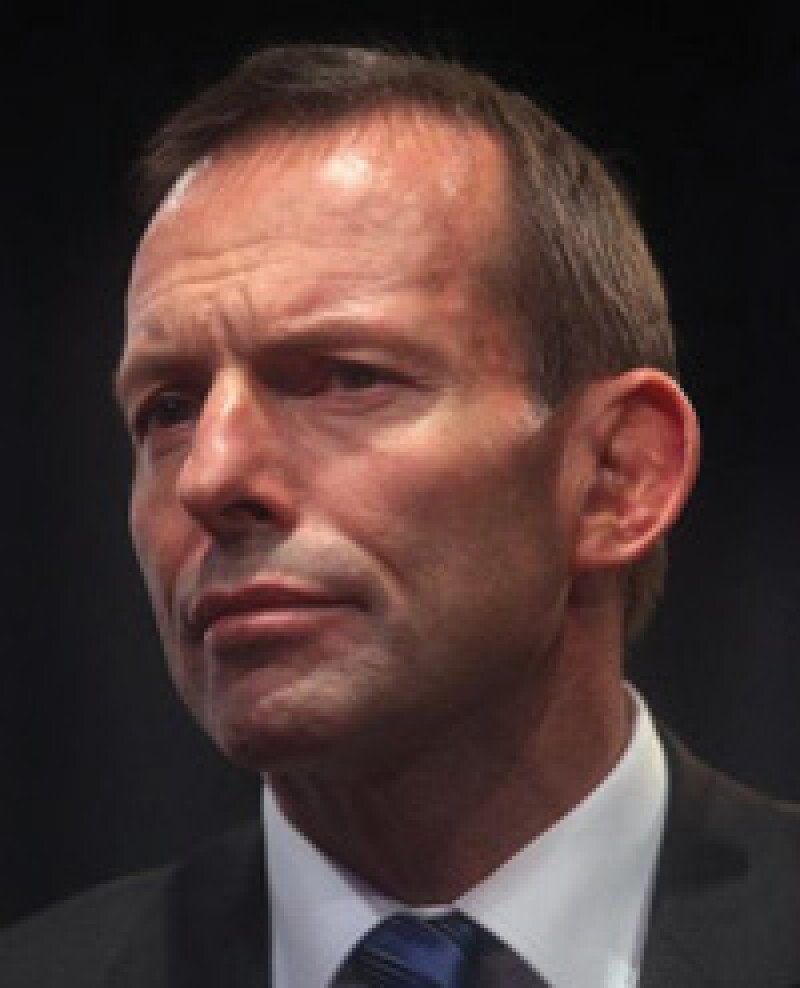

Tony Abbott was elected Prime Minister of Australia in September 2013, one corporate promise being that he would repeal the carbon and mining taxes.

Abbott considers the election to be a referendum on the carbon tax and he wasted no time bringing a Bill before Parliament to scrap it.

“The carbon tax will go, but the carbon tax compensation will stay so that every Australian should be better off,” Abbott said when he introduced the Bill. “Repealing the carbon tax will reduce costs for all Australian businesses, every single one of them.”

The Bill easily passed the House of Representatives, but it will face a tougher time getting through the Senate, where Abbott’s party lacks a majority.

Nevertheless, Abbott, a one-time boxing blue at Oxford, is used to a tough fight. If he wins this one, his influence will not only be assured on Australian tax policy to come, but on the potential for a global carbon market, which his plans imperil.

Further reading |

The Global Tax 50 2013 |

||

|---|---|---|

Shinzo Abe |

||