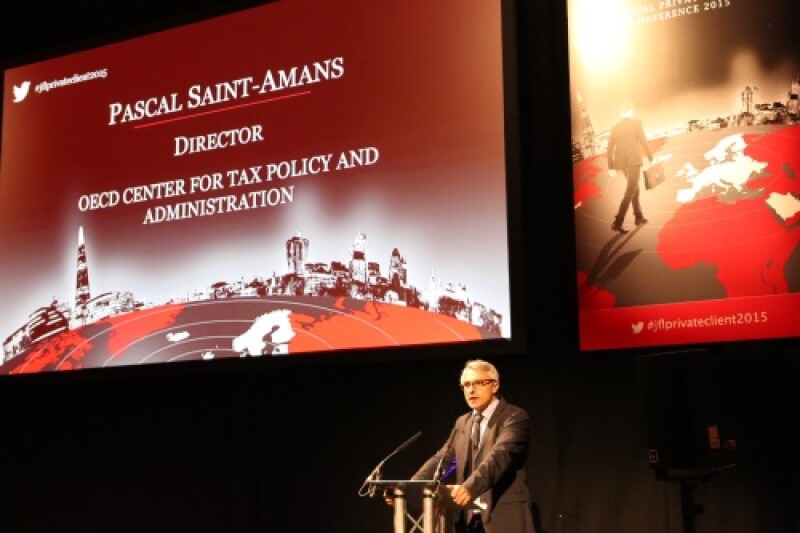

Saint-Amans, the head of the OECD’s Centre for Tax Policy and Administration (CTPA), which is leading the work on the base erosion and profit shifting project (BEPS) on behalf of the G20, said international tax is on the “radar screen” of all governments and leaders.

“If we want to stop politicians paying attention to international tax, we’d better solve the problems in the system,” he said in a speech at Jersey Finance’s annual private client conference in London on May 12.

“We’re at a critical time. I don’t know where we’re heading on cooperation, maybe back to more at a national level,” he added. “There are risks and opportunities because tax is at the core of sovereignty.”

The Frenchman said it was important to keep up the level of engagement, especially of developing countries. At the same time, he described the BEPS Project as a “big-country agenda”.

“This is often against smaller jurisdictions, whether we like it or not,” Saint-Amans said.

The CTPA director said key dates for G20 discussion of the outcomes from the BEPS project will be meetings of finance ministers in Ankara, on September 4 and 5, and Lima, on October 8, when the results of the entire BEPS project are due to be presented; and the heads of government summit in Antalya on November 15 and 16.

Transparency

Referring to aspects of the work related to BEPS, Saint-Amans said transparency was good for governments, professionals and taxpayers.

“Jurisdictions who don’t move will pay a heavy price,” he said. Saint-Amans was particularly critical of Panama, who, he said, “has not shown any movement”.

Confidentiality is a key aspect of increased transparency which automatic exchange of information is designed to bring about.

Fifty one jurisdictions became the first signatories of the Common Reporting Standard in Berlin in October 29, which will introduce the automatic exchange of tax information globally from 2017.

“The more transparent the world gets, the more attention we need to pay to confidentiality,” Saint-Amans said. “The challenge for the Global Forum [on Transparency and the Exchange of Information for Tax Purposes] is to design a system of peer review that can check if jurisdictions can exchange information securely.”

Information exchanged should be correct and should only be used for tax purposes, and the tax administrators to whom it is sent should not be under political influence, Saint-Amans added.

The OECD is maintaining the feverish pace of the BEPS Project. Three sets of public comments on discussion drafts on distinct action points have been published since the beginning of May, covering strengthening controlled foreign company rules (parts 1 and 2), mandatory disclosure and data analysis. And a new discussion draft on preventing the artificial avoidance of permanent establishment came out on May 15,