|

Thuan Pham |

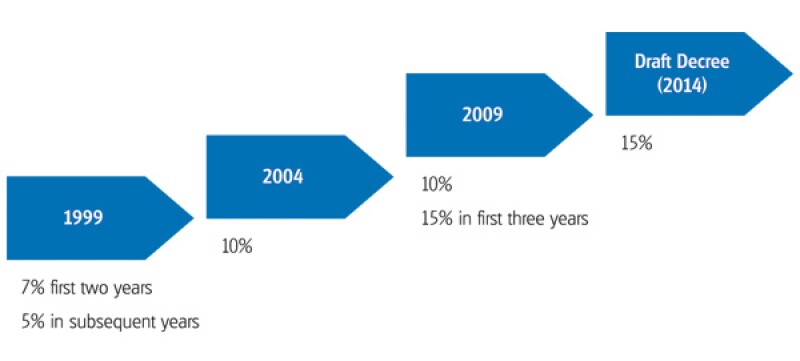

Nowadays, advertising and promotion (A&P) activities play a big role in the business strategy of an enterprise. A&P costs make up a large proportion of the budget of a company, especially for multinational companies in Vietnam. A question that arises is whether these costs are fully deductible for corporate income tax (CIT) purposes. In this regard, the government has issued a draft decree to amend the CIT regulations including issues of A&P deductible cost and interest deduction on loans. Diagram 1 is a summary of the evolution of the regulations regarding the treatment of A&P costs. In the first issuance of the CIT law (effective January 1 1999), enterprises generally were allowed to deduct A&P costs from 5% to 7% of total deductible expenses (except for cost of goods sold of commercial activities).

Starting in 2004, with the intention to make it more equitable for all players, the Ministry of Finance (MOF) issued a new circular to amend the A&P cap. The rules increased the cap to a maximum of 10% for all industries.

Diagram 1 |

|

In 2009, there was a big push for tax reform. The government issued several new laws regarding taxes such as VAT, CIT and personal income tax (PIT). There were many contradictory opinions among experts regarding whether the A&P cap should be removed. For foreign-invested companies that are strongly financed by the parent company and spend a lot on A&P activities, the 10% limitation was the cause of great concern, especially in the initial years of market entry, when they may be in a loss position but still paying tax. After much debate and consideration, the new law on CIT was finalised and went into effect on January 1 2009, with new rules on non-deductible expenses as follows:

"That part of expenses for advertising, marketing, promotion and broker's commissions; of expenses for receptions, formal occasions and conferences; of expenses for assisting marketing, of expenses for assisting costs, and for discounting payments; and of expenses for complimentary newspapers by press agencies directly related to production [and/or] business which exceeds ten (10) per cent of the total amount of deductible expenses; [but] applicable to newly established enterprises, that part of [such] expenses which exceeds fifteen (15) per cent in the first three years as from the date of establishment…."

The 2009 rule provided a harmonised solution for enterprises, even though it was not the full solution expected by most foreign-invested enterprises.

To encourage more foreign investment into Vietnam and increase its competitive index within the region as well as remove any unfair tax treatment among enterprises, the government is considering a draft decree to amend the CIT regulations. The decree is expected to apply for the 2014 fiscal year, though it is still in process and is at the stage of receiving public opinions on it. Some of the key changes under the new draft decree are noted below:

A&P Cap: The A&P cap will be 15% and will apply to all types of businesses, regardless of whether they are newly established or not. In addition, discount payments and complimentary newspapers will be removed from the A&P category cap.

CIT rate: The CIT rate would be reduced to 20% – 23%. For the oil and gas industry, the rate will still be 32% – 50%.

Thin capitalisation rule: Vietnam does not have a thin capitalisation rule. However, under current regulations, there are some restrictions on interest loan deduction when (i) the interest rate paid to non-economic organisations and non-credit institutions exceeds 150% of the basic rate announced by the State Bank of Vietnam; and (ii) the loan is used for financing charter capital. In an effort to reduce transfer pricing abuse, the government has introduced a thin capitalisation rule in the draft decree. Specifically, a tax deduction will not be allowed when interest paid for the loan amount which exceeds (i) 10 times its equity (applicable for credit institutions) or (ii) four times its equity (applicable for other enterprises).

If the decree is passed, taxpayers, especially foreign-invested enterprises, would enjoy more tax benefits from lower CIT rates and maximising deductions for A&P costs. However, for those with large shareholder loans leverage, the result may be a doubling of tax when the enterprise must still pay withholding tax at 5% on the loan interest paid, while not being able to deduct all of it for CIT purposes.

Thuan Pham (thuan.pham@vdb-loi.com)

VDB Loi

Tel: +84 8 3914 7272

Fax: +84 8 3915 4248

Website: www.vdb-loi.com