Arm's length price setting versus outcome testing approach

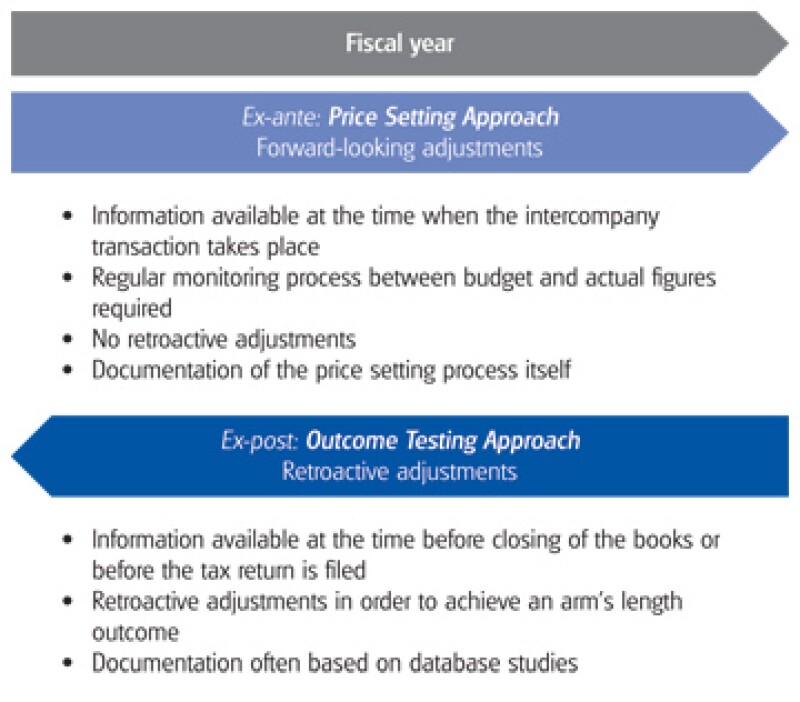

Two distinctive approaches are known when it comes to price setting. The topic discussed here relates to the underlying fundamental question of which information should be used to establish and document arm's-length transfer prices: Should information be used for determining and documenting transfer prices that is available at the time when the intercompany transaction takes place (ex-ante or price setting approach)? Or should the actual outcome of the transaction between related parties be used when demonstrating whether the conditions actually comply with the arm's-length principle (ex-post or outcome testing approach)?

The main difference between these two methods is the latter may lead to compensating adjustments before closing of the books or alternatively before the tax return is filed, in case the actual outcome of the transfer pricing is outside the arm's-length range of results. Whereas, the first approach might render the initial transfer pricing to be binding without the possibility of any retroactive adjustments.

The different methods can result in significantly deviating outcomes mainly relating to three areas when it comes to proving the arm's-length nature of transfer pricing. Firstly, which financial data of the transaction partner(s) should be used in determining and testing transfer pricing? In case of the first approach, budget figures based on information of the economic and market conditions including financial projections at the time of the transaction need to be applied, whereas under the latter, actual figures on revenues and cost structures are already available. This may lead to significant deviations.

Secondly, which financial information on uncontrolled comparable transactions is available? As a practical constraint regarding availability and collection of comparable data, sufficient information from external databases, such as Bureau van Dijk's databases, is generally only obtainable with a certain time lag. Thus, comparable data used for calculating compensating adjustments under the outcome testing approach is likely to be more recent. In addition, the outcome testing approach may be based on information on economic and market changes that occurred after the time the transaction was undertaken.

Thirdly, under the price setting approach transfer pricing documentation may look significantly different compared to the outcome testing approach. Under the first approach, the taxpayer is obliged to prove that all information concerning economic and market conditions (including financial projections reasonably available at the time of the transaction) is utilised in the price setting process and documented accordingly. Whereas, under the latter approach a simple comparison of the actual results of the tested party to the results of comparable transactions may be sufficient.

Due to the differences in those three areas, related party transactions between countries where tax authorities apply different approaches may lead to disputes and potential double taxation for the taxpayer.

So far, both OECD and EU JTPF accept both methods. However they provide only limited guidance under which circumstances one of the approaches may be preferred. In the last few months, this rather fundamental question has become a hot topic in the transfer pricing arena due to recent publications of the OECD and the EU JTPF, which will be outlined below.

OECD regulations and reform initiative

Based on para. 3.67ff. of the 2010 OECD guidelines, both methods are allowed. Furthermore, the OECD emphasises that both approaches, as well as combinations of these, are followed by OECD member countries and that these may result in different outcomes and potential disputes with tax authorities. However, apart from the description, no further guidance is provided about which method should be taken under specific circumstances.

To manage the discrepancy of the conflicting views and in response to the need for more advice to taxpayers, Working Party No 6 started a reform initiative in 2012. This initiative aimed at revising paragraphs 3.67 to 3.71 of the OECD guidelines (2010) and providing more practical guidance regarding the application of the two methods. The OECD published a discussion draft that made an effort to clarify the methods and asked the business community for comments. Unfortunately, the project was abandoned in spring 2013 due to the extremely conflicting views within Working Party No 6.

EU Joint Transfer Pricing Forum's report on compensating adjustments

The EU JTPF analysed the views of its member states' tax authorities with respect to the timing issue, which resulted in the recently issued report on Compensating Adjustments (January 2014). Similar to the approach taken by the OECD, the report does not yield at bridging the gap between the different views or defines one approach to be the preferred one under certain circumstances. The report, rather, gives practical guidance in case tax authorities follow different approaches to reduce disputes.

In particular the EU JTPF provides for conditions under which potential compensating adjustments, as a result of the application of the outcome testing approach, should be accepted. This should be the case wherever the taxpayer:

Made reasonable efforts to achieve an arm's-length outcome at the time of the transaction and documents such efforts;

Applies the approach symmetrically in the accounts of both companies;

Applies the approach consistently over time;

Makes the compensating adjustment before filing of the tax return; and

Documents the reasons for deviations between budget and actual figures (in case required by one of the member states involved).

It should be noted that the EU JTPF explicitly stresses that this practical solution should not encourage member states to introduce stricter regulations on this topic and that accepting a compensating adjustment based on the outlined conditions should not be regarded as a change in the view of one member state.

This aspect is important to emphasise because, although the EU JTPF provides a framework to reduce future disputes, member states do not come to a common understanding on the described timing issue. Unfortunately, given the controversies on an OECD and EU JTPF level, such common understanding on which method should be applied under which circumstances in related party transactions seems to be out of reach for the moment.

German regulations on compensating adjustments

German tax authorities outline their views on the timing issue in their Administrative Principles – Procedures. It should be mentioned that the Administrative Principles are (as all administrative principles) only an internal interpretation of the tax authorities' view of the legal requirements and only binding for tax authorities. According to the principles, compensating adjustments are only allowed in case the provision of services has been agreed on in advance, including all factors determining prices and a predefined calculation process for the adjustment (adjustment mechanism). The only reason for justifying the adjustment is because of existing uncertainty regarding one or more factors relevant for the price setting. The adjustment is therefore considered to be acceptable if, later-on, certainty regarding the respective factor is achieved. In this respect the view of the authorities is in line with a court ruling of the Federal Tax Court dated December 17 1997.

German tax authorities go beyond the position taken in the court ruling because they express that retroactive price adjustments shall be accepted but not changes based on the level of profit itself. However, from our point of view it is difficult to defend why price adjustments naturally leading to a different profit shall be accepted whereas an adjustment based on the sole price determinant profit is refused.

German tax authorities argue that unrelated parties would not agree on retroactive adjustments to their profits but instead only accept changes to the pricing and this only based on a forward-looking basis. It is claimed that a guaranteed profit in the form of a fixed net margin, as often agreed on (for example, limited-risk distributors), would not be observed between third parties.

Looking at the regulations regarding relocation of functions, German tax authorities take quite the opposite view.

Under section 1 paragraph 3 of the Foreign Tax Code it is refutably assumed that third parties would have agreed on retroactive price adjustments under such circumstances. Therefore, in cases where the transaction parties have not agreed on a specific price adjustment clause, the regulation stipulates that tax authorities may assume price adjustments within a 10 year period. This shows that retroactive adjustments are not a priori rejected by German tax authorities.

However, overall German tax authorities strongly prefer the price setting approach over the outcome testing approach and allow only under specific circumstances that transfer prices are adjusted retroactively.

Expected decree law regarding the application of the arm's-length principle

Notwithstanding the international discussions on ways to bridge the discrepancy between the two methods and the explicit advice of the EU JTPF to its member states not to introduce any further regulations, it is expected that German tax authorities will issue detailed regulations in an anticipated decree law on the application of the arm's-length principle. It should be highlighted that compared to administrative principles, decree laws are binding for tax authorities and taxpayers.

Given the views of the German tax authorities it is doubtful they will, in general, accept the outcome testing approach. It is, rather, to be expected that the price setting approach will manifest. However, in line with the Federal Tax Court ruling and the Administrative Principles – Procedures, it is anticipated that compensating adjustments remain possible within very narrow limits and subject to very specific conditions.

Recommended actions for German and EU taxpayers

Although guidance on the application of the different methods is unlikely to be provided soon by any of the multinational organisational bodies as described earlier, taxpayers should now analyse their transfer pricing systems to see whether these are fit to comply with the conditions laid out by the EU JTPF to reduce disputes in Germany and within the EU.

In particular, although a recent Federal Tax Court ruling limits tax adjustments based on the violation of formal requirements alone (see Federal Tax Court, Court Ruling dated 11 October 2012, I R 75/11.), it is nevertheless recommended that any agreement between related parties applying the outcome testing approach should provide for a pre-defined adjustment mechanism, ensuring that adjustments follow only a pure calculation exercise.

Finally, taxpayers should review their documentation and see whether it fulfils the requirements as laid out by the EU JTPF in particular regarding the proof that reasonable efforts have been made to achieve an arm's-length outcome at the time of the transaction.

Susann van der Ham |

||

|

|

Transfer pricing partner PwC Tel: +49 211 981 7451 Susan van der Ham is a transfer pricing partner at PwC Düsseldorf. Susann has more than 10 years of experience in consulting multinationals in the field of transfer pricing. Her expertise encompasses transfer pricing structuring, value chains transformation, system implementation, documentation and tax audit defence. She advises large international clients (both German and foreign headquartered) and has led a variety of projects in the retail & consumer and automation/automotive industry among others. Susann frequently publishes articles in international and domestic tax and transfer pricing journals and she is a regular speaker on transfer pricing events. Susann holds a degree in economics and she is a German certified tax adviser (Steuerberaterin). |

Karin Ruëtz, CFA |

||

|

|

Transfer pricing senior manager PwC Tel: +49 211 981 2226 Karin Ruëtz is a transfer pricing senior manager at PwC Düsseldorf. After her studies in Economics at the University of Munich, Copenhagen and Cologne, Karin started her career in transfer pricing in 2007 with a Big-4 company in Germany. From 2012 to 2013, Karin worked for the TP practice in Rotterdam, the Netherlands, and specialised in the areas of transfer pricing system design and implementation. In January 2014, she joined the TP practice of PwC. Karin advises her multinational clients in various transfer pricing matters such as (transfer pricing) implementation, tax audit defence, dispute resolution and efficient global documentation approaches. She consults large multinationals from different industries and has led a variety of projects in the automotive, technology and medical industries, among others. Karin holds a degree in economics from the University of Cologne. She is a Chartered Financial Analyst and member of the CFA Institute. |