1. Introduction

The Association of Southeast Asian Nations (ASEAN) has achieved significant economic growth over the past five decades, and is attractive for foreign investors due to its countries’ demographic profiles and developed infrastructure and legal systems.

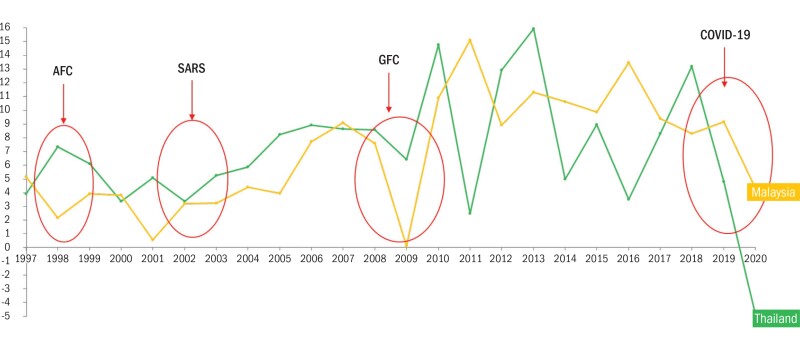

The region has had its share of crises – such as the Asian financial crisis (AFC) that occurred in 1997, the global financial crisis (GFC) in 2008, the Severe Acute Respiratory Syndrome (SARS) outbreak in 2002, and, most recently, COVID-19 – but overall remains one of the most attractive investment regions globally.

This article focuses on managing the tax implications associated with entering and doing business in ASEAN at a portfolio level.

A brief history of ASEAN and its economic growth

ASEAN was established on August 8 1967 by the founding nations: Indonesia, Malaysia, Philippines, Singapore, and Thailand. Brunei Darussalam joined on January 7 1984, followed by Vietnam on July 28 1995, Lao PDR and Myanmar on July 23 1997, and Cambodia on April 30 1999, making up what are today the ten member states of ASEAN. The population of ASEAN in 2020 stood at about 667 million, which is approximately twice the population of the USA and approximately 50% bigger than the EU.

Figure 1: ASEAN countries

Source: Asean.org

Table 2: Population by country

Source: World Bank data

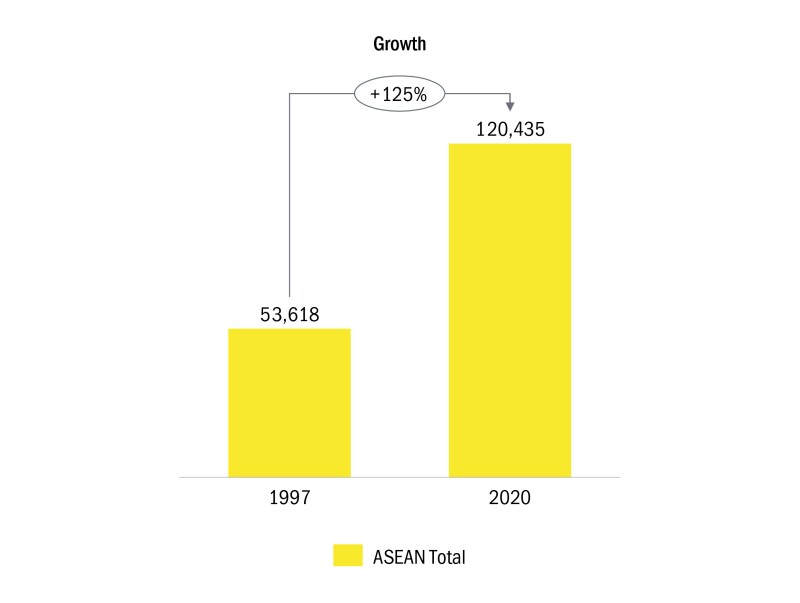

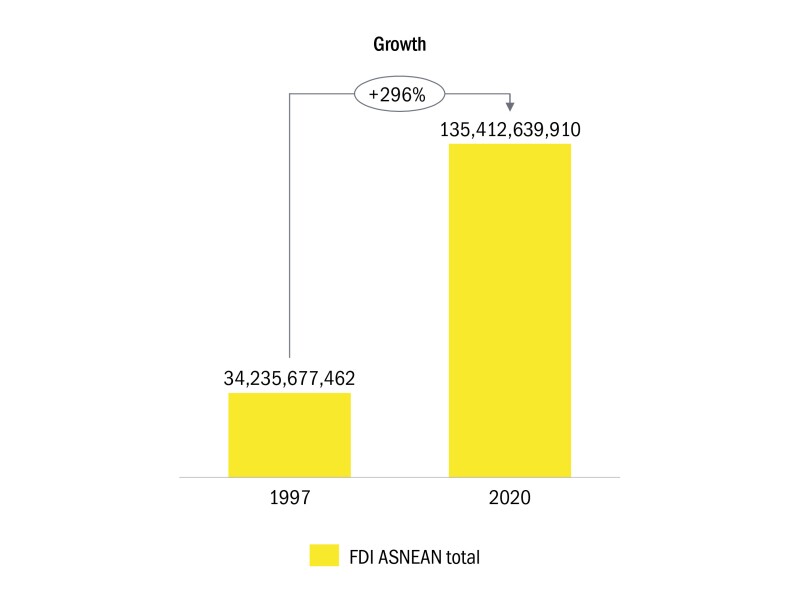

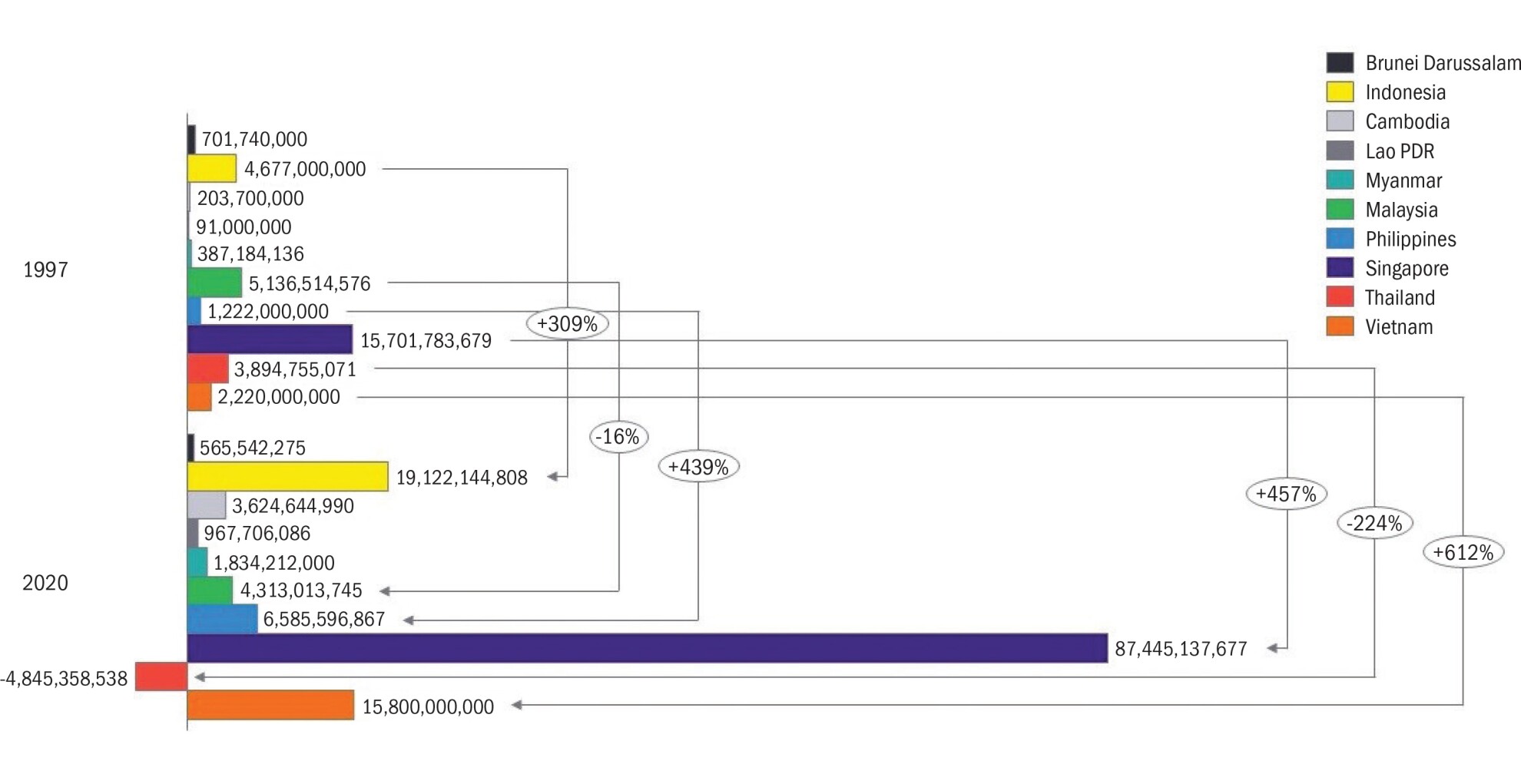

A core aim of ASEAN was to unite fragmented economies. The total gross domestic product (GDP) and foreign direct investment (FDI) growth between 1997 and 2020 are presented in Table 3 and Table 4.

Table 3: GDP per capita (USD) – 1997 v 2020

Source: World Bank data

Table 4: FDI net inflows total (USD) – 1997 v 2020

Source: World Bank data

Despite all the success, many challenges still exist, such as protectionism in certain sectors and political instability in some countries.

In addition, unlike the USA, where there is a common language, or the EU, where there is a common tax and customs framework and monetary policy, ASEAN is still highly fragmented in such areas (with vastly different language groups, tax and customs frameworks, and levels of economic development). This poses challenges for multinational companies (MNCs) that are already doing business in, or are exploring establishing a footprint in, ASEAN.

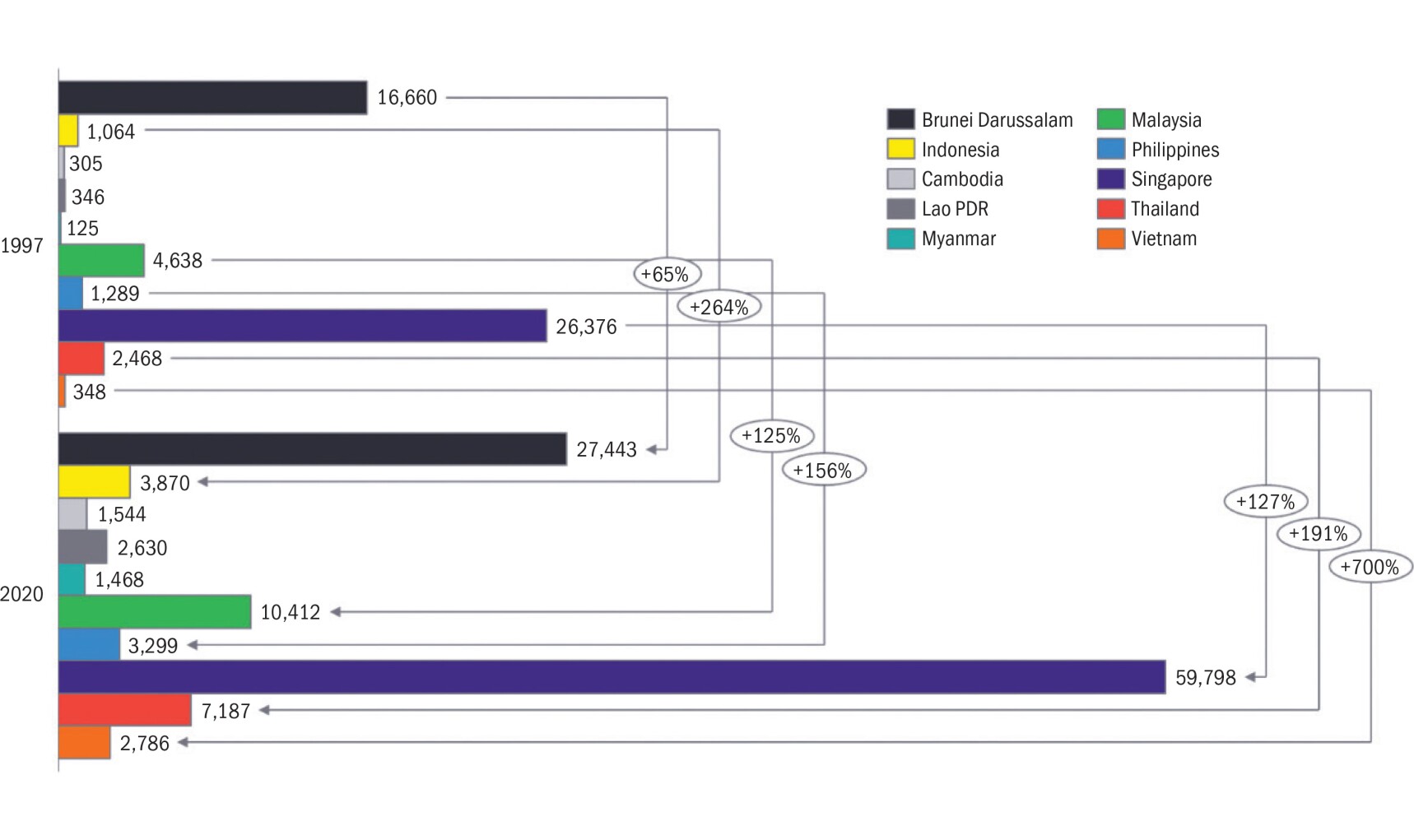

Therefore, it is still relevant to break down the data to the country level when deciding to enter ASEAN and for developing a robust commercial strategy, which will be touched upon in this article.

Table 5: GDP per capita in USD broken down by country – 1997 and 2020

Source: World Bank data

Table 6: FDI in USD broken down by country – 1997 and 2020

Source: World Bank data

Table 7: FDI net inflows in USD (billions) for Thailand and Malaysia year on year

Source: World Bank data

Singapore stands out as it attracted significant amounts of investment with a significantly smaller population when compared with other countries with material FDI growth. This is likely due to political and economic stability, prudent management of fiscal and monetary policies, more attractive corporate income and personal tax rates, and significantly less bureaucracy with regard to establishing a legal footprint, such as in company incorporation and dealing with various government agencies.

Nevertheless, the region in totality has achieved significant growth and is projected to continue this path. Initiatives such as the creation of the ASEAN Economic Community (AEC) and the Regional Comprehensive Economic Partnership (RCEP) should propel ASEAN to the forefront as an economic powerhouse in the decades to come.

2. ASEAN tax landscape

The direct and indirect tax architecture among ASEAN nations is complex and therefore requires careful planning by MNCs that are exploring entering the region and/or robust management by enterprises that have already set anchor in ASEAN.

The current legal and tax landscape can largely be explained historically and depending on who colonised a specific territory, it was either left with a civil law system (for example, the Dutch in Indonesia or the French in what we know today as Vietnam, Cambodia, and Laos) or a common law system (for example, the British in Burma (modern-day Myanmar), Malaysia, and Singapore). There are important differences between these systems that have an impact on tax law as well.

ASEAN nations have, on balance, competitive corporate and personal income tax rates, and have effectively used tax policy and incentives to attract non-portfolio FDI. Table 7 summarises the prevailing corporate income tax (CIT) rates of each ASEAN nation.

Table 7: Summary of the ASEAN tax landscape in FY 2021

Sources: EY worldwide tax guide 2021 and EY ASEAN incentives guide 2021

The fragmentation in ASEAN requires MNCs to have a well thought-through strategy with respect to entering and doing business in ASEAN countries.

Approach to entering ASEAN and market entry models

EY proposes a three-step approach for entering ASEAN that involves the following.

1) Understand / develop commercial strategy

“Essentially, developing a competitive strategy is developing a broad formula for how a business is going to compete, what its goals should be, and what policies will be needed to carry out these goals”

Michael Porter: Competitive Strategy: Techniques for Analysing Industries and Competitors (1980)

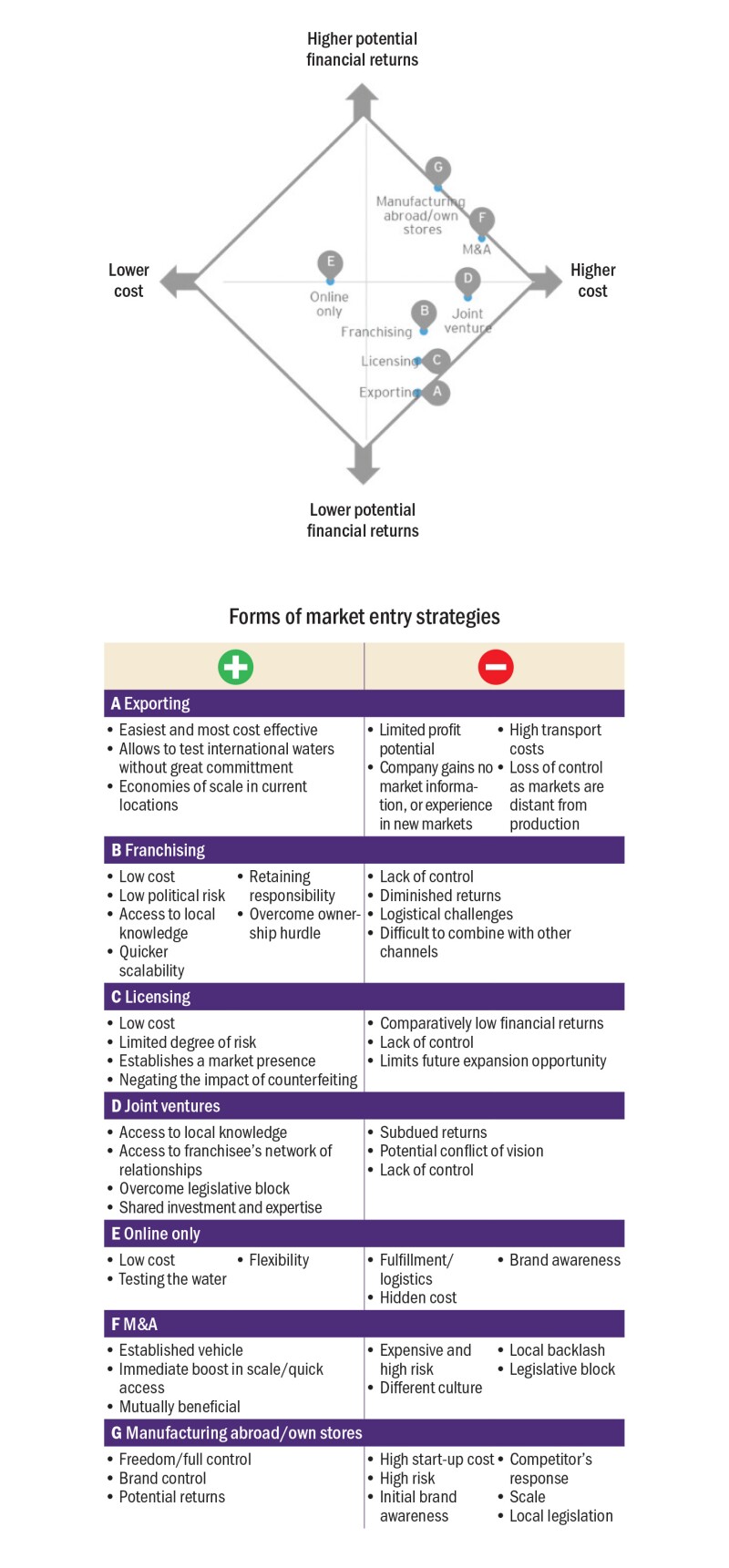

Multinationals use a variety of market entry models when expanding or growing in new or existing markets in ASEAN. Table 8 outlines the common models.

Table 8: Market entry models

The most risk-averse approach is a pure export model, which is denoted as (A) in the table.

Clearly, the low risk of an export model offsets the higher market share and profit opportunity as the buyer on the other end can control the price for the end consumer and therefore take market share and margin. Other potentially negative aspects of a pure export model are loss of control over quality and branding, and, depending on the Incoterms (international commercial terms), higher transport costs. That said, most enterprises that do not have an overseas footprint start with an export model and gradually move to a more complex market entry model.

On the other end of the market entry model spectrum is building or buying factories, stores, warehouses, and distribution entities across ASEAN. A deeply ingrained and wide physical footprint allows for greater capture of market share and profits, consumer market insights, and faster adaptability to trends against the competition.

The key point of the different market entry models is that they all have vastly different direct and indirect tax implications, especially with regard to doing business in ASEAN. For example, under the franchising model, there are three types of structures:

Corporate-owned franchisees;

Third-party franchisees; and

A hybrid of both.

Irrespective of the structure, the franchisor will receive a franchise fee, which can be split into three components:

A marketing fee;

A service support fee; and

A royalty.

All three fee types have different tax implications. First, all three types of fees will need to pass the tax deductibility test of the source country. Second, the portion of the fee that is characterised as a royalty will be subject to withholding tax at source. Third, it is not uncommon in the region for service fees to have withholding tax imposed on them or the tax authorities arguing that the character of the service fee is one of a royalty.

It is obvious that market entry into ASEAN requires careful planning. Failure to identify the key direct and indirect tax issues for a given market entry model is likely to lead to a breakdown in proper execution of the MNC’s commercial objectives. In ensuring tax alignment with commercial strategy, an MNC should, first and foremost, evaluate, design, and then implement an appropriate operating model to enable execution of its commercial strategy in ASEAN. This is covered in the second step of EY’s market entry approach.

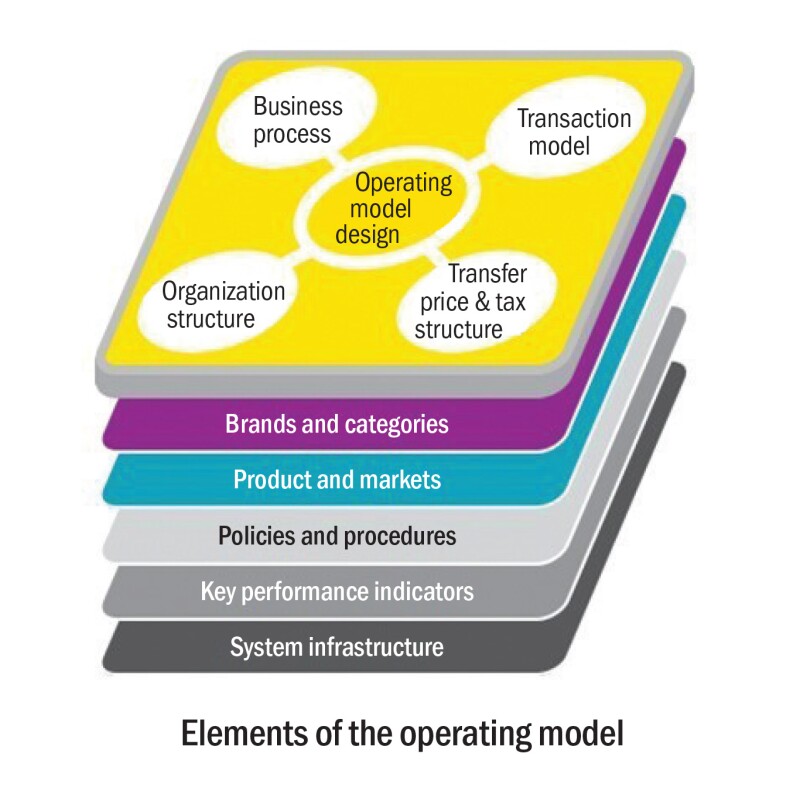

2) Designing and implementing and operating model

A business operating model is a set of elements that come together to enable the execution of the commercial strategy. Experience shows that without the design and implementation of a fit-for-purpose operating model, MNCs struggle or completely fail in achieving their commercial objectives in new markets.

Whilst all the elements of a business operating model are critical, the focus here is on the tax aspects in the design of a fit-for-purpose operating model. That is, once the commercial strategy and market entry models are set, the question to ask is: What infrastructure do we need to execute on our commercial strategy? To answer this question, we will assume that an MNC decided to establish its own manufacturing footprint, its own distribution network, and a regional headquarters to run and oversee its activities in ASEAN.

With the above in mind, the following aspects of an operating model then need to be properly evaluated, designed, and implemented:

Legal entity structure – What is the most appropriate legal entity structure? In other words, who owns whom?

Organisation and governance – What do my people structure (who reports to whom) and governance framework (for example, delegation level of authority, and responsible, accountable, consulted, and informed matrix, or RACI) look like?

People capability and processes – Do we have the right people capability and structured processes to make our business a success in the region?

Transaction flows – Do we design a buy/sell model, or service/franchise fee model?

Intellectual property (IP) – How do we organise the legal versus economic ownership of our IP? Specifically, how do we allocate our development, enhancement, maintenance, protection, and exploitation (DEMPE) functions?

Legal and regulatory – Are there specific legal and regulatory considerations? For example, licensing, FDI, minimum capital requirements, and movement of data.

Technology – Do we have the technological capability to operate our business in the region? This is becoming especially important not just from a commercial perspective but for tax reasons with the advent of the OECD’s BEPS 2.0 two-pillar frameworks.

Managing the above in ASEAN is far more difficult than, for example, in the EU, where there is a Community Customs Union and therefore more clarity. In ASEAN, each country has its own rules that an MNC must stay on top of and manage on an ongoing basis. An obvious solution is for customs authorities to team with transfer pricing departments with the tax offices of the ASEAN countries. However, in practice, this is not the case. Making post-import adjustments is not a straightforward matter in ASEAN (a more detailed discussion on this can be found in Adrian Ball’s article, TP adjustments and customs duties in a post-COVID-19 environment, ITR, July 1 2020).

This is one of the reasons why ASEAN operating models must be maintained by way of review on a frequently (usually annual) basis. This leads us to the third step in EY’s recommended approach to doing business in ASEAN: maintain and manage growth.

3) Maintain and manage growth

In a fast-changing global geopolitical, regulatory, and business environment, an MNC’s operating model needs to be frequently reviewed to establish whether the design still meets the overall commercial objectives, and any new risks are adequately addressed.

Model: Are you still ‘living the model’? Does the initial design still meet your objective?

Taxes: Are you in compliance with your tax obligations, such as corporate income tax, indirect taxes, and transfer pricing documentation.

M&A: Have you bought and/or divested business units and in doing so, have there been changes to your model?

This article has touched upon several macro forces that may trigger an MNC to rethink its commercial strategy and therefore its operating model. Key macro forces that impact operating models are:

BEPS;

Sustainability (ESG factors);

Changes to business models (that is, product sales to servitisation, or the provision of a service rather than a product); and

Changes to global supply chains through factors such as 3D printing, nearshoring, and resilience.

Considering these macro forces, as well as idiosyncratic aspects, it is crucial that an MNC reviews its operating model and evaluates whether the current design is maintainable.

An important topic in the maintain and grow phase is to regularly review your operating model and question whether macro and idiosyncratic forces at play necessitate a re-evaluation and change.

3. Appropriateness of specific jurisdictions for the location of specific activities

Historically, within ASEAN, different jurisdictions have been used for different parts of the supply chain. Broadly, the jurisdictions can be split into three categories:

Hubs – Locations that will house senior management to run the region and are ultimately accountable and responsible for the success of the business in the region. A multi-hub model, as touched upon in the previous section, is beyond the scope of this article, but it is likely to become more prevalent for various reasons.

Manufacturing locations – Jurisdictions that are attractive for establishing manufacturing sites.

Distribution network – Locations where you have sales, marketing, and distribution entities versus using third parties.

The design varies from industry to industry. However, there is a common pattern that is seen in the region with respect to how MNCs set up their operating models. The table below summarises where MNCs set up their activities.

Table 9: Indicative locations of various parts of the supply chain based on EY’s experience

Table 9 is based on experience of working with public and privately held MNCs that enter and do business in ASEAN. It should be stressed, however, that within ASEAN there are headquartered companies in Cambodia, Laos, Philippines, Indonesia, etc., meaning a cross does not indicate that a hub location in that jurisdiction is not suitable. On the other hand, even with ASEAN-headquartered MNCs, there is a theme of preferences where hubs with value-driving people functions are located.

The most common jurisdictions are Singapore, Kuala Lumpur, and Bangkok. This is usually visible when MNCs undertake a hub location analysis based on a specific methodology and criteria, backed by third-party data. By contrast, a similar location study for a manufacturing facility generally propels countries such as Indonesia, Vietnam, and Thailand to the forefront. Philippines is commonly known for the establishment of shared service centres and certain manufacturing facilities.

A critical design feature, in hub structures, is ensuring that the hub has an appropriate level of substance when viewed through a functions, assets, and risks (FAR) lens. From a tax perspective, it is improper to establish an entity in, say, Singapore, which has the lowest CIT in ASEAN, have no-to-limited people functionality, and park residual profits there.

It will be interesting to perform location assessment exercises, considering the macro forces at play mentioned earlier.

4. Concluding remarks on ASEAN market entry

As one can probably conclude, entering a region such as ASEAN into multiple jurisdictions is no small feat. Some of the key messages are:

ASEAN is clearly more diverse across regulatory, tax, commercial, logistics, and business environments when compared with other large regional markets, such as the EU and US.

Various market entry models yield various tax outcomes that would naturally be evaluated as part of an overall operating model design.

MNCs, public and private, should have a clear commercial strategy before entering or expanding into/within ASEAN. For example, strategy should be aligned to global objectives but adapted to the ASEAN environment.

A proper operating model feasibility and design exercise should be undertaken to ensure the risks and opportunities are covered off.

Hub structures should be substance based, with a clear identification and delineation of value-driving functions from routine functions and activities.

Global macro forces should be constantly monitored and tested against the current operating model.

In conclusion, success in entering ASEAN requires a multifaceted, carefully crafted approach.