After a long court battle, Cairn Energy and the Indian government have finally reached a settlement. The energy company has withdrawn its arbitration claim, alongside interest and costs. This is a significant victory for the taxpayer.

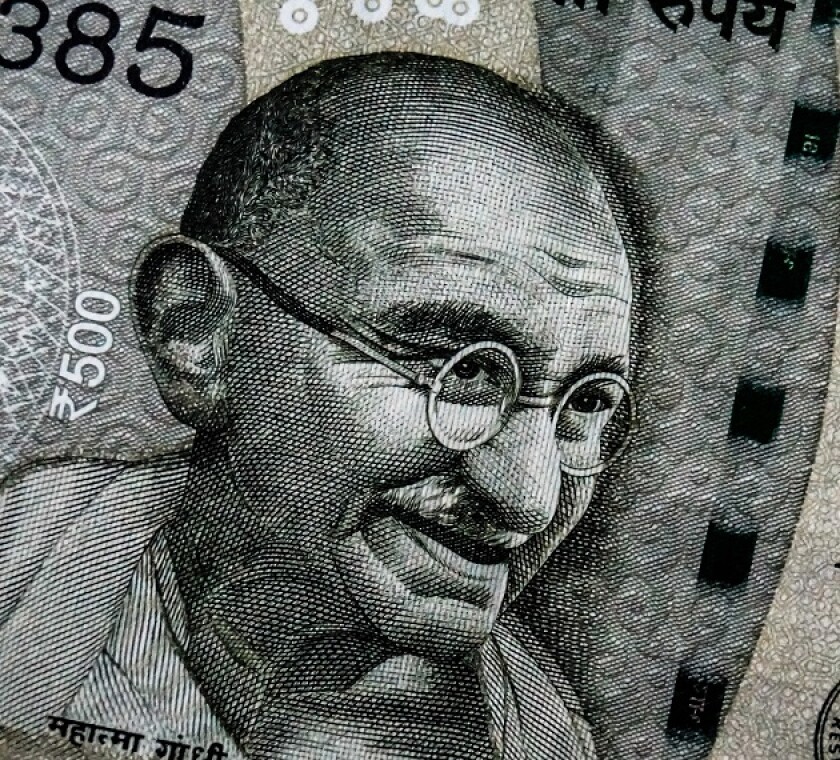

The Cairn case revolves around capital gains tax on a restructured company sold a decade ago. The Edinburgh-based company restructured its operations in India and transferred ownership of its Rajasthan oil field to Cairn India in 2006.

Cairn Energy sold most of its holding in the Indian unit to billionaire Anil Agarwal’s Vedanta Resources for $8.7 billion in 2011. However, the Indian government changed the law in 2012 and applied retroactive taxation to the transfer of ownership.

In 2014, the Indian Tax Department claimed the company owed $1.4 billion in taxes. The tax authority would later seize 10% of Cairn India’s shares, valued at around $1 billion, in pursuit of back taxes.

After failing to resolve the matter through the Indian judiciary, the company filed a dispute under the UK-India investment treaty and sought international arbitration that started in 2015 for the losses over expropriation of its investments in India from the minority holding.

Cairn Energy pursued its case at the Permanent Court of Arbitration at The Hague and won a $1.2 billion arbitration award in December 2020. Cairn registered the claim in a number of jurisdictions, including Canada, France, the Netherlands and the US.

Here you can see ITR’s past coverage of the case and its implications:

India set to axe infamous retrospective tax provision

Cairn and Vodafone pursue talks to settle Indian tax claims

India rebuffs Cairn’s offer to settle tax dispute

India decides to fight Cairn arbitration decision

Cairn tries to outmatch India for $1.4 billion arbitration award

The Cairn case is just one of a series of tax disputes that have made headlines last year, but the implications of this case will unfold for years to come.

The most important transfer pricing cases of 2021 and 2022

Cameco, Engie, and Nike headlined the biggest corporate transfer pricing (TP) cases from 2021, and 2022 could offer more court rulings that revise in-house TP practices at other large multinational enterprises (MNEs).

TP practices evolved in 2021, with major tax disputes coming to an end. While the Amazon vs the European General Court case illustrated a win for the taxpayer on digital taxation, other MNEs such as Cameco, Engie, and Nike lost their TP battles. Additionally, 2022 just marked the end of a long dispute between Cairn Energy and the Indian government.

Many of the TP cases involving MNEs in 2021 were ruled in favour of the tax authority. This may illustrate a new era in TP, in which regulators continue to tackle the use of shell companies and profit shifting for the purpose of tax avoidance.

The European Commission proposed a key initiative in December 2021 that aimed at fighting against the misuse of shell corporations for improper tax purposes. In the same month, the US Treasury also called for further beneficial ownership reporting requirements, under which companies will report data to Financial Crimes Enforcement Network (FinCEN) for the first time in US federal law.

With the pandemic continuing to affect economies across the globe, more regulations aimed at tackling tax avoidance can be expected in the years to come, particularly with the emergence of variants such as Omicron. Mobilising domestic revenue will continue to top governmental agendas.

Q4 2021: Top indirect tax disputes

In the final quarter of 2021, the CJEU ruled in favour of a pharmaceutical company, the US dropped its tariff threat against European countries over DSTs, and Uber faced another blow in the UK.

The final three months of 2021 heralded a big win for the international tax world, as 136 countries signed up to an OECD-brokered global tax agreement. Pillar two ensures a corporate tax floor of 15%, while pillar one provides for taxing rights to market jurisdictions.

The latter is designed to replace digital services taxes (DSTs), which have been causing problems due to concerns over double taxation. In addition, DSTs provoked the US, which saw these unilateral measures as unfairly penalising American technology companies, into threatening retaliatory tariffs.

Following the OECD agreement in October, the US agreed to drop the threat of tariffs against some European countries – including Austria, France and Italy – in return for a promise to repeal their unilateral DSTs. Yet other disputes over DSTs remain possible until the OECD agreement is implemented in 2023.

Meanwhile, the ride-hailing company Uber lost a UK High Court ruling over the status of its drivers and the company’s responsibilities. In combination with a UK Supreme Court ruling earlier this year, this is likely to have significant tax implications for the business.

Finally, the pharmaceutical company Boehringer Ingelheim won a second case at the European Court of Justice (CJEU), cementing its right to deduct certain payments from its tax base for VAT purposes. The win will be welcomed by other companies in a similar position.

Next week in ITR

ITR will be looking at the implications of the EU ‘unshell’ directive for businesses across Europe. Tax advisors may have an opportunity to market restructuring plans for companies looking to wind-up old shell structures.

ITR will revisit the global supply chain crisis and the impact of COVID-19 on transfer pricing models. Businesses are still grappling with the difficulties that have come out of the pandemic. The Omicron wave may mean the crisis is far from over.

Meanwhile, European governments are facing greater pressure to cut VAT on energy amid soaring gas prices. The UK government is facing such calls, but has ruled out a VAT cut. However, the demands for a fiscal response to the energy crisis will continue.

Readers can expect these stories and plenty more next week. Don’t miss out on the key developments. Sign up for a free trial to ITR.