|

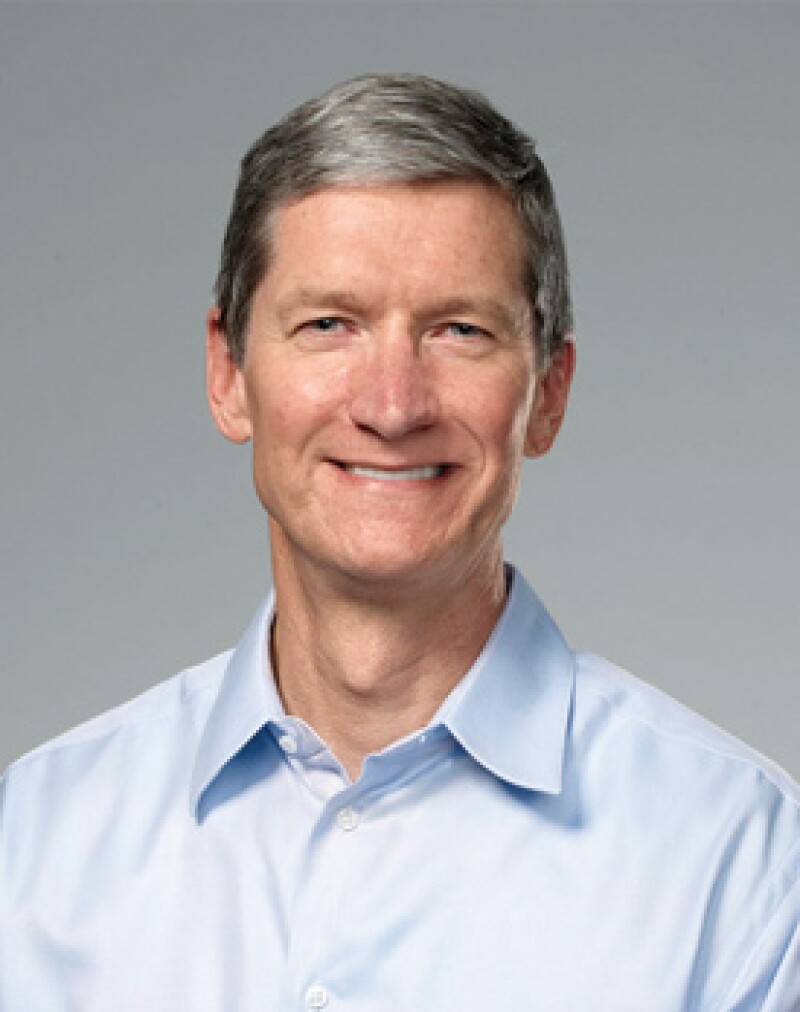

Apple is a new entry this year, CEO Tim Cook was also in the Global Tax 50 2013. |

The technology company has come in for some intense scrutiny of its tax affairs in various parts of the world over the past few years. The company's chief executive officer, Tim Cook, earned himself a place on the Global Tax 50 2013 for advancing the US tax reform debate by staunchly defending the legitimacy of Apple's tax practices in front of the US Senate Permanent Subcommittee on Investigations. During that May 2013 hearing, Cook declared that Apple pays "all the taxes we owe, every single dollar" and added that the company not only complies with the law but also with the spirit of the law. His defence was so convincing that some senators even pitched in to throw their support behind Apple.

"I am offended by the tone and tenor of this hearing," said Senator Rand Paul. "I am offended by a $4 trillion government bullying, berating and badgering one of America's greatest success stories."

"If anyone should be on trial here it should be Congress [for creating such a complex tax code]," added the Republican.

But the "bullying, berating and badgering" did not stop there.

In June of this year, the European Commission opened formal state aid investigations into tax arrangements agreed with certain multinational companies by certain EU member states. The tax deals being looked at, of course, included rulings agreed between Ireland and Apple in 1991 and 2007.

The EC has released a preliminary view which states that "the tax rulings of 1990 (effectively agreed in 1991) and of 2007 in favour of the Apple Group constitute state aid". This is an opening decision and does not constitute a formal decision that state aid rules have been breached.

A key aspect of the investigation into the Irish tax deals is the length of the advance agreements made with Apple. The 1991 agreement lasted 16 years, which the EU says is much longer than the five year agreement typically entered into by European states.

A formal decision could take some time. However, Margrethe Vestager, the new European commissioner for competition and antitrust, and Global Tax 50 2014 member, has promised not to tolerate state-subsidised tax avoidance. She says she will "send a signal" by quickly resolving the investigations into national deals struck with Apple, Fiat Finance & Trade, Starbucks and Amazon, describing this as a "high priority". The involvement of Apple will ensure that, whatever outcome is reached, headlines will be made, and multinationals, funds and other taxpayers will be watching keenly to gauge whether they are likely to receive similar scrutiny in 2015 and beyond.

The fact Apple is such a globally recognised brand counts against it in the context of these investigations. Any political win on the tax fairness front is easier to peddle if the company is highly visible in the public eye. This helps to explain why the company's operations in Australia are being investigated on top of the scrutiny being applied in Europe and the US. All of this means 2015 is certain to be another busy year for Apple as it seeks to detach its brand from the tax avoidance label that authorities around the world are trying to pin on it.

The Global Tax 50 2014 |

||

|---|---|---|

| Gold tier (ranked in order of influence) 1. Jean-Claude Juncker 2. Pascal Saint-Amans 3. Donato Raponi 4. ICIJ 5. Jacob Lew 6. George Osborne 7. Jun Wang 8. Inverting pharmaceuticals 9. Rished Bade 10. Will Morris Silver tier (in alphabetic order) Joaquín Almunia • Apple • Justice Patrick Boyle • CTPA • Joe Hockey • IMF • Arun Jaitley • Marius Kohl • Tizhong Liao • Kosie Louw • Pierre Moscovici • Michael Noonan • Wolfgang Schäuble • Algirdas Šemeta • Robert Stack Bronze tier (in alphabetic order) Shinzo Abe • Alberto Arenas • Piet Battiau • Monica Bhatia • Bitcoin • Bono • Warren Buffett • ECJ Translators • Eurodad • Hungarian protestors • Indian Special Investigation Team (SIT) • Chris Jordan • Armando Lara Yaffar • McKesson • Patrick Odier • OECD printing facilities • Pier Carlo Padoan • Mariano Rajoy • Najib Razak • Alex Salmond • Skandia • Tax Justice Network • Edward Troup • Margrethe Vestager • Heinz Zourek |

||