For the buyer, the tax invoice is evidence that the liable VAT has been paid. When a VAT taxable enterprise fails to issue a tax invoice, the tax office may impose a sanction of 2% of the VAT tax base.

A seller usually issues a tax invoice to a buyer who directly receives goods. However, due to the complexity of cross-border trade, foreign enterprises can provides local enterprises with goods acquired from other local enterprises. It is also common that a local enterprise can provide other local enterprises with goods acquired from another foreign enterprise.

Below are some complexities of tax invoice issuance that need to be addressed in cross-border transactions.

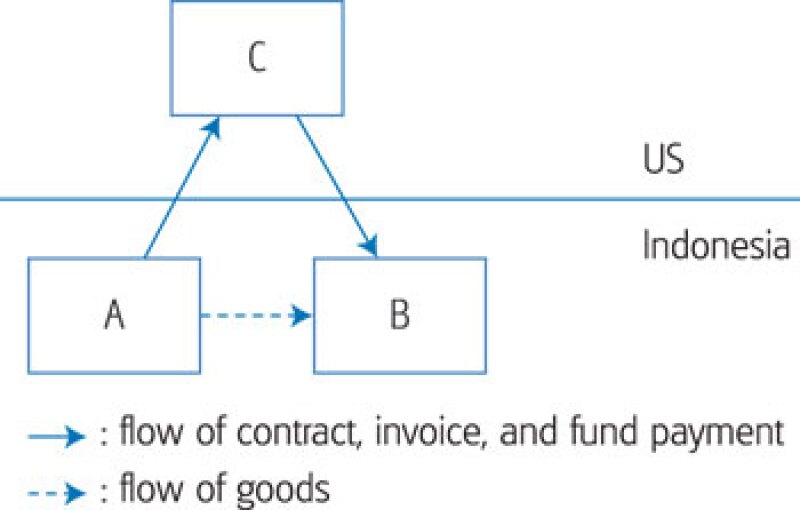

Example one

Company A and company B are Indonesian. Company C is in the.

C purchases goods from A and sells them to B.

C asks A to deliver the goods directly to B.

|

The selling of goods by company A to company C is treated as an export transaction that is subject to VAT of 0%. Since company A delivers the goods directly to company B, it is a transfer within the Indonesian customs area, which is subject to VAT of 10%. Therefore company A is obliged to issue a tax invoice to company B. If company B intends to use the invoice as a tax credit, it must prove that the goods are provided domestically.

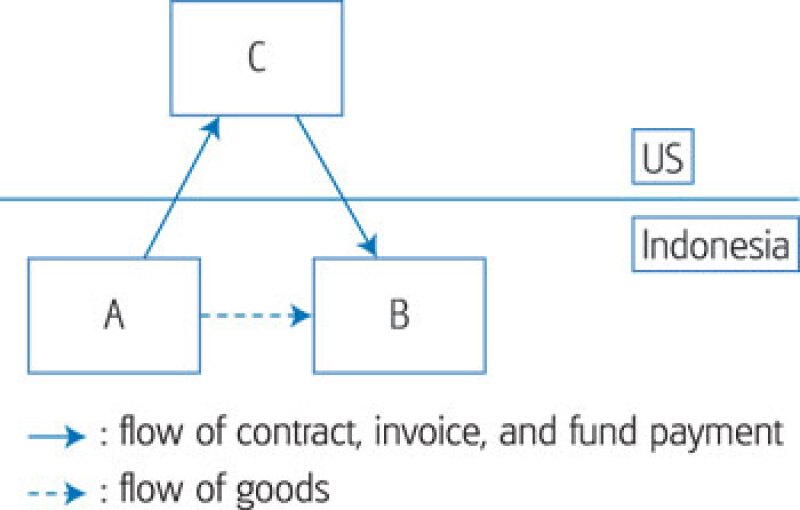

Example two

Company A, in Indonesia, sells goods to company C in the US.

Company B, a producer in Indonesia, sells goods to company A who is instructed to export the goods to company C.

|

The sales of company B may be interpreted as export or local sales. The goods delivered to company C may be treated as export and subject to VAT of 0% and company B will record domestic sales to company A.

No tax invoice will be issued by company B, except the export notification. In this case, company B may face challenges from the tax office to prove it is an export transaction rather than a local sale.

The sales of company B may be treated as local sales to company A and company B must issue a tax invoice and collect VAT of 10%.

Subsequently, company A will export the goods directly from company B’s inventory, subject to VAT of 0%.

In this case, a liquidity issue arises because company A will recover the paid VAT at the end of the fiscal year. However, the tax office will not challenge company A and company B, regarding the implementation of the VAT law.

The issuance of a tax invoice to an enterprise that is different to the buyer stated in a commercial invoice must be managed, in order to prevent an unnecessary tax penalty imposed by the tax office.

Novilia (novilia@pbtaxand.com)

PB Taxand

Website: www.pbtaxand.com