The Russian Ministry of Finance has sent a proposal to its Swiss colleagues requesting amendments to the current double taxation treaty (DTT) between Russia and Switzerland. Information about this move was provided by the deputy minister of finance, Alexey Sazanov. Unfortunately, as yet, there is no copy of the letter available, but presumably the Ministry of Finance (MoF) is proposing to revise the treaty based on the ‘Cypriot model’. This is the same model structuring as the recent negotiations with the Netherlands.

In March 2020, Russia’s President, Vladimir Putin, announced an increase in the withholding income tax on dividends and interest payments to 15% in respect to so-called transit jurisdictions (countries to which businesses withdraw funds away from taxation in the Russian Federation). Switzerland is now the fifth state to which the MoF has sent a request to amend the DTT. Agreement was achieved with the first three countries of Cyprus, Malta and Luxembourg. Unfortunately, no compromise was achieved with the Netherlands, and the treaty with this country will cease to apply on January 1 2022.

Switzerland is rarely used by Russian businesses to create holding or financial companies, especially when compared with Cyprus or the Netherlands. As a rule, Russian businesses use Switzerland to register trading companies, for example, Russian metals, chemicals and oil groups have Swiss trading companies.

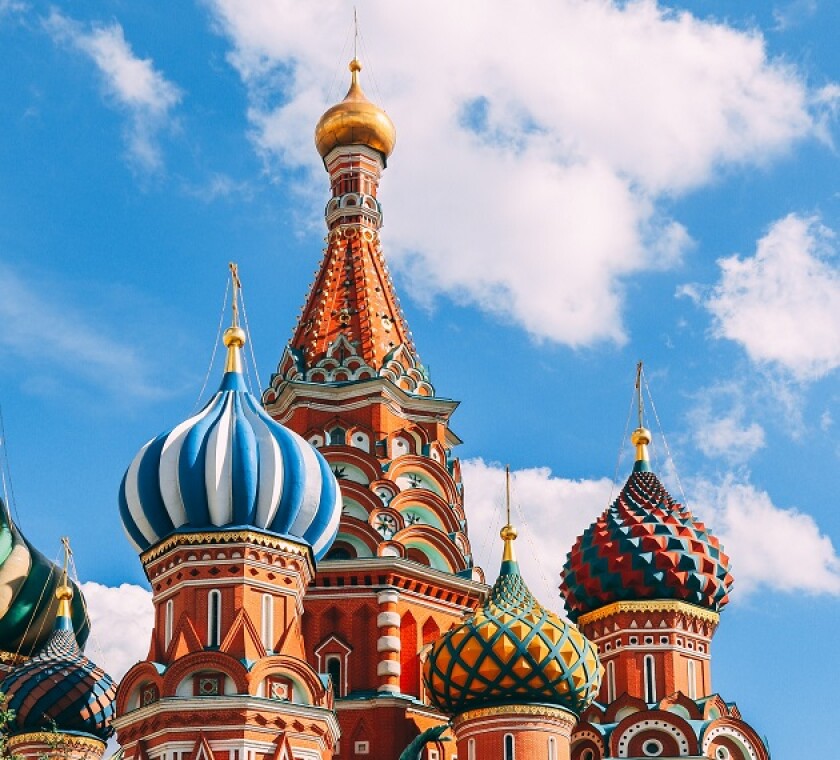

Switzerland’s excellent reputation, convenient geographical location, and favourable tax regime – especially in the canton of Zug, which is much preferred by Russian groups, made Switzerland popular for incorporating a trading company.

In general, trading companies do not rely on benefits provided by DTT with respect to their trading income. Revenues in the RF from the sale of goods from Switzerland (e.g. by a Swiss purchasing company) are, for the buying company (e.g. a Russian buyer), exempt from income tax, in accordance with Russian domestic tax law.

But as part of distributing profits as dividends from Swiss subsidiaries to Russian holding companies, an income tax of 35% arises in Switzerland. This is significantly higher than, for example, in the Netherlands, where the dividend tax rate is 15%. The only way to reduce it to 5% is to apply the DTT, which Russia now insists on revising. If it is amended in the same way as those amended with Cyprus, Malta and Luxembourg, it will be possible to reduce the rate only to 15%. And if no agreement is found, and the treaty denounced, the tax implications in Switzerland will be significant.

It is still unclear whether these consequences will stop the MoF from taking tough action. The 15% tax for Russian subsidiaries in the Netherlands was no obstacle to terminating the treaty.

The lack of a treaty will complicate the life of trading companies for another reason – it will be impossible to conclude a transfer pricing (TP) agreement between the tax authorities of the RF and Switzerland. These TP agreements are in practice becoming popular for Russian groups with a foreign presence.

Many Swiss businesses have been actively investing in the Russian economy. These include big businesses such as ABB, Nestle, and Novartis, as well as lesser known smaller companies. Both groups may suffer from the DTT renegotiation (except for public companies for which the ‘Cypriot model’ allows for the retaining of benefits under certain conditions).

However, Swiss banks will not suffer from the DTT amendment. The tax treaty in the current or revised version will provide an exemption from the withholding income tax in the RF on interest paid to Swiss banks. Banks will be affected if Russia and Switzerland terminate the treaty. In this scenario, interest on loans from Swiss banks paid by a company from Russia will be taxed at 20%. In other words, it will no longer be cost-effective for a company to take a Swiss loan.

It is still difficult to predict how negotiations will go, but given that Switzerland traditionally tries to find compromises, revision of the treaty seems more realistic (like in case with Luxembourg) than the more radical outcome of denunciation, as happened with the Netherlands.

Of course, the result of this revision is unlikely to be beneficial for business, but a ‘bad’ treaty may be better than no treaty at all.

Alexander Tokarev

Partner, KPMG