As of 2021, India continues to be one of the most popular international investment jurisdictions. While global foreign direct investment (FDI) activity fell by 42% in 2020 due to the challenges posed by the COVID-19 pandemic, India registered a healthy 13% growth in its FDI inflows.

The enactment of general anti-avoidance rules (GAAR) under the domestic tax law of India and the modification of tax treaties on account of the multilateral instrument (MLI) have had a significant bearing on inbound investments into India. This article discusses key considerations under GAAR and MLI that should be taken into account while planning a new inbound investment structure or reviewing an existing structure.

Inbound investments: GAAR considerations

The introduction of GAAR with effect from April 1 2017 has resulted in codification of anti-avoidance principles under the domestic tax law. The provisions of GAAR would trigger when an arrangement is regarded as an impermissible avoidance arrangement (IAA).

An arrangement is regarded as an IAA where both primary test and secondary test are satisfied. The primary test is said to be met when the 'main purpose' of the arrangement is to obtain a tax benefit. The secondary test is considered to be satisfied for an arrangement if any of the following conditions are met:

It is not at arm's-length;

It results in misuse or abuse of the provisions;

It lacks commercial substance;

It is entered in a manner not employed for bona fide purposes.

Threshold

GAAR provisions would not apply to an arrangement where tax benefit, in aggregate, to all parties to the arrangement do not exceed INR 30 million (approximately $0.4 million) in a single financial year.

Carve-outs

GAAR provisions do not apply to:

Investment by a foreign portfolio investor (FPI), who has not availed treaty benefit;

Investment made by a non-resident by way of offshore derivative instruments or otherwise, directly or indirectly, in an FPI; or

Income from transfer of investment, which such investment has been made prior to April 1 2017.

Foreign investment

An overseas investor may typically invest in an Indian company either directly or through an intermediate holding company (IHC). Historically, countries like Mauritius, Netherlands and Singapore, among others, have been commonly used for investing in India.

The need for setting up an IHC is often driven by commercial considerations such as:

Ease in raising funds;

Investor preference;

Ease in overseas listing;

Holding company for consolidation of overseas operations, facilitating better management and exit opportunities;

Ring fencing the parent company from the obligations of the investee entity;

Intellectual property (IP) protection where the IHC is to own intangibles.

Additionally, an IHC in a low tax jurisdiction can offer certain tax benefits in the form of lower withholding rates and tax efficiency on exit.

Key considerations

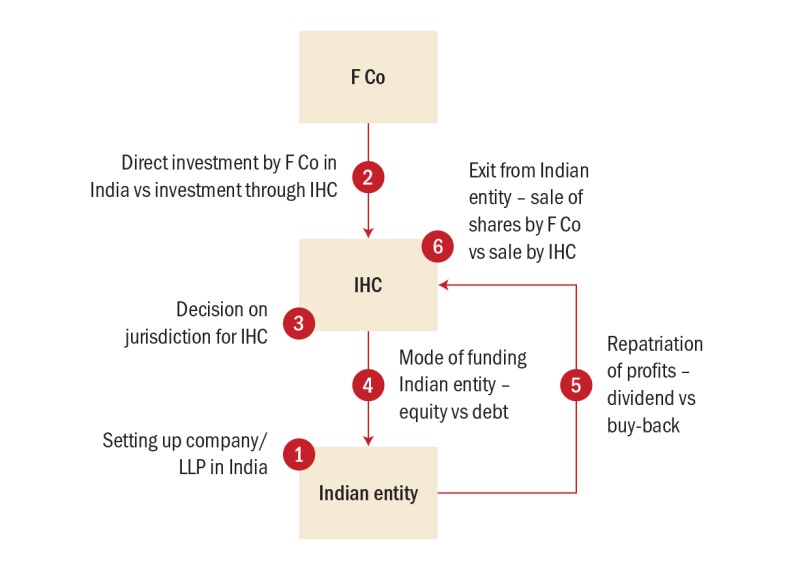

A typical corporate structure and key considerations have been captured in Figure 1.

Figure 1

Table 1 outlines commonly considered parameters for setting up operations in India.

Table 1

Particulars |

Non-tax factors |

Tax aspects |

Investment directly or through an IHC |

• Factors mentioned above |

• Favourable tax treaty • Lower withholding tax rates • Nil or low tax on exit |

Form of entity to be set up in India – company vs limited liability partnership (LLP) |

• Operational flexibility • Ease in administration • Scale of business • Regulatory considerations |

• Applicable corporate tax rate: • Profit upstreaming costs – dividend taxable in the hands of shareholder while share of profit exempt for partners in LLP in India |

Funding instrument/capital structure – debt vs equity |

• Lender covenants • Serviceability • Regulatory requirement |

• Deductibility of interest expenditure • Withholding cost on interest and dividend depending upon the applicable treaty rates |

Mechanism for repatriation of profits – dividend vs buyback |

• Company policy for rewarding shareholders • Impact on capital structure • Future business plans • Regulatory considerations |

• Dividend would be taxable in the hands of shareholders at 20% or treaty rate whichever is lower • Buy-back tax payable at 23.3% by the company (resulting in an effective tax rate of 18.9% for the shareholder) and no further tax payable by shareholders |

Exit mechanics – slump sale vs sale of shares vs buyback |

• Buyer’s preference for a particular option – integration of operations, deciding whether to inherit company’s history, liabilities, and litigation • Continuity of licenses and registrations |

• Slump sale – capital gains tax payable by company and further tax cost on cash extraction for shareholders • Sale of shares – capital gains tax payable by shareholders • Buyback – lower effective tax rate |

Exit mechanics – sale of shares of Indian operating company vs sale of shares of IHC |

• Commercial reasons for setting up IHC as discussed above |

• Treaty protection in case of sale of shares of special purpose vehicle (SPV) – resulting in indirect transfer of shares of Indian operating company |

In view of GAAR provisions, it is important to demonstrate that the main purpose of investing in India through a particular jurisdiction is motivated by commercial reasons and not merely to obtain tax benefits. Furthermore, it would be prudent to ensure that due weightage is given to commercial factors while taking decisions on parameters mentioned above rather than being solely driven by tax considerations.

Consequences of triggering GAAR provisions

Where GAAR provisions are invoked, the tax authorities would have sweeping powers like:

Disregarding the whole arrangement or any step in an arrangement;

Disregarding the corporate structure;

Treating the place of residence of any party to the arrangement at a place other than the place of residence as provided under the arrangement;

Denial of treaty benefit – while a taxpayer has an option to apply the provisions of domestic tax law or tax treaty whichever are more beneficial, GAAR under the domestic tax law overrides treaty provisions;

Characterising equity as debt or vice-versa

Choice principle

The Central Board of Direct Taxes of India (CBDT) has issued a circular, dated January 27 2017, which clarifies that GAAR will not interplay with the right of taxpayer to select or choose a method of implementing a transaction. Thus, arguably, where a transaction or arrangement has an underlying commercial purpose, the manner of implementing it should not be questioned under GAAR, even if it results in tax benefit. For instance, if a multinational corporation desired to set up a business presence in India, it may choose between a company vehicle or a LLP vehicle.

Inbound investments: MLI considerations

The multilateral instrument, an OECD initiative under the BEPS project, is a multilateral convention signed by over 90 countries to implement tax treaty related measures to prevent base erosion and profit shifting. Tax treaties entered by India with various countries have undergone changes on account of the MLI. Some of the treaties that stand amended include treaties with Singapore, Australia, Canada, Cyprus, France, Netherlands, UAE, and UK.

India's tax treaty with Mauritius has still not been impacted by the MLI, since Mauritius has not covered its tax treaty with India under the purview of the MLI. A similar position has been adopted with Germany. Furthermore, the US is not a signatory to the MLI, and hence MLI provisions would not impact the India-USA tax treaty.

Principal purpose test

The most significant change brought in by the MLI is perhaps the introduction of the principal purpose test (PPT) in the tax treaties that seeks to prevent treaty abuse.

The PPT states that a benefit under treaty shall not be granted if it is reasonable to conclude that obtaining such a benefit was one of the principal purposes of any arrangement that resulted directly or indirectly in that benefit, unless it is established that granting that benefit would be in accordance with the object and purpose of the relevant treaty provisions.

Where it is established that granting a treaty benefit would be in accordance with the object and purpose of the relevant treaty provisions, a treaty benefit should not be denied. For instance, gains from the transfer of shares of an Indian company acquired by a Singapore company before April 1 2017 are not taxable in India under the India-Singapore treaty due to grandfathering provisions.

It needs to be considered whether such a treaty benefit can be denied under other circumstances. In this context, it seems possible to argue that in view of grandfathering provisions under the India-Singapore treaty, investment by a Singapore resident in India may be regarded to be in accordance with object and purpose of treaty and hence should be outside the ambit of the PPT.

Impact on inbound investments

In light of the PPT, it is pertinent for an investor to establish commercial rationale for investing through an IHC from a particular jurisdiction. Furthermore, in case of countries like Singapore, an investor will have to comply with both the PPT rule as well as the limitation of benefits (LOB) clause that is already present in the tax treaty.

|

|

“While global FDI activity fell by 42% in 2020 due to the challenges posed by the COVID-19 pandemic, India registered a healthy 13% growth in its FDI inflows.” |

|

|

While most of the treaties entered into by India provide taxing rights to India in respect of capital gains earned by a non-resident on alienation of shares of an Indian company, gains on alienation of quasi-equity and debt instruments (such as convertible and non-convertible debentures) are generally taxable only in the country of residence of transferor. Such choice of instrument may however be questioned in light of the PPT provisions and the same needs to be backed by adequate commercial considerations.

In addition to the PPT, a country may decide to opt for a more objective criteria for determining eligibility for treaty benefit in form of simplified limitation of benefits (SLOB) provsions. India has opted for the SLOB provision in addition to the PPT. The SLOB provision will however apply only if both the treaty partners have opted for it, or where one treaty partner has opted for it and the other treaty partner allows its applicability asymmetrically. At present, there are very few treaties entered into by India that would be impacted by the SLOB rule and some of these include Russia, Norway, Kenya, Denmark, Slovakia and Uruguay.

Other MLI amendments

The MLI has introduced changes to tax treaties to mitigate artificial avoidance of permanent establishments (PEs) through fragmentation of activities and through splitting up of contracts and also enhanced the scope of dependent agency PEs.

There are also certain anti-abuse rules introduced in the articles relating to the taxability of dividends and capital gains in tax treaties.

Interplay between GAAR and the PPT

Both GAAR and the PPT seek to curb tax avoidance. There are however certain points of distinction with respect to applicability of GAAR and the PPT, as shown in Table 2.

Table 2

Particulars |

GAAR |

PPT |

Main purpose test |

Triggered where main purpose (and not one of the main purposes) of an arrangement is to obtain tax benefit |

Wider scope – applicable where one of the main purposes of an arrangement is to obtain tax benefit |

Additional test for applicability |

In addition to main purpose test, one of the four tainted element tests needs to be met |

No additional test to be met |

Threshold for exemption |

Not applicable where tax benefit arising from an arrangement in aggregate in a year is lower than INR 30 million |

No threshold for exemption |

Grandfathering benefit |

Not applicable to income from investment made before April 1 2017 |

No grandfathering benefit under the PPT |

Object and purpose of treaty |

May apply even if obtaining tax benefit is in accordance with object and purpose of treaty |

Not applicable where obtaining tax benefit is in accordance with object and purpose of treaty |

Approving panel |

Matter to be referred to the approving panel to decide on applicability of GAAR |

No such mechanism under the PPT rule |

Thus, while there is some overlap between GAAR and the PPT, implications under both these anti-abuse measures need to be tested independently, and one measure cannot displace the another.

Structuring investments

The introduction of anti-abuse measures under the GAAR and the MLI framework would have far reaching implications on the manner in which inbound investments are structured. Both, GAAR and MLI provisions have been recent introductions and hence a detailed judicial insight thereon are not yet available.

It is imperative that investors review their investment structures into India considering these provisions as well as the risk of potential litigation which may arise. There will be an increasing thrust on demonstrating a commercial need at each stage to be substantiated by adequate documentation and this would apply even for existing structures.

The needle has moved away from tax driven structures and is now pointing at a more balanced approach which involves creation of substance and having a commercial objective as a primary driver of all tax structuring steps.

Click here to read all the chapters from ITR's India Special Focus

Vishal Gada |

|

|---|---|

|

Founder, mentor Aurtus Consulting T : +91 98212 70900 E: vishal.gada@aurtusconsulting.com Vishal Gada is the founding partner of Aurtus Consulting, a boutique tax and regulatory consulting firm in India. He specialises in mergers and acquisitions (M&A), international tax structuring, and devising family and business succession structures. Over the past 20 years, Vishal has gained immense experience in advising clients on making inbound investment in India, structuring outbound investments from India, and optimising contractual arrangements within group companies. He also has expertise in undertaking corporate re-organisations, transactions for both buy-side/sell-side M&A and devising ideal succession structures for businesses and families. Throughout his career, he has worked for elite Indian corporates as well as several multinational corporations. Prior to founding Aurtus Consulting, Vishal was a partner at a Big Four firm and a co-founder of another leading Indian tax firm. He is a chartered accountant, a frequent speaker at eminent tax seminars and professional forums, and has co-authored books on tax topics in India. |

Zeel Jambuwala |

|

|---|---|

|

Director Aurtus Consulting T : +91 98258 24468 E: zeel.jambuwala@aurtusconsulting.com Zeel Jambuwala is a director at Aurtus Consulting. She has over 12 years of experience in advising clients in the tax and regulatory domain. Zeel has worked on several M&A transactions, corporate re-organisations, and corporate tax issues. Her area of expertise also includes advising on inbound/outbound transactions, private equity fund set-ups and devising family and business succession structures. She has worked across industry sectors such as infrastructure, pharmaceutical, technology, start-ups and financial services. Prior to Aurtus Consulting, Zeel was associated with a leading Indian tax firm and a Big Four firm. She is a qualified chartered accountant, and has co-authored various articles on tax topics and chapters in prominent tax journals. |

Jay Shah |

|

|---|---|

|

Principal Aurtus Consulting T : +91 96623 21835 E: jay.shah@aurtusconsulting.com Jay Shah is a principal at Aurtus Consulting. He has over eight years of experience in advising clients in the tax and regulatory domain. Jay's work experience includes advising clients in the areas of M&A, business restructuring, succession planning, litigation and structures involving inbound and outbound investments. He has worked with clients across diverse industries ranging from manufacturing, pharmaceuticals, infrastructure, financial services and technology, among other areas. Prior to Aurtus Consulting, Jay worked at a leading Indian tax firm and a Big Four firm. He is a qualified chartered accountant, and has co-authored various chapters and papers on tax and regulatory topics. |