Though often being considered the new kid on the block, Malta is increasingly being recognised as a tax and cost efficient jurisdiction in which to incorporate a holding company. When choosing a holding company location, tax and cost efficiency are however not the only aspects that are considered: availability of resources and economic soundness must also be considered. Malta has largely remained unharmed by the financial crisis (the European Commission held that Malta's accumulated growth in 2011 significantly exceeded the average for the euro area and economic growth is projected to accelerate in 2013-2014 and to continue to outperform the euro average) and its banking system has been ranked 13th soundest in the world by the World Economic Forum's Global Competitiveness Report (2012-2013).

Malta ticks all the rights boxes needed as a holding company jurisdiction, and not just because of Malta's flexible participation exemption system and tax-free and efficient repatriation of profits to shareholders (which are undoubtedly central features of any holding company jurisdiction) but also thanks to a stable legal system and Malta's adoption of the International Financial Reporting Standards (IFRS) as adopted by the EU (Malta's auditing and financial reporting standards have in fact ranked 16th most stable in the world).

Logistics of setting up a company in Malta

While there is no hard and fast rule as to the speed of setting up a company in Malta, the procedure is relatively straightforward and free of excessive bureaucratic encumbrances. To set up a company in Malta a minimal share capital of €1,165 ($1,526) must be deposited in a bank account by the shareholders on behalf of the company. The company must then present the memorandum and articles of association, with any necessary due diligence to the Registrar of Companies that will then register the company within a couple of days. The memorandum and articles of association are prepared in English (English being an official language in Malta) and are of a similar format to the UK statutes, with objects clauses, procedures for the running of the company, minority rights and powers of the directors (among others) all being included in the statute.

Application of participation exemption

Malta adopts a flexible 100% participation exemption on profits (dividends) derived from a qualifying company or from the transfer thereof (gains on transfer). To benefit from the participation exemption, the Maltese company's holding must entitle it (in substance or in form) to any two of the following rights (known as equity holding rights):

A right to votes;

A right to profits available for distribution; and

A right to assets available for distribution on a winding up of that company.

A qualifying company is one which satisfies one of a series of tests. Typically, as with most participation exemption jurisdictions, Malta has an ownership test which is set at 10%. However, this test does not require a minimum holding period. Furthermore, where the ownership test is not fulfilled, the participation exemption may be acceded to by satisfying other less onerous conditions including a holding with an acquisition value of €1.164 million ($1.5 million) held for an uninterrupted period of 183 days, or one which entitles the holder to a right to sit or appoint a director on the board or to a right to purchase the remainder of the capital.

While the participation exemption is typically available where a Maltese company holds shares in a subsidiary, it may also be availed of when the Maltese company is a partner in a limited partnership similar to a Maltese partnership en commandite the capital of which is not divided into shares, or where the Maltese company is an investor in a collective investment scheme which provides for limited liability of their investors, provided the Maltese company has any two of the equity holding rights and one of the above tests are satisfied.

With respect to dividends, the participation exemption is applicable if the qualifying company:

Is resident or incorporated in a country or territory which forms part of the EU; or

Is subject to tax at a rate of at least 15%; or

Has 50% or less of its income derived from passive interest or royalties; or

Is not held as a portfolio investment and it has been subject to tax at a rate of at least 5%.

As is evident from the foregoing, unlike many other EU jurisdictions, the subject-to-tax clause is not a sine-qua-non for the applicability of the participation exemption and the exemption may be availed of even if the qualifying company suffered no tax.

Taxation of permanent establishments (branches)

Though Malta generally relieves juridical double taxation by means of the credit method, as from January 1 2013, Malta has adopted an exemption method with respect to any income or gains derived by a company registered in Malta which are attributable to a permanent establishment (including a branch) situated outside Malta or to the transfer of such permanent establishment.

Taxation of investors

Given that there are no withholding taxes on dividend distributions (or on payments of interest or royalties, or liquidation proceeds) to non-residents, the repatriation of dividends to shareholders is easy and free of any tax.

This exemption from withholding tax is not dependent on double tax treaties, or the application of any EU directive, but is determined in terms of Malta's domestic law. It applies no matter whether the shareholder is a company, an individual or any other entity, and no matter where the shareholder is resident.

Exit strategy

From a tax perspective, a Maltese structure may be wound down with the same ease as setting it up and operating it. In fact, provided the Maltese company does not own, whether directly or indirectly, nor have any real rights over, immovable property situated in Malta, a non-resident shareholder will not be taxable on any gains derived from the transfer (including liquidation) of a Maltese company.

The same will apply if the shareholder of the Maltese company is another Maltese company, thereby ensuring a tax neutral exit from Malta without unnecessary burdensome tax planning.

The importance of substance

A key theme in international tax planning nowadays is substance as tax authorities and courts are attacking structures which do not have enough. While it is debatable what level of substance a holding company should have, besides the obvious manpower which is always required it would be advisable to ensure that a holding company does not just act as a passive holding company, but rather one that actively manages its subsidiaries, and if possible allow for the holding company to carry out other functions within a group other than that of a mere holding company.

Should a company carry out activities other than the pure holding of shares in its subsidiaries, it would expect to derive further income in terms of its transfer pricing policies, though there are no transfer pricing rules in Malta.

In support of Malta's drive to eliminate economic double taxation, since 1994, Malta has embedded in its fiscal legislation a system of tax refunds which was revised to its current form, upon EU accession after being rubber-stamped by the Commission as being fully in conformity with EU law.

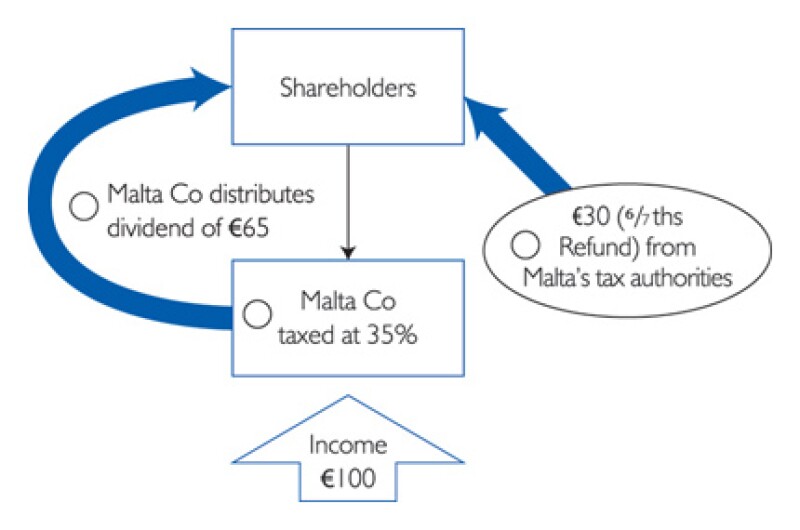

Maltese resident companies, including a foreign company with a branch in Malta, deriving income, other than dividends from qualifying companies, first pay tax on their profits at 35%. Upon the distribution of taxed profits, whether derived from local or foreign sources (other than from immovable property situated in Malta), the shareholders would be entitled to a full or partial refund of the tax paid by the company.

Diagram 1 |

|

The quantum of the tax refund is dependent on the nature of the income, whether local or foreign sourced and whether double taxation is claimed. Generally, the refund is 6/7ths of the 35% underlying tax, resulting in a 30% tax refund of the taxable profits (6/7ths of 35%).Where the company derives income other than dividends from a qualifying company (or gains from the transfer of a partial or full transfer of such holding), the company will be taxable in Malta at the standard rate of 35%. However, upon a distribution of dividends, the shareholder may claim a tax refund which will be paid directly to the shareholder's bank account by the tax authorities. The tax refund will reduce the effective tax to as low as (generally) 5%. See Diagram 1.

This implies that ensuring substance in Malta can be achieved in a cost and tax efficient way. Malta is in fact often used as a hub for various activities with holding and trading activities or other intra-group activities being carried out from Malta. The application of the tax refund system, together with the participation exemption, results in a low effective tax rate, without recourse to any base erosion techniques or use of hybrid instruments which have been subject to so much negative press lately.

Taxation of companies incorporated outside Malta but tax resident in Malta

Malta's tax rules applicable to companies incorporated outside Malta that are tax resident in Malta, that is having its management and control in Malta, make such entities versatile and powerful vehicles for any tax planning structure.

Such companies are only subject to tax in Malta on income or capital gains arising in Malta. Income arising outside Malta is only taxable in Malta to the extent that it is received in Malta whereas capital gains arising outside Malta are not taxable in Malta even if received in Malta.

Such companies are widely used to receive foreign source income outside Malta, however, where a relevant treaty is applicable which includes specific anti-avoidance provisions aimed at such companies which are taxable on a receipt basis, receipt of the income in Malta would be required to ensure treaty protection. In any case, in these situations, the tax refund system would anyway apply.

Using Malta as an intellectual property holding company

Malta is also a tax efficient jurisdiction for owning intellectual property (IP). Where a Maltese company derives royalties from patents, copyrights or trademarks it may benefit from an exemption from tax in Malta. Otherwise, as explained above, the tax refund system may reduce the effective tax to as low as 5%.

Malta's ever increasing treaty network, the availability of a step-up of the value of IP owned by a company becoming tax resident in Malta, re-domiciling to Malta or acquiring the IP following a cross-border merger, together with the attractive tax depreciation rates on IP all contribute to making Malta an attractive IP holding jurisdiction.

Ongoing compliance with national laws

Companies incorporated in Malta must maintain financial statements in terms of the IFRS as adopted by the EU, and these financial statements must be audited and registered with the authorities.

A holding company incorporated in Malta would also need to prepare consolidated financial statements for all its group, provided it does not benefit from an exemption to prepare such consolidated financial statements based on the fact that it has distanced itself from the management of the subsidiaries, or based on the size of the group, or because consolidated financial statements are prepared by the parent company of the Malta holding company.

Malta's sound financial reporting and audit system ensure the shareholders have transparency of the activities of the group, all in a cost-effective jurisdiction.

Other essential factors:

Malta does not tax capital or wealth, until certain specific capital assets are disposed of. In essence, tax on capital gains is levied restrictively in the case of a transfer of shares, securities, business, goodwill, business permits, copyright, patents, trademarks and immovable property, among others.

Thin capitalisation is not regulated in Malta. A financing holding company may therefore efficiently finance acquisitions of interests in other companies without restriction, also pushing debt downwards. Further, the Maltese holding company may be entitled to deduct interest paid on shareholder loans.

Malta does not impose controlled-foreign company rules.

Biography |

||

|

|

André Zarb KPMG Tel: +356 2563 1004 Mobile: +356 7942 1252 Email: andrezarb@kpmg.com.mt André Zarb has headed the tax function of KPMG in Malta since 1994. André advises several clients on international tax issues, including investments undertaken by such companies in Malta and investments by such companies in other countries through corporate structures in Malta. André has been crucial in the development of Malta's tax system, having advised the government on its development since 1994. His involvement ranged from advising on Malta's incentive legislation to ensure these are compliant with EU state aid rules as well as with the development of Malta's tax refund system and participation exemption. |

Biography |

||

|

|

John Ellul Sullivan KPMG Tel: +356 2563 1154 Mobile: +356 7940 3795 Email: johnellulsullivan@kpmg.com.mt John Ellul Sullivan is a senior manager in the tax function of KPMG in Malta, focusing mainly on international tax structures. John mainly focuses on international tax issues, advising multinationals, pension schemes and high net worth individuals on their existing, planned or potential operations in Malta and beyond. John read for a master's of advanced studies in international taxation at the International Tax Center, Leiden, where he also worked as a teaching assistant – giving workshops on the fundamentals of international taxation and tax treaties, and lectures on issues of domestic and international taxation across various courses in Malta. |