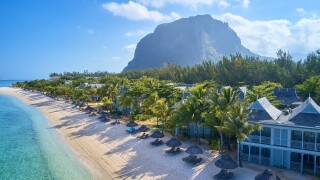

Mauritius

As we move into an era of ‘substance over form’, determining the fundamental nature of a particular instrument is key when evaluating the tax implications of selling hybrid securities

Global stakeholders will be closely watching the Supreme Court’s ruling in a case that will have substantial implications for foreign investment, says Sanjay Sanghvi of Khaitan & Co

As a new agreement between India and Mauritius may unsettle foreign investment, Sanjay Sanghvi and Avin Jain of Khaitan & Co examine the possible impact and offer potential solutions

With carbon taxes expected in the global shipping industry, onlookers say the costs of climate inaction would only be worse.

Sponsored

Sponsored

-

Sponsored by EY Asia-PacificDesmond Teo of EY highlights six key trends that family enterprises and entrepreneurs must consider as they grow their businesses in the increasingly globalised and digitalised world.

-

Sponsored by EY Asia-PacificKareena Teh and Catherine Wong of EY assess how corporate protocols to conduct effective internal investigations must be flexible and consider different laws, regulations and enforcement requirements.

-

Sponsored by Arendt & MedernachThe OECD has released its long-awaited transfer pricing guidance on financial transactions. Danny Beeton and Alain Goebel of Arendt & Medernach review the guidance and suggest the best approaches for pricing and documentation.

Article list (load more 4 col) current tags