Key transfer pricing law changes are expected under the newly elected administration, which will come into office in February. Heading the list, the advance pricing agreements (APA) system is expected to become more accessible. An advance ruling programmes, under which a taxpayer and the tax authority may enter into an agreement on the interpretation and application of the law to a certain transaction, will be introduced to reduce potential tax disputes.

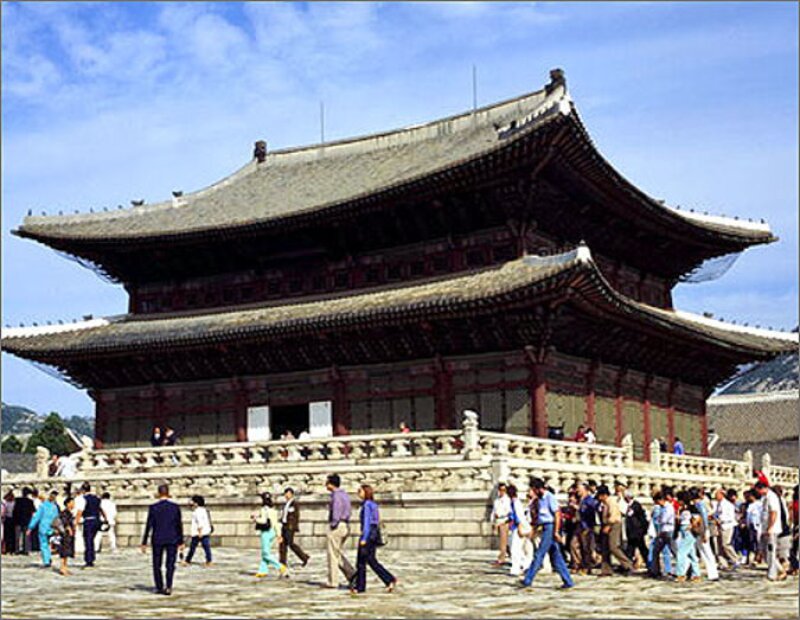

President-Elect MB Lee has repeatedly emphasised business friendly policies and tax related aspects include a reduction of tax rates and a general mprovement of the tax environment in Korea. There are not yet any specific details of Lee's plans, but one suggested change would reduce the corporate income tax rate from the current 25% (not including resident surtax) to 20% for general corporations and further lowering the tax rate to 8% for corporations qualifying under the Small and Medium Size Enterprise Act.

In early January, in response to Lee’s statements, the new commissioner of the National Tax Service in his 2008 New Year message to NTS officials said that the NTS will make all efforts to create a "business-friendly tax environment” and in order for tax audits not to be an obstacle to inducement of foreign investment.

The NTS will identify bottlenecks and improper standards to be revised through contacts with the foreign business community. It is widely expected that the NTS will establish, within its national office, a division that will be fully devoted to the processing and administration of the APA programme. Currently, the NTS does not have a separate organisation for the APA programme, which has caused delays in processing of APA applications.

In late January, the NTS commissioner visited the American Chamber of Commerce and again stated that the NTS will minimise audits on foreign companies operating in Korea and help creating a more business-friendly tax environment. The commissioner also said that the NTS is considering adopting an advance ruling system' under which businesses can settle potential tax issues in advance of a potential transaction to provide better certainty at an earlier stage of an investment or other transaction. The details of such advance ruling programme are not publicly known, but it appears that a taxpayer and the tax authority would be able to enter into an agreement with regard to the interpretation and application of the law to a specific transaction, all in an effort to reduce potential tax disputes between taxpayers and the tax authorities.