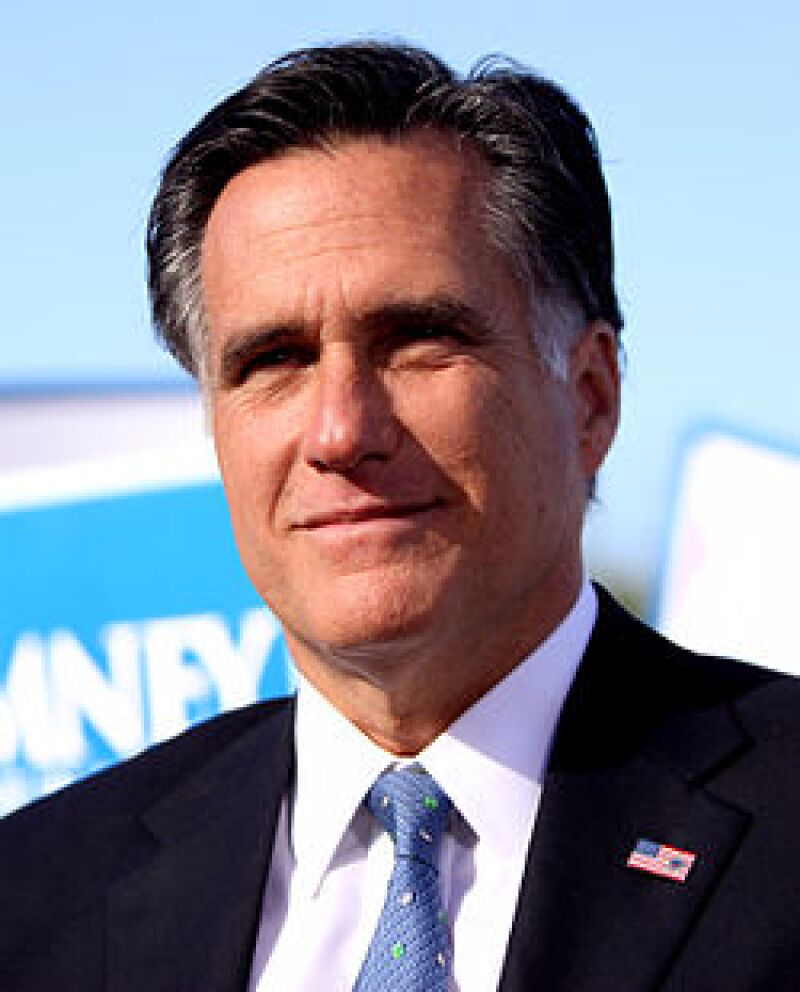

The call was framed as part of the need for comprehensive corporate tax reform, with Romney and President Obama this week outlining divergent economic plans, which Obama described as “two fundamentally different views between what direction America should take”.

“We have this repatriation tax,” said Romney. “If you make a lot of money in some other foreign country and you want to leave it there, we don’t tax you. But if you want to bring it home, to invest here, then we do tax you, up to 35%. That doesn’t make a lot of sense to me. If you want to bring your money home, please bring it home.”

But previous repatriation holidays have not lead to increased investment and job creation. Instead, companies hoarded the money, or paid higher dividends to their shareholders. This does not worry Romney, though.

“And I know some people say, “Yeah but companies might put it out as dividends.” Well that’s OK too,” he said.

At present, the US uses a worldwide system of taxation. But, as Bob McIntyre from Citizens for Tax Justice points out, the system is actually more accurately described as a hybrid of the pure worldwide system and the territorial system.

“The US technically has a worldwide tax system in which all profits of US corporations are subject to US taxes, but it undermines this rule by allowing taxes on offshore profits to be deferred until those profits are brought back to the US (repatriated). Often, these offshore profits are never repatriated,” said McIntyre.

Romney’s comments came just days before the Joint Committee on Taxation (JCT) released its report on the revenue proposals contained in President Obama’s fiscal year 2013 budget proposal, which was submitted to Congress in February.

The report outlines Obama’s proposals and compares them with existing law, as well as providing analysis of related policy issues.

Though there is widespread disagreement over how best to pursue effective tax reform, many stakeholders believe a corporate tax rate reduction should be effected before further reform is dealt with.

“Reduce the rate as a first step and that allows you to remove some of the unnecessary and unwanted provisions,” said Bob Rinninsland, attorney at the Ruchelman Law Firm. “We were ok until [former president Ronald] Reagan and then we took the European route ending up with a lot of tax law, but not a lot of context.”

Rinninsland argued that a rate reduction is the “most visible first step” and said it would serve as a statement of intent that the US is pursuing tax simplification.