the IPO price and the actual investment cost) | |

Stamp duty (SD) | 0.05% on gross sales proceeds for both transaction parties | 0.1% on gross sales proceeds for BidCo as the seller | |

HoldCo/USD fund (in the form of upstream distribution of proceeds) | Not applicable | There should be no Chinese tax leakage on the upstream distribution of proceeds by BidCo to USD fund through HoldCo, provided that these offshore entities are managed in a manner such that they are not considered to be Chinese TREs or constitute taxable permanent establishments in China. | |

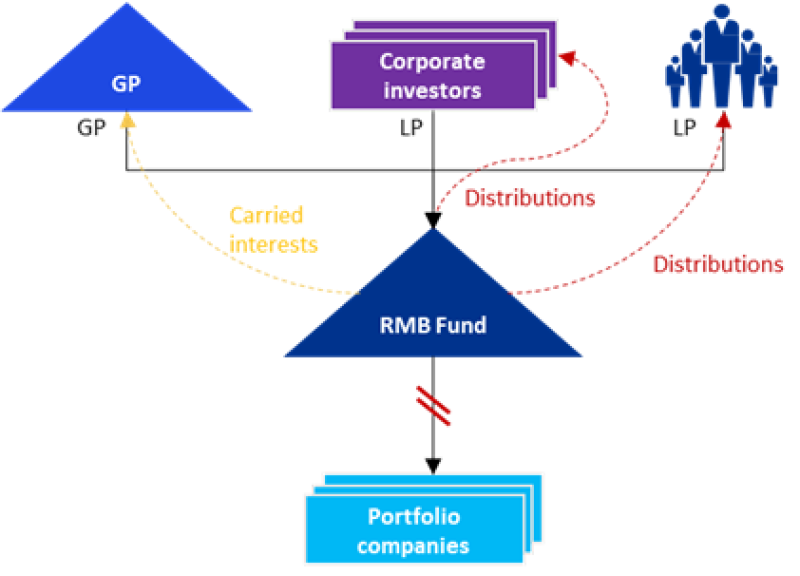

Tax implications for RMB funds on exits from portfolio companies

The key Chinese tax considerations arising from an onshore direct transfer of shares in a Chinese company by an RMB fund (as illustrated in Figure 2) are discussed in Table 2 for both pre-IPO share disposal and post China IPO exit scenarios.

Figure 2: Typical simplified investment structure and exit route of an RMB fund

Table 2: Chinese tax implications for RMB funds on exits from portfolio companies

Chinese tax implications for RMB Funds on exits from portfolio companies | ||||

Entities | Tax | Pre-IPO disposal | Post-IPO exit | |

RMB fund | CIT | Not applicable as a partnership is a ‘pass-through’ entity for CIT purposes. Taxes are levied at the level of its partners in accordance with their legal forms (e.g., corporation, partnership or individual). | ||

VAT | Not applicable | 6% on taxable gains (i.e., gross sales proceeds minus the higher of the IPO price and the actual investment cost) | ||

SD | 0.05% on gross sales proceeds for both transaction parties | 0.1% on gross sales proceeds for the RMB fund as the seller | ||

Chinese corporate limited partners (LPs) | CIT | Corporate LPs should include allocated income from RMB funds in their taxable income and pay CIT in respect of their taxable profits. | ||

Chinese individual LPs | Individual income tax (IIT) | • For investment capital gain, individual LPs are liable for IIT on the allocated income from RMB funds at progressive rates from 5% to 35%, whilst 20% IIT applies for individual LPs of qualified venture capital funds opting to account its investment portfolio on a single basis. • IIT for individual LPs shall be withheld by RMB funds. | ||

Notes:

1. Applicable taxes on investment exits for funds established in other legal forms (e.g., corporation and trust) would be different and are not discussed in the above table.

2. Certain Chinese tax circulars also provide the incentive of CIT deferral (special reorganisation tax treatment) for transactions provided certain criteria could be met. However, as a partnership is a ‘pass-through’ entity in China for CIT purposes, the eligibility of the CIT deferral treatment for the RMB fund as a partnership or its corporate LPs remains uncertain.

3. For the LPs of the partnership, regardless of if the profit from RMB fund is distributed or not, the LPs would technically be subject to CIT or IIT on the gains attributable to them.

4. If an intermediate HoldCo is used to hold the portfolios, additional tax implications should be assessed at the level of intermediate HoldCo.

Special considerations for investment exit of QFLP

With a view to improving access to the Chinese market for foreign investors, China started a pilot programme of qualified foreign limited partners (QFLP) in 2010. QFLP refers to a limited partnership established in China with overseas LPs, which is designed to lift the rigorous foreign exchange restrictions and provide a more convenient way for foreign investors to participate in equity investments in China.

Currently, there is no clear tax regulation in force regarding the tax treatment for distribution of capital gains made by QFLP to its offshore LPs. This lack of guidance leaves it open to argue whether the offshore LPs have a permanent establishment in China, leading to such gains being subject to Chinese CIT at 25% on a deemed basis, or that the distribution should be characterised as a dividend and subject to 10% WHT on gross payment.

With the above tax uncertainties in mind, it is important for QFLPs to closely monitor the relevant market practices and regulatory updates during the whole investment process and have robust tax analysis based on their actual circumstances.

Exit at the offshore levels

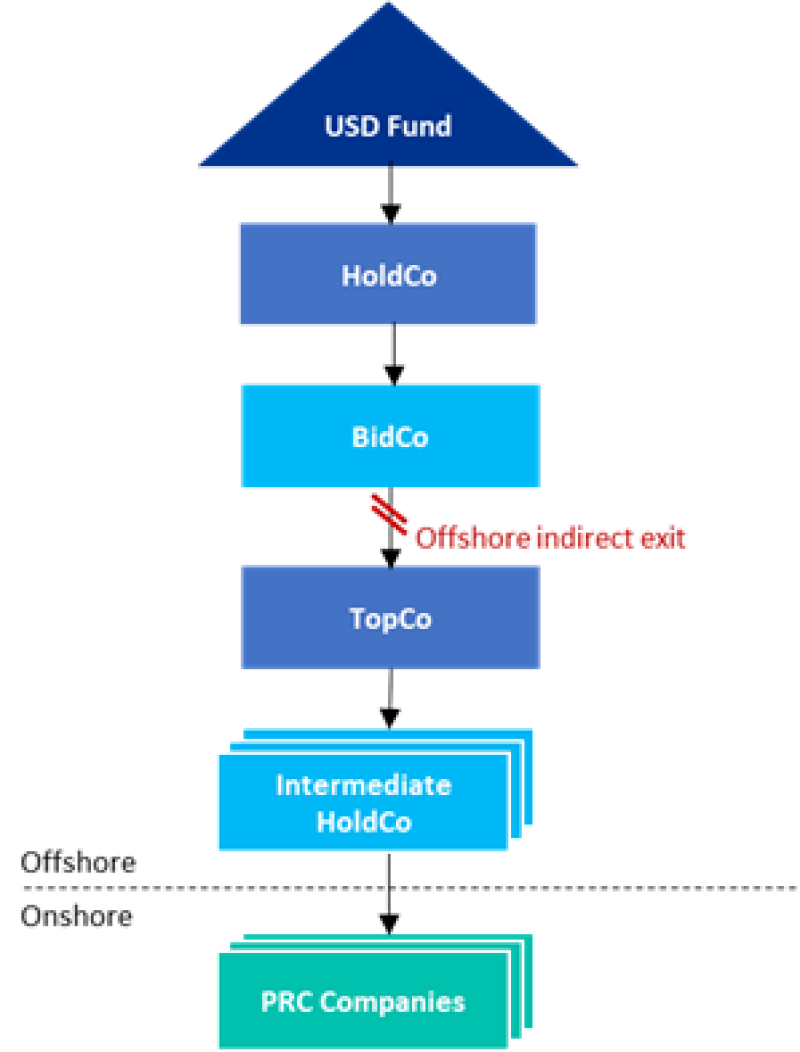

Chinese companies looking for overseas listings generally adopt a ‘red-chip’ structure, i.e., founders set up a multi-tiered offshore holding structure (a TopCo and offshore ‘Intermediate HoldCo’ SPVs) to hold Chinese companies for future overseas IPO purposes. A USD fund’s initial investment and the subsequent exit generally occurs at the level of the TopCo (as illustrated in Figure 3).

Figure 3: Typical simplified “red-chip” structure and offshore exit route of a USD Fund

The USD fund’s exit at TopCo level will lead to an indirect transfer of shares of the underlying Chinese portfolio companies, which shall be governed by the rules set under State Taxation Administration (STA) Announcement [2015] No.7 (Announcement 7).

Announcement 7 shall apply where the offshore exit is undertaken without ‘reasonable business purpose’ (RBP) with the aim of avoiding Chinese tax. This will result in the transaction being re-characterised as a direct transfer of Chinese taxable property and subject to 10% Chinese WHT on the gain attributable to the Chinese taxable property. However, certain areas under Announcement 7 remain ambiguous and need further clarification, such as identifying the quantum of the capital gain attributable to the Chinese taxable property which is subject to Chinese WHT. In some extreme cases, we have seen local tax authorities in China compute a taxable capital gain amount which was well above the actual commercial gain amount, leading to an effective tax burden much greater than the headline 10% WHT rate for onshore direct exits.

In addition to the Chinese tax considerations under Announcement 7, the USD PE fund should consider any tax implications arising from the exit for the fund, its holding SPVs and/or investors in the respective jurisdictions in which they are located.

Other emerging exit routes

Considering some of the challenges associated with exiting via an IPO, such as rigid IPO regulatory approvals, IPO lock-up periods and weaker stock prices in recent years, investors are also looking to the feasibility of exits at the PE fund level instead of the portfolio company level.

Secondary funds and successor funds:

While secondary transaction structures in Western PE markets have reached maturity through decades of development, comparable models and structures for secondary transactions in China remain at an early stage. Two exit approaches involving secondary funds in China have involved:

LPs transferring their partnership interests in a PE fund to a secondary fund; or

A PE fund disposing its underlying investments to a secondary fund.

Another emerging form of secondary fund are successor funds, where a PE fund which is close to maturity transfers its portfolio companies to a successor fund (with LPs either rolling over to the successor fund or exiting with the expiring fund).

The tax implications arising from secondary funds formed through a transfer of the underlying investments of a PE fund will be similar to those discussed earlier in this article.

With respect to the tax implications arising from the LPs transferring their partnership interests in RMB funds to secondary funds, generally the gains derived from disposal of partnership interests would be taxable in China. The applicable tax rates depend on the LP’s tax profile (e.g., a Chinese tax resident or a non-Chinese tax resident, a corporate, a partnership or an individual). For LPs disposing of USD funds’ partnership interests, where the overseas LPs exit by transferring partnership interests of USD funds, in theory Announcement 7 will also be triggered.

Exit through distribution in-specie:

This generally involves the distribution of shareholdings in the portfolio companies/assets (or the holding SPVs) by a PE fund to its LPs. However, there remains several uncertainties associated with such distributions, including their characterisation from a tax perspective (i.e., repatriations of dividends or transfers of equity/assets), the timing of tax withholding/payments, and the calculation methodology of any taxable income.

Going forward

While the continued opening-up of the Chinese market has seen the emergence of various exit approaches for PE participants, prevailing Chinese tax rules and regulations relating to partnerships are yet to catch up. This can lead to tax uncertainty for the industry, particularly for the emerging exit routes discussed in this article. At present, Chinese tax authorities and the associated regulatory bodies are stepping up the promulgation of relevant tax policies. It is hoped that the clarity provided through such new policies can provide a further catalyst for M&A activity and the PE market in China.

It is also hoped that the Chinese tax authorities will continue to clarify rules on the taxation of exits within the China PE market. In the meantime, investment managers and investors are recommended to seek appropriate advice from tax professionals, keep a close watch on tax rule development and awareness of tax authority interpretation. In addition, active participation in Chinese PE associations will be important for highlighting areas for improvement within the Chinese regulatory and taxation framework.