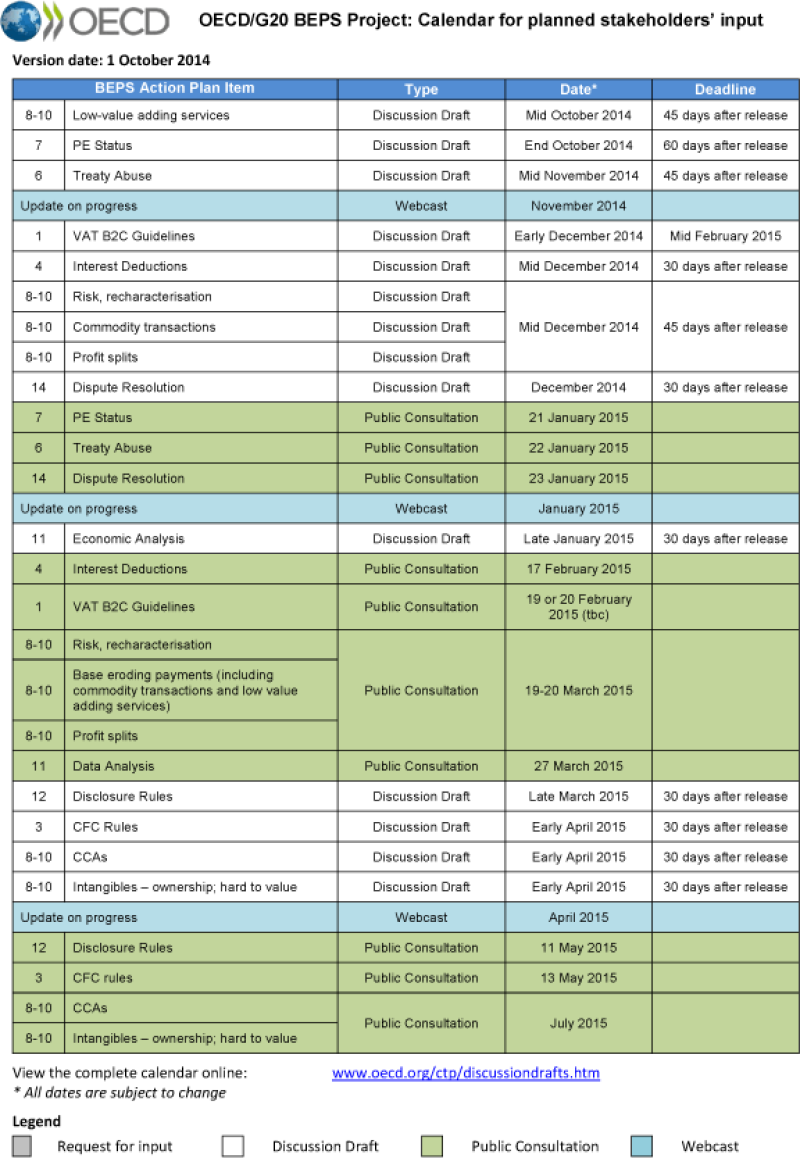

It is less than two weeks since the OECD presented its first set of recommendations and reports on BEPS to G20 finance ministers and already it is showing its determination to complete the rest of the work on time by the end of next year. It has published the schedule for discussion papers, public consultations and webcasts over the next 10 months.

First up is the discussion draft on low-value adding services, which is due out in mid-October. This paper is one of the exceptions to the general rule that the period for comment on discussion drafts will be 30 days.

This draft will be open for comment for 45 days, as will treaty abuse (out in mid-November), and three separate papers covering risk and recharacterisation, commodity transactions and profit splits (mid-December). The PE (permanent establishment) status draft, which is bound to attract a lot of attention, is due out at the end of this month and will be open for comment for 60 days.

There will be 10 public consultations, starting with PE status, dispute resolution and treaty abuse over three consecutive days in January and finishing with separate sessions on CCAs (cost contribution arrangements) and intangibles, covering ownership and valuation, in July 2015.

The OECD is also continuing with its series of well-received BEPS webcasts, giving updates on progress. Three will take place, in November, and next year in January and April.