|

Giannos Ioannou |

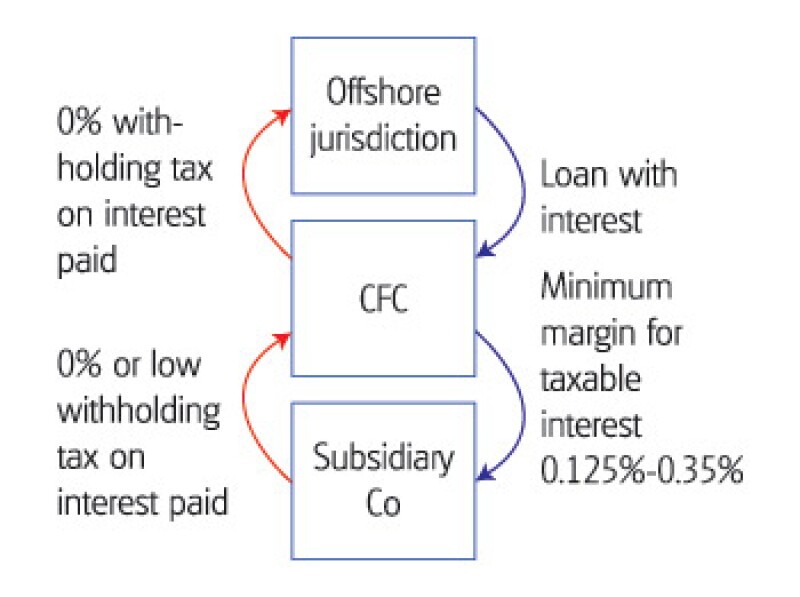

Cyprus Financing Companies (CFCs) are commonly used in international tax structuring mainly due to the wide range of tax related benefits they have to offer. The advantages that have made Cyprus a favourable financing company jurisdiction for investors and it is considered a major vehicle for international tax planning are based on two main reasons:

Firstly, due to the country's flexible tax system;

Secondly, the existence of the DDT between Cyprus and many countries that limits withholding taxes.

Diagram 1 |

|

According to the Commissioner, the minimum interest margins to be accepted by the Department of Inland Revenue would be determined based on the loan amount as shown in Table 1.

Interest free loan agreements would be subject to a deemed interest margin of 0.35% and shall apply irrespective of the loan amount.

The above margins are applicable for the tax years 2008 onwards. For the tax years 2003-2007 the acceptable margin is 0.3% irrespective of the amount and whether it is interest bearing.

The above margins apply when Cyprus companies are used as intermediary financial vehicles to finance other related or connected companies and the following conditions are satisfied:

The funds borrowed should be used within a six-month period;

The write off of any loans should not create any tax benefit or tax liability for the Cyprus company.

Table 1 |

||

Loan amount |

Interest bearing loans |

Interest free loans |

EURO |

% |

% |

Up to 50 millions |

0.35 |

0.35 |

From 50 millions up to 200 millions |

0.25 |

0.35 |

More than 200 millions |

0.125 |

0.35 |

The above also applies when the funds are borrowed by a bank and the loan facility as guaranteed by other related or connected companies.

In line with the above, the use of Cyprus as a Financing Company minimises the tax implications which are further reinforced by the recent clarifications on the definition of minimum/maximum interest margin.

Intra-group loans by the use of an intermediary CFC minimises the tax luggage carried forward due to minimum margin frames and no withholding taxes on interest paid are imposed.

Giannos Ioannou (giannos.ioannou@eurofast.eu)

Eurofast Taxand, Cyprus

Tel: +357 22 699 222

Website: www.eurofast.eu