|

|

|

Jim Fuller |

David Forst |

Private letter ruling 201517003 describes a Country X parent company (Parent) that owns US Sub, which, in turn, owns US Sub-2. US Sub intends to borrow from Parent the X Country currency equivalent of a certain dollar amount. US Sub will issue to Parent a convertible debt instrument denominated in the X currency with a stated principal amount equal to the amount advanced by Parent. US Sub and US Sub-2 will use the borrowed funds to repay their previously outstanding dollar debt owing to Parent.

The stated interest rate will be set at a market rate on the issue date and will exceed the applicable federal rate in effect on that date. Stated interest will accrue monthly but will not be paid until maturity. On the repayment date, US Sub must pay the Parent the stated principal amount plus all accrued interest. US Sub will make this payment in cash unless the convertible note is converted into shares of US Sub stock.

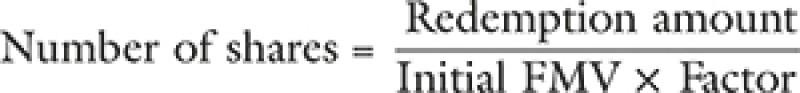

The maximum number of shares subject to conversion will be determined on the issue date using the following formula:

|

The number that US Sub proposes to use for Factor is greater than 1.0. The number of shares that Parent is eligible to receive will be adjusted if certain organisational changes occur that would, without adjustment, dilute or concentrate Parent's potential ownership interest.

US Sub represented that under the X tax laws, the portion of the redemption amount that exceeds the principal (that is, the accrued but unpaid stated interest) will be treated as capital gain regardless of whether US Sub delivers cash or shares. Parent and its subsidiaries in X now have a capital loss carryforward that will offset the capital gain on the convertible note.

US Sub also represented that Parent will exercise the conversion feature only if the value of the stock to be received exceeds the redemption amount.

Because the interest will not be paid currently in cash, the stated interest on the convertible note is original issue discount (OID). The OID will not be deductible as interest until US Sub delivers either cash or shares to repay the redemption amount.

Under § 163(l) no deduction is allowable for any interest paid or accrued on a disqualified debt instrument. A disqualified debt instrument means an indebtedness of a corporation that is payable in equity of the issuer or a related party or equity held by the issuer (or any related party) in any other person.

Section 163(l)(3)(A) states that indebtedness will be treated as payable in equity of the issuer or any other person if "a substantial amount of the principal or interest is required to be paid or converted, or at the option of the issuer or a related party is payable in, or convertible into, such equity…"

The flush language at the end of § 163(l)(3) also states "For purposes of this paragraph, principal or interest shall be treated as required to be so paid, converted, or determined if it may be required at the option of the holder or a related party and there is a substantial certainty the option will be exercised."

The issue the ruling addressed was whether the governing provision was § 163(l)(3)(A), which would deny a deduction for the interest expense, or § 163(l)(3)'s flush language which would deny a deduction based only on certain facts (a substantial certainty of exercise).

The Service concluded that it is appropriate in this case to read the language of § 163(l)(3)(A) as informed by the flush language at the end of § 163(l)(3). Thus, on the facts presented, the note will be a disqualified debt instrument under § 163(l) only if there is a substantial certainty the option will be exercised.

The Service stated that it expressed no opinion whether the facts provided by US Sub indicate that there is substantial certainty that Parent will exercise its conversion rights.

This ruling clearly will have significance, and be helpful, any time a foreign parent company makes a loan to its US subsidiary in exchange for the subsidiary's issuance of a convertible note.

Jim Fuller (jpfuller@fenwick.com) and David Forst (dforst@fenwick.com)

Fenwick & West

Tel: +1 650 335 7205; +1 650 335 7274

Website: www.fenwick.com